Quick Take

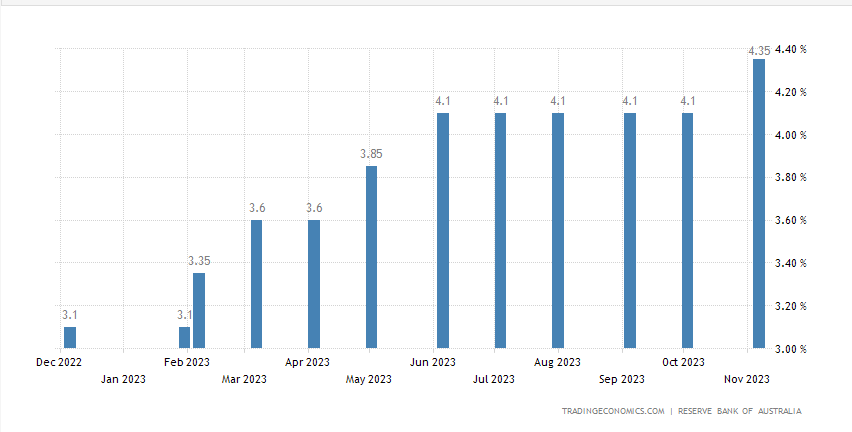

The Reserve Bank of Australia’s (RBA) recent decision to increase their interest rate from 4.1% to 4.35% – the first rise since May 2023 – presents an intriguing trend in contrast to the anticipated actions of the Federal Reserve and other Western central banks. Australia’s Consumer Price Index (CPI) inflation currently persists at 5.4%

Most markets are bracing for a pause in rate hikes from these institutions, forecasting a potential cut next year despite inflation not hitting the 2% target.

Australia’s move could suggest the dawn of a new wave of interest rate increases, placing it at the forefront of this shift. This potential global monetary policy change could have far-reaching implications, particularly on Bitcoin and other risk-tolerant assets, which have already factored in the expectation of no further rate hikes in the current cycle by the Federal Reserve.

With this unexpected turn of events, a recalibration of these assets’ valuations may occur. Future market movements will hinge on whether other central banks align with the RBA’s decision or maintain the status quo, thus intensifying the global economic chess game.

The post Australian central bank’s surprise interest rate hike could signal global shift appeared first on CryptoSlate.