In a week brimming with anticipation, the Bitcoin and crypto market is poised to witness a series of significant events that could steer the trajectory of digital assets. From pivotal price action in Bitcoin to crucial decisions by the US Federal Reserve (Fed), and from landmark trials to influential crypto conferences, the week is packed with developments that could have substantial implications for investors and the crypto industry alike.

So here’s a detailed look at the top four events that are expected to capture the market’s attention in the coming days.

#1 Bitcoin At $40,000 This Week?

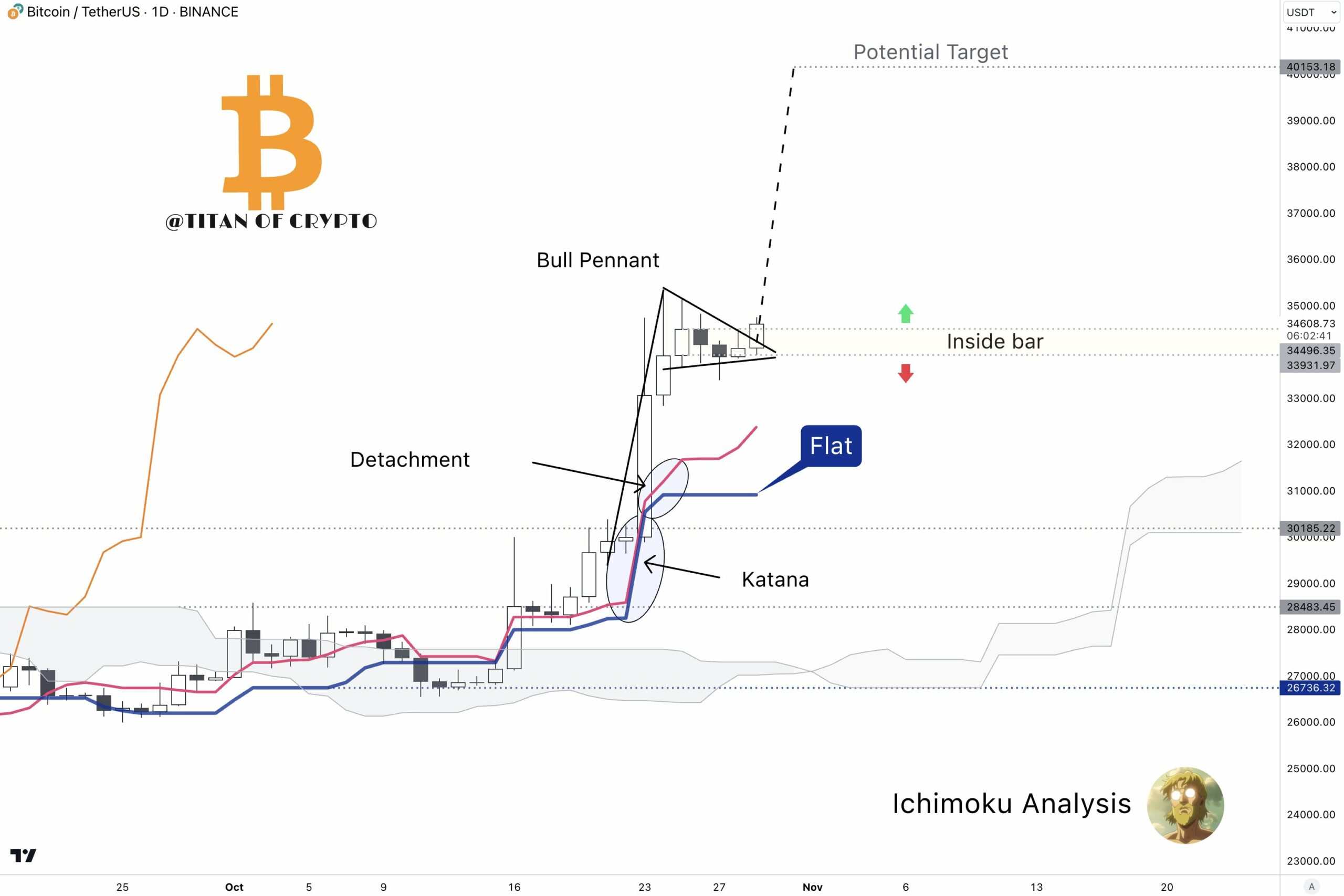

Bitcoin’s recent performance has been nothing short of impressive. The leading cryptocurrency marked its highest weekly close since May 2022, with a 15% gain last week. The bullish sentiment is further fueled by the anticipation of a spot Bitcoin ETF. Currently, Bitcoin is in a consolidation phase, but renowned technical analyst, “Titan Of Crypto,” believes there’s more to come.

Sharing a chart, he said via X:

Bitcoin at $40,000 next week? BTC is trying to break out from both bullish pennant and the inside bar’s range. Tenkan starts pointing up. If the following conditions are matched: Kijun follows Tenkan, daily candle manages to close above the range and stay above $34.5k. [Then,] Bitcoin could teleport to $40k in a blink of an eye.

