Data shows that Bitcoin Inscriptions have observed a resurgence recently, leading to a boost in the transaction fee of the miners.

Bitcoin Inscriptions Have Risen Back To 400,000 A Day

In a new post on X, analyst James V. Straten has talked about the latest trend in the BTC Inscriptions. The “Inscriptions” refer to directly inscribing data into the Bitcoin blockchain.

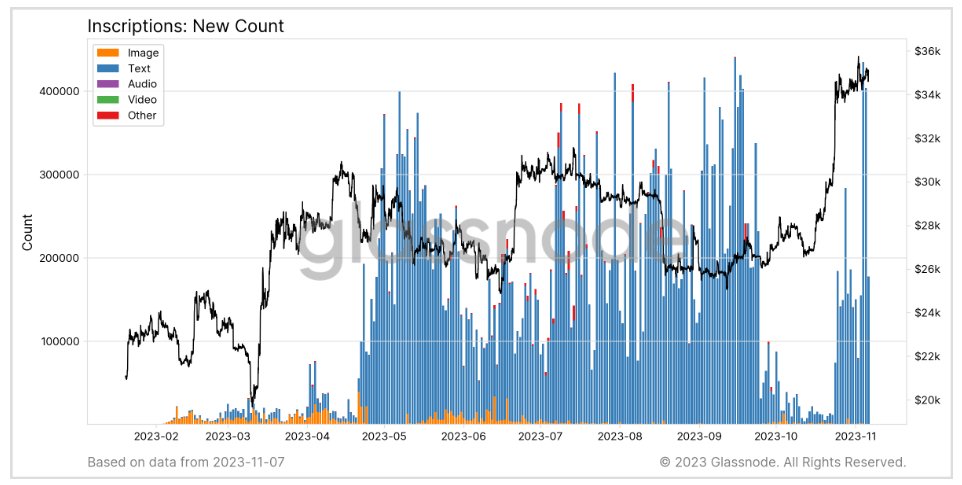

The Inscriptions can be made using any data, whether text, audio, image, or even video. This technology has found use in various applications on the network, including non-fungible tokens (NFTs) and BRC-20 tokens.

Whatever type of data the Inscriptions may use, they occupy the same place in the block as normal transactions, meaning that they influence all metrics related to the network.

Image and other types are naturally data-intensive, while text-based Inscriptions are lightweight and add little memory to the blockchain. In its early life, the tech saw a dominant usage from the image type, as NFTs were the hot thing then.

As new applications surfaced, the cheaper text transactions blew up. The chart below shows the total Bitcoin Inscription count and how the distribution among the different types has changed over the past year.

The graph shows that the Bitcoin Inscriptions had been highly popular between May and September, but these transactions lost all steam in October.

Following the latest rally in the cryptocurrency’s price towards the $35,000 mark, the fad seems to have returned in the sector. Straten notes that the Inscriptions are being made at a rate of 400,000 per day again, similar to the peak seen in the mania earlier in the year.

As mentioned before, the Inscriptions are much like the normal financial transactions on the blockchain, so the spike in operations at such a high rate has been affecting the economics of the network.

