Quick Take

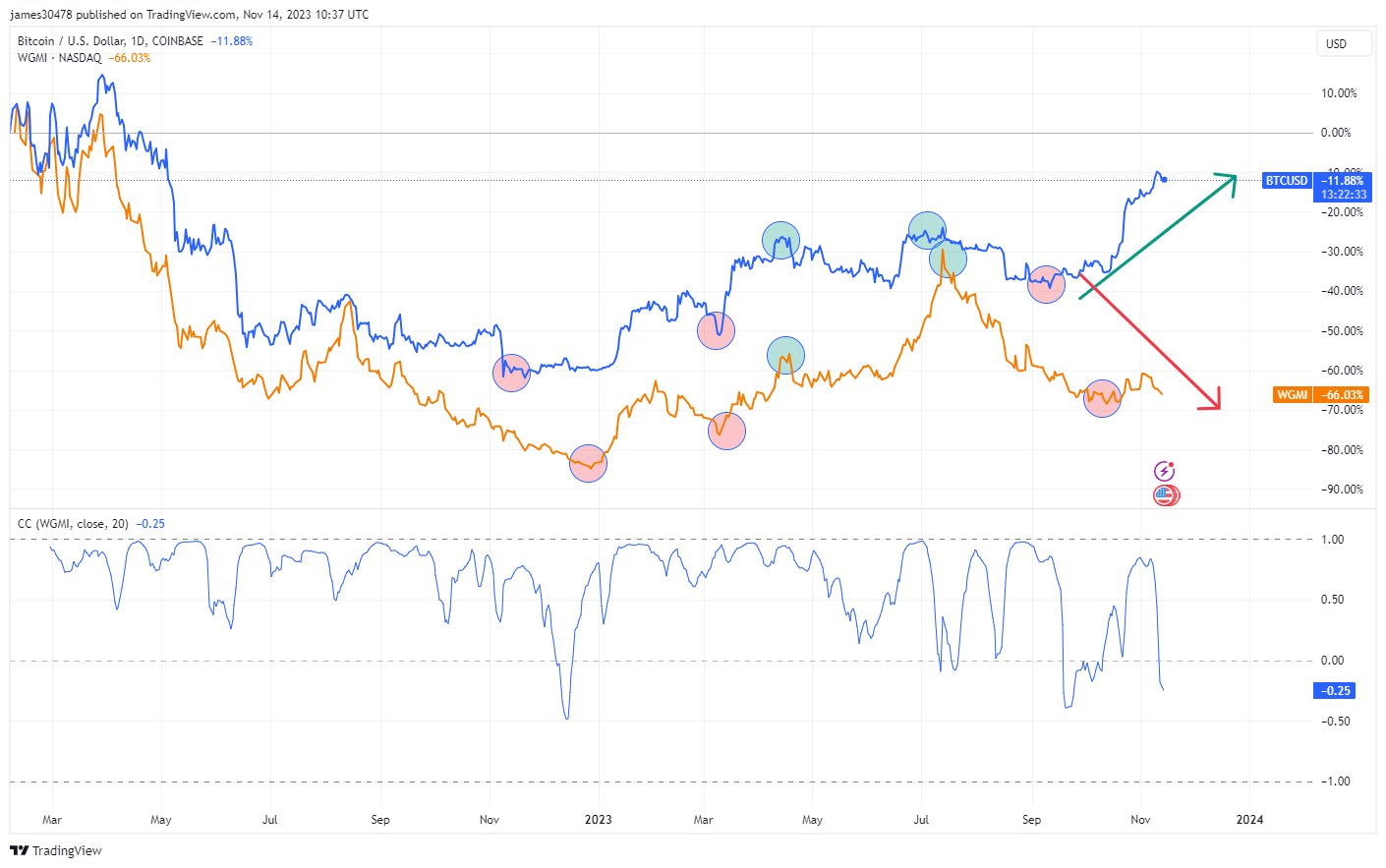

The correlation between Bitcoin and the Bitcoin mining ETF, WGMI, although strong through much of 2022 and 2023, has seen significant divergence since July 2023.

Despite Bitcoin carving a year-to-date high north of $37,000, mining stocks represented by WGMI trailed, continuing to close lower. This suggests a paradigm shift in investor behavior. The ‘buy and hold’ mentality typical among Bitcoin holders, supported by on-chain analysis indicating long-term holder supply nearing historic highs, differs from the potential profit-taking approach favored by mining stock investors.