#2 Fed Rate Decision And FOMC

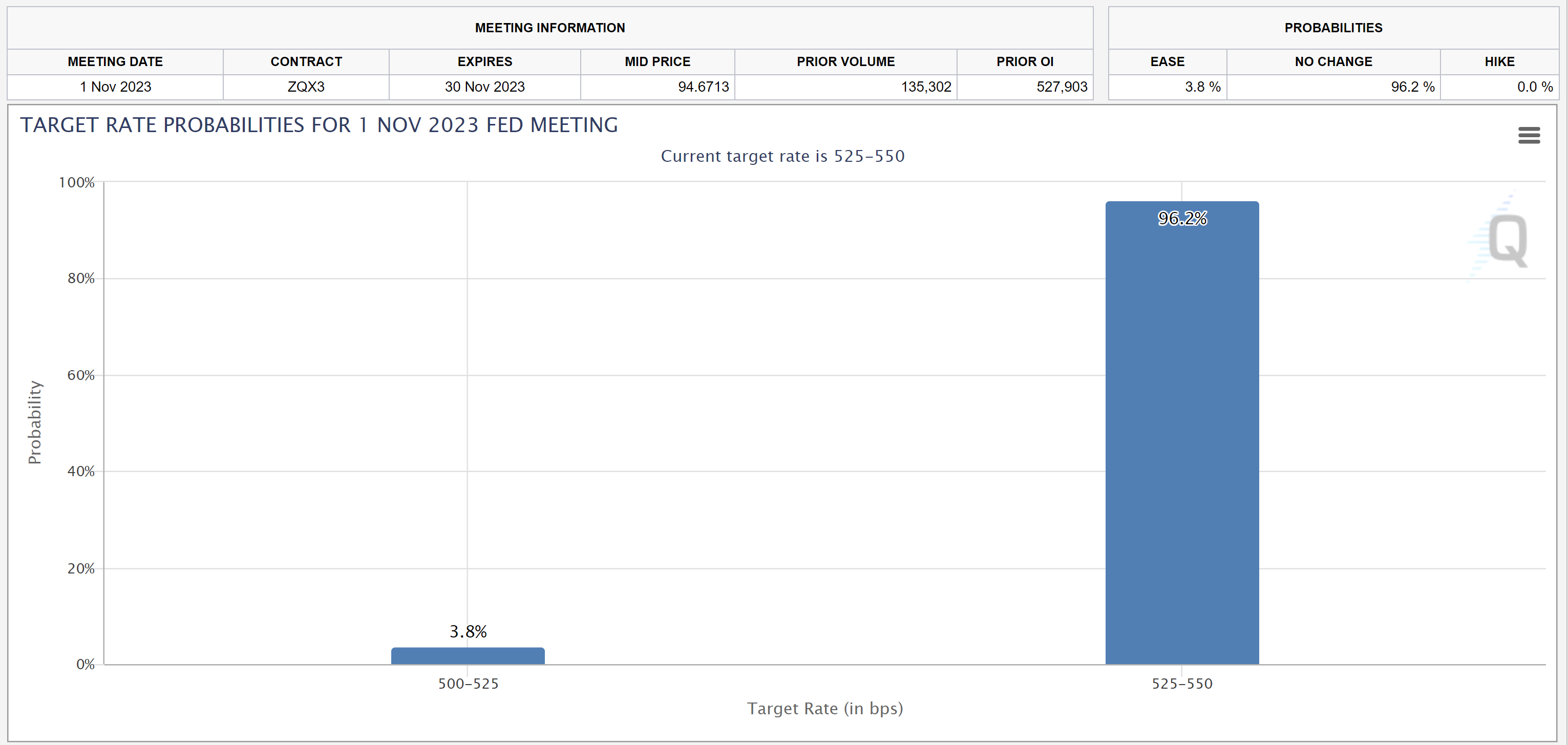

The Federal Open Market Committee (FOMC) is set to make its rate decision on Wednesday, November 1, 2023, at 2:00 pm, followed by a press conference with Fed chair Jerome Powell at 2:30 pm. The consensus among analysts is that the FOMC will maintain the target range for the federal funds rate at 5.25 to 5.5. The CME FEDWatch tool supports this, with 96.2% expecting no change.

Notably, market conditions have become far more fragile than they were a year ago. The Fed needs to navigate their battle against inflation carefully as it can’t afford a severe recession.

Bank of America commented on the upcoming meeting, stating, “We still do not expect a hike in November, as the Fed is clearly worried about the extent of financial tightening. But today’s robust spending and inflation data keep a December hike on the table.”

Goldman Sachs economists added, “Fed officials appear to have signaled that they will not be hiking at their November meeting next week… the story of the year so far has been that economic reacceleration has not prevented further labor market rebalancing and progress in the inflation fight.”

#3 Sam Bankman-Fried’s Trial Nears End

The high-profile trial of Sam Bankman-Fried, related to the collapse of the FTX exchange, is nearing its conclusion. As the trial resumes on Monday, October 30, 2023, Bankman-Fried will continue his direct examination by his defense lawyer, presenting an alternative narrative to the testimonies of former employees and witnesses against him.

Following this, the government will cross-examine him, potentially leading to a rebuttal case by the prosecution. This part of the trial is expected to consume most of the week, with the jury likely to make a decision by next week’s end.

#4 Solana Breakpoint Conference

Solana’s annual Breakpoint conference is set to kick off today in Amsterdam, the Netherlands. The event, which runs from October 30 to November 3, will feature Solana Labs CEO Anatoly Yakovenko, key project leaders from the Solana ecosystem, and speakers from Stripe and Visa.

Historically, Breakpoint has been a platform for significant announcements. Last year, Solana Labs unveiled a $100 million social media fund and a $150 million blockchain gaming fund. This year, there’s buzz around RNDR – Render Network’s team, which is expected to launch Render 2.0 soon. The entire conference will be livestreamed on X and Solana’s YouTube channel.

At press time, Bitcoin traded at $34.555.