On Tuesday, Tether Holdings Ltd.’s financial statements for the third quarter of 2023 were validated by BDO, an internationally known independent public accounting firm. The firm gave an assurance opinion, revealing $3.2 billion in surplus reserves supporting the company’s tokens, some of which are backed by U.S. Treasuries.

Report Shows Over 85% of Tether’s Reserves Tied to Cash and Near-Cash Assets

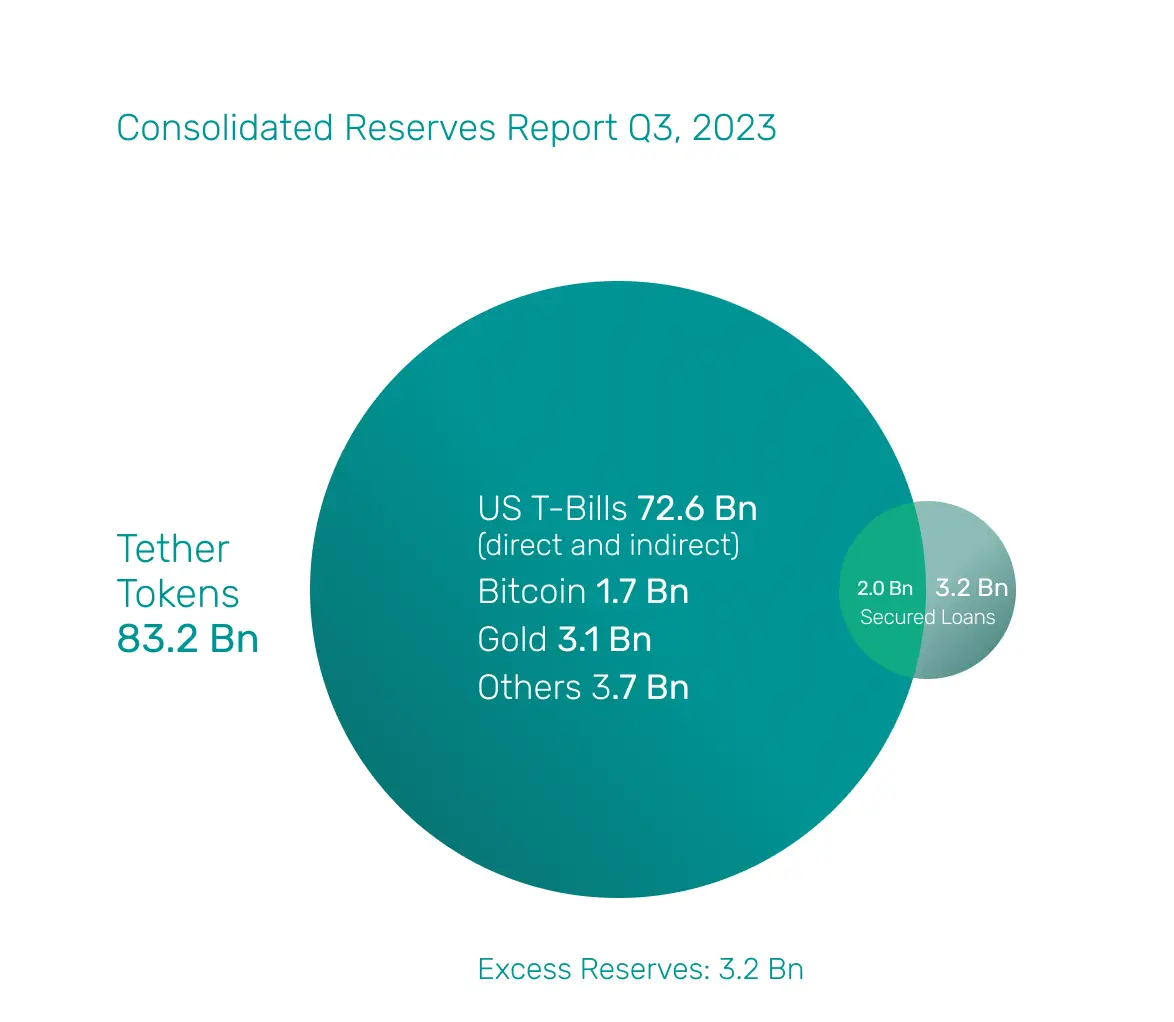

In the recently published financial disclosure for Q3 2023, Tether presented a breakdown of its assets, as confirmed by BDO. The Consolidated Reserves Report (CRR) indicated that 85.7% of Tether’s reserves are held in “Cash and Cash Equivalents,” primarily US T-Bills. The report also noted a significant reduction in secured loans, amounting to over $330 million.

The CRR sheds light on Tether’s financial strategies and risk management. “We’ve achieved the highest ever percentage of our reserves held in Cash and Cash Equivalents, signaling our dedication to maintaining liquidity and stability within the stablecoin ecosystem,” said Paolo Ardoino, CEO of Tether.

Tether further revealed actively invested in industry-related research fields, with investments totaling over $800 million since the start of the year. “Our investments in sustainable energy, Bitcoin mining, data, and P2P technology exemplify our commitment to building a more sustainable and inclusive financial future for all,” Ardoino elaborated.

Recently ascending to the CEO position on October 13, 2023, Ardoino took over from Jean-Louis van der Velde. Tether has also been diversifying its investment portfolio, venturing into bitcoin (BTC) mining and making significant strides in the artificial intelligence (AI) sector with a $420 million investment in Nvidia GPUs. As of November 1, 2023, data shows 84.80 billion USDT circulating across various blockchains, with the majority split between Tron and Ethereum.

What do you think about Tether’s latest financial disclosures? Share your thoughts and opinions about this subject in the comments section below.