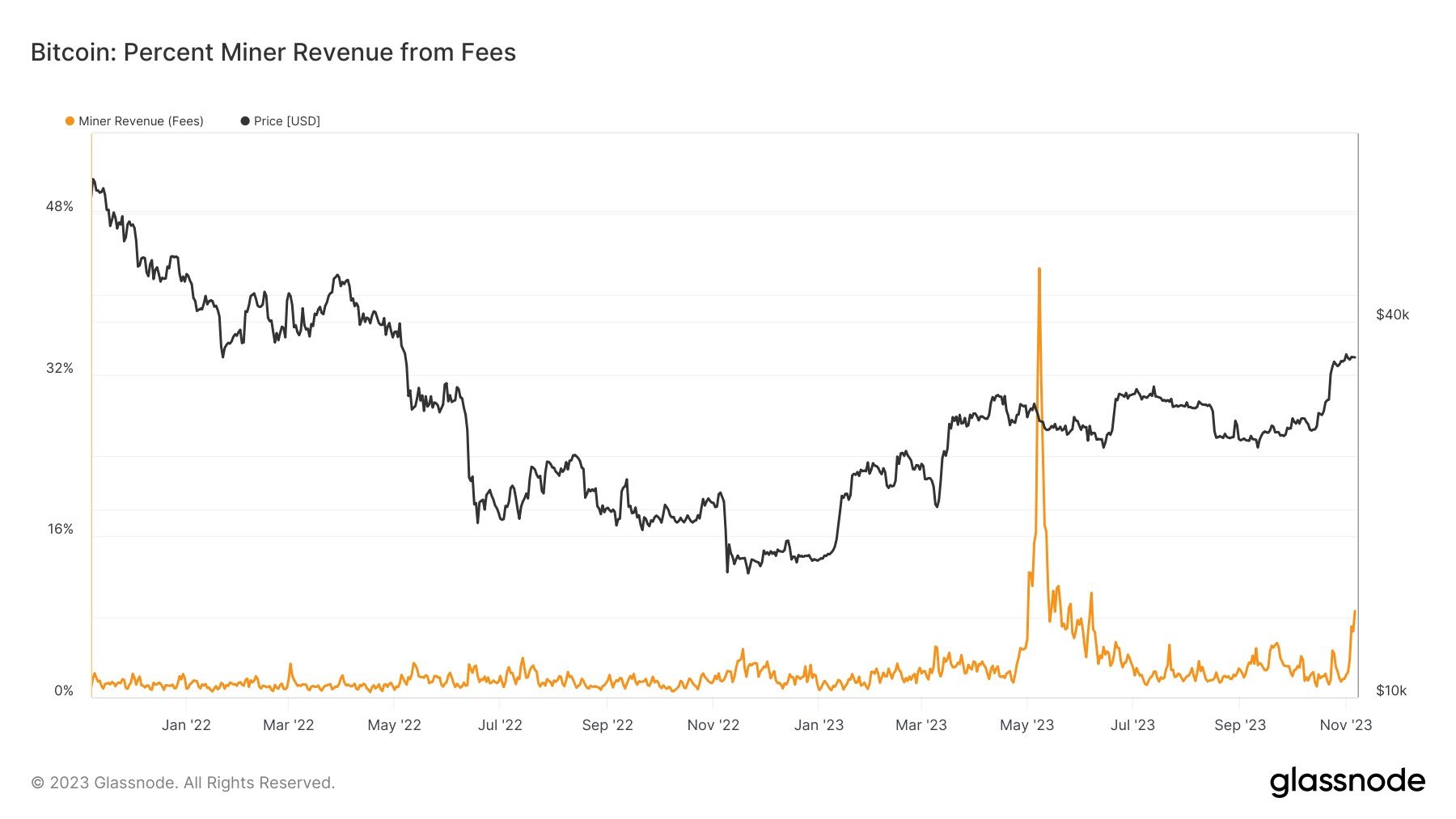

In particular, the total transaction fees that miners receive have registered an uptick during phases of Inscription mania, as the chart below shows.

Normally, the block rewards make up the main source of revenue for the miners, with the transaction fees being a secondary income stream that doesn’t make up for more than 2% to 4% of their total revenue.

During periods when the Inscriptions have been popular, though, the fees have provided a significant portion of the income of these chain validators. With the Inscription count shooting up again, it’s not a surprise that the miners are once again benefitting from the fees, adding up to a notable part of their revenue.

Block rewards will run dry in the future as there will be no more BTC left to mine. The miners will thus need to rely solely on the transaction fees to make their money. Applications like the Inscriptions perhaps show how the fees could sustain these chain validators.

BTC Price

At the time of writing, Bitcoin is trading at around $35,200, up 3% in the past week.