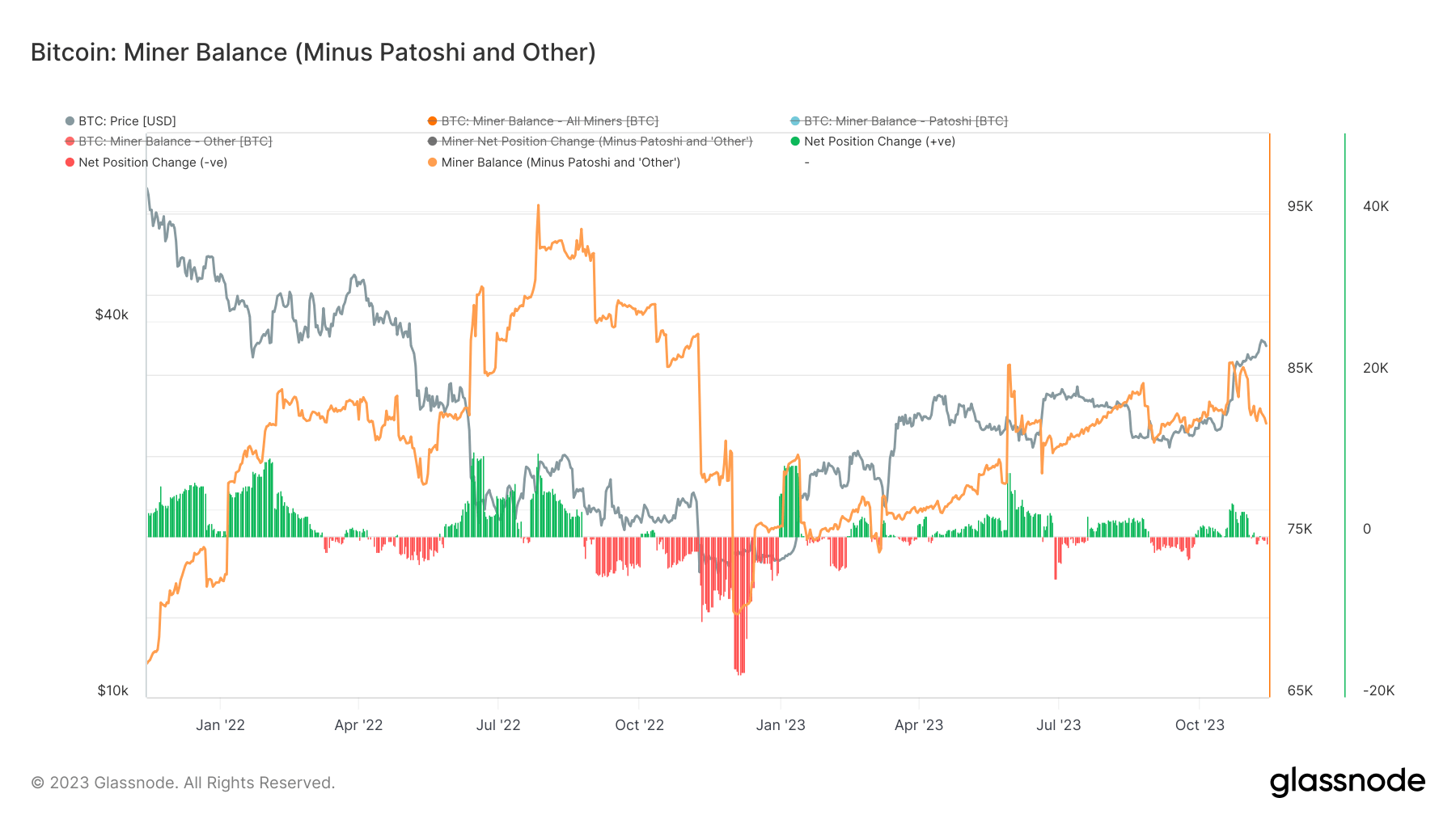

Further complicating matters is the uptrend in Bitcoin miners’ balance throughout 2023. Despite a slight recent sell-off, over 80K BTC remain in miner wallets (excluding Patoshi coins). This implies a lack of immediate sell pressure from miners, suggesting they are not under the intense pressure that their declining share prices would otherwise indicate. It’s an intriguing market dynamic that throws light on the possible divergence of investment strategies between Bitcoin and its mining stocks.

The post Bitcoin and mining ETF pathways diverge, reflecting shift in investor strategies appeared first on CryptoSlate.