On-chain data suggests the next major Bitcoin support level could be at $30,200 if the level pointed out by this analyst is lost.

Bitcoin Currently Has Support Levels At $36,400 And $34,300

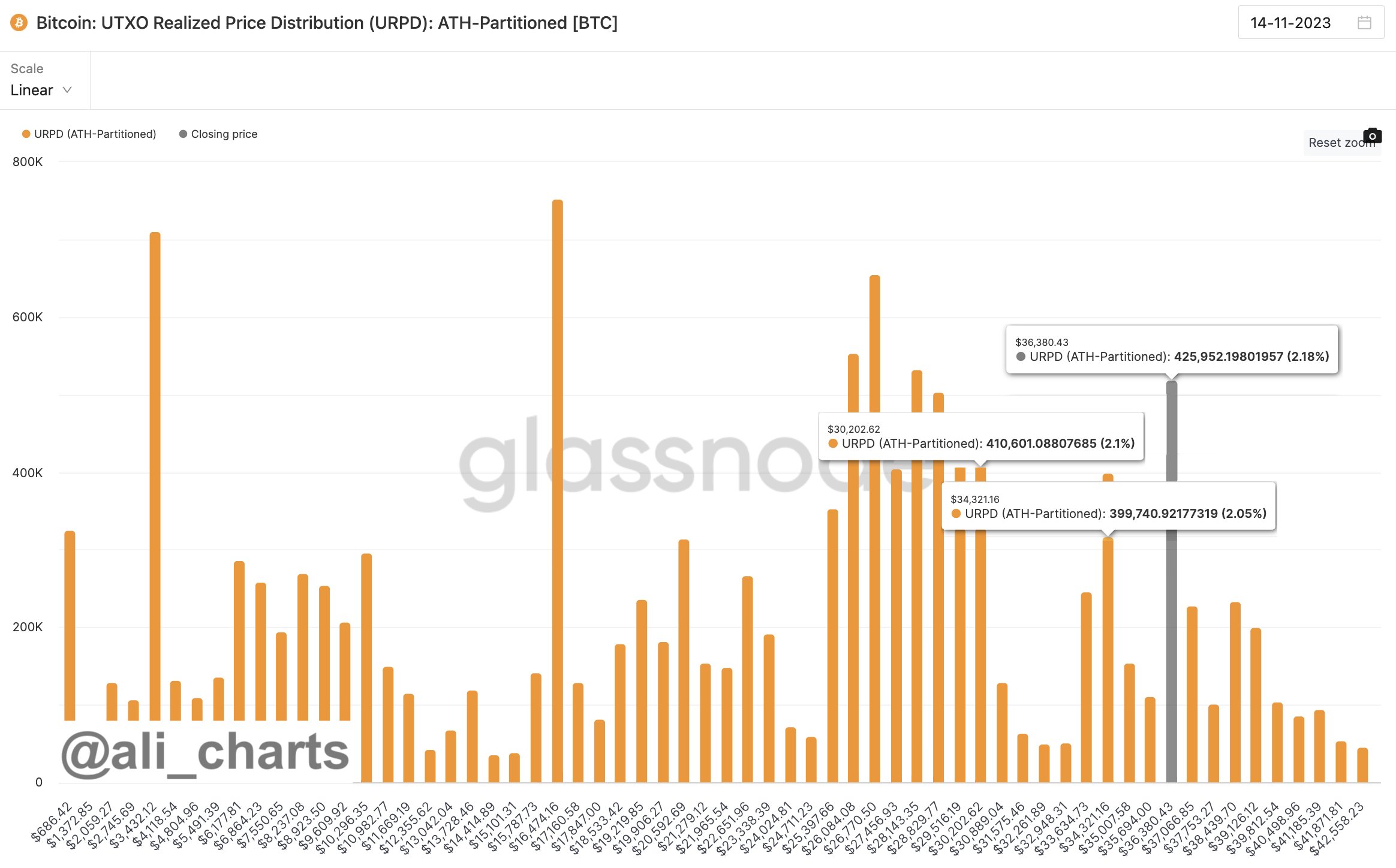

In a new post on X, analyst Ali has discussed how the various support levels of BTC are looking like right now from an on-chain perspective. A level may be defined as support based on the amount of Bitcoin that was bought by the investors at said level.

Generally, whenever the price declines to the cost basis of an investor, they might become more likely to show some kind of move. Since the holder had last been in a state of profit, they might tend to believe that the asset would rise again in the future, if the prevailing trend is bullish in the market.

Thus, the investor could decide to buy more near their cost basis, thinking that it would turn out to be a profitable “dip” buy. Naturally, just a few traders showing this behavior won’t have any real effects on the price of the cryptocurrency. But if a large number of investors had bought around the same price level, the asset retesting at this level could produce a notable reaction in the market.

Such buying that would emerge could provide support to the cryptocurrency. Now, to view these support levels, the analyst has cited the “UTXO Realized Price Distribution” (URPD) metric from Glassnode, which tells us about the amount of supply that was last acquired at each of the price levels that the asset has visited in its history.

As displayed in the above graph, the prices around $36,400 hold the cost basis of a notable amount of the supply. The asset has dipped under this mark during the past day, though, implying that the cryptocurrency may be beginning to lose this major support area.

If the asset can’t reclaim this level, the next major support level would be present at $34,300. A decline towards this mark would suggest losses of more than 5% for the asset.

This support level is thinner than the one the asset is retesting right now, however, meaning it’s possible that the level may not be able to stop the asset from declining even further.

Should this scenario play out, Bitcoin would next have support about 16% down from the current spot price of $30,200. From the chart, it’s visible that all of the price levels below this support area till $25,000 host the cost basis of a significant amount of investors, meaning that these levels should pose a potentially impenetrable wall for the asset.

Thus, a decline to $30,200 is possible in the near term if the $34,300 level becomes lost, but it’s unlikely that Bitcoin would drop further than that.

BTC Price

Bitcoin had been hanging on at $37,000 recently, but it appears that the asset has finally slipped, as it’s now trading under $36,300.