Quick Take

The Bitcoin market continues to demonstrate maturation, as evidenced by a unique reaction to the recent 5% dip in Bitcoin’s price. Historically, such fluctuations have triggered panic selling among investors, notably those who purchased Bitcoin at a value exceeding $35,000. This demographic, primarily composed of short-term holders who have retained Bitcoin for less than 155 days, has often reacted impulsively to market turbulence.

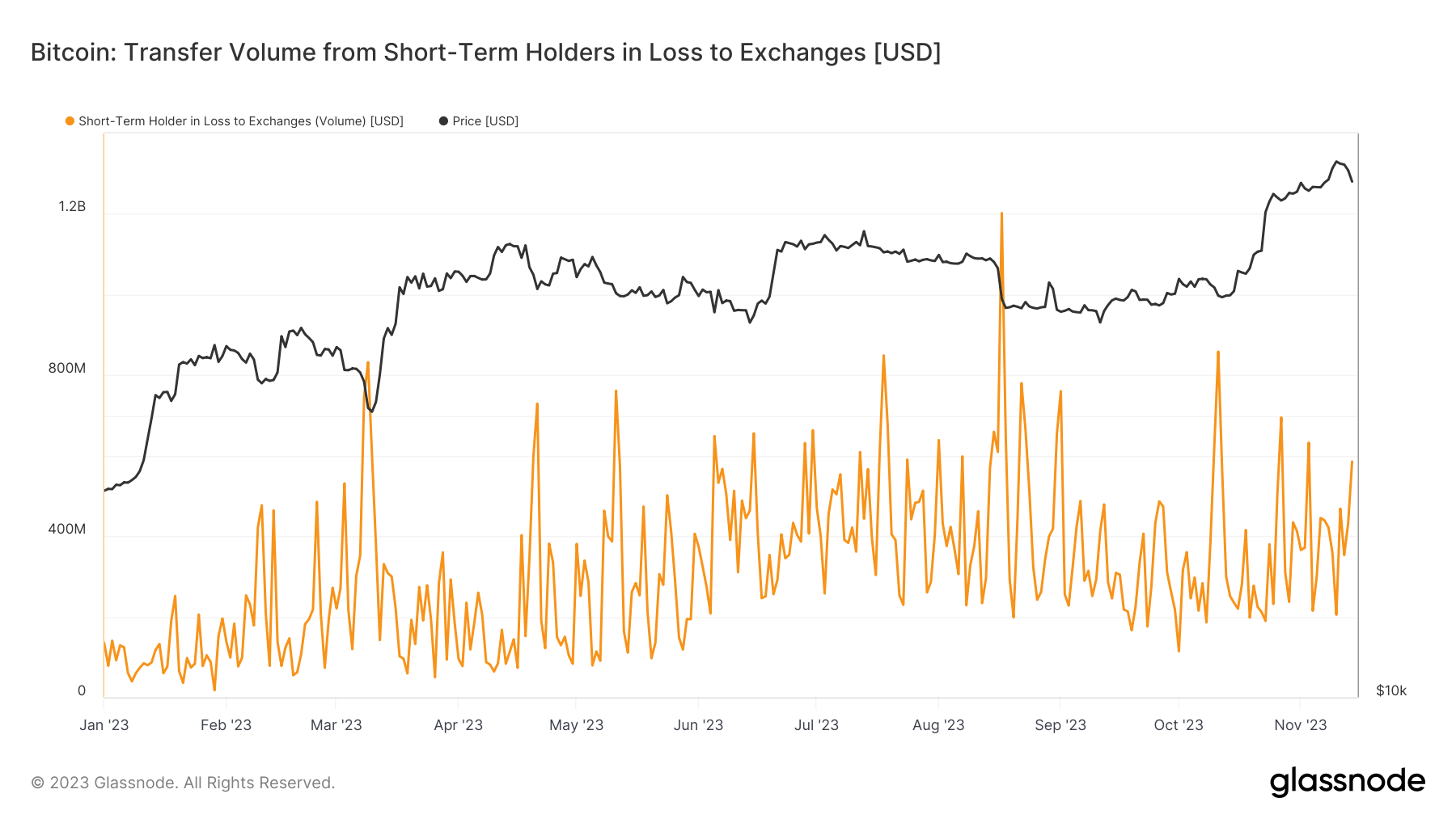

However, the recent market response has deviated slightly from this pattern. This investor cohort has recorded roughly $600 million in losses to exchanges, which, while substantial, falls notably short of the dramatic spikes witnessed amid the SVB collapse in March or August’s abrupt drop to $25,000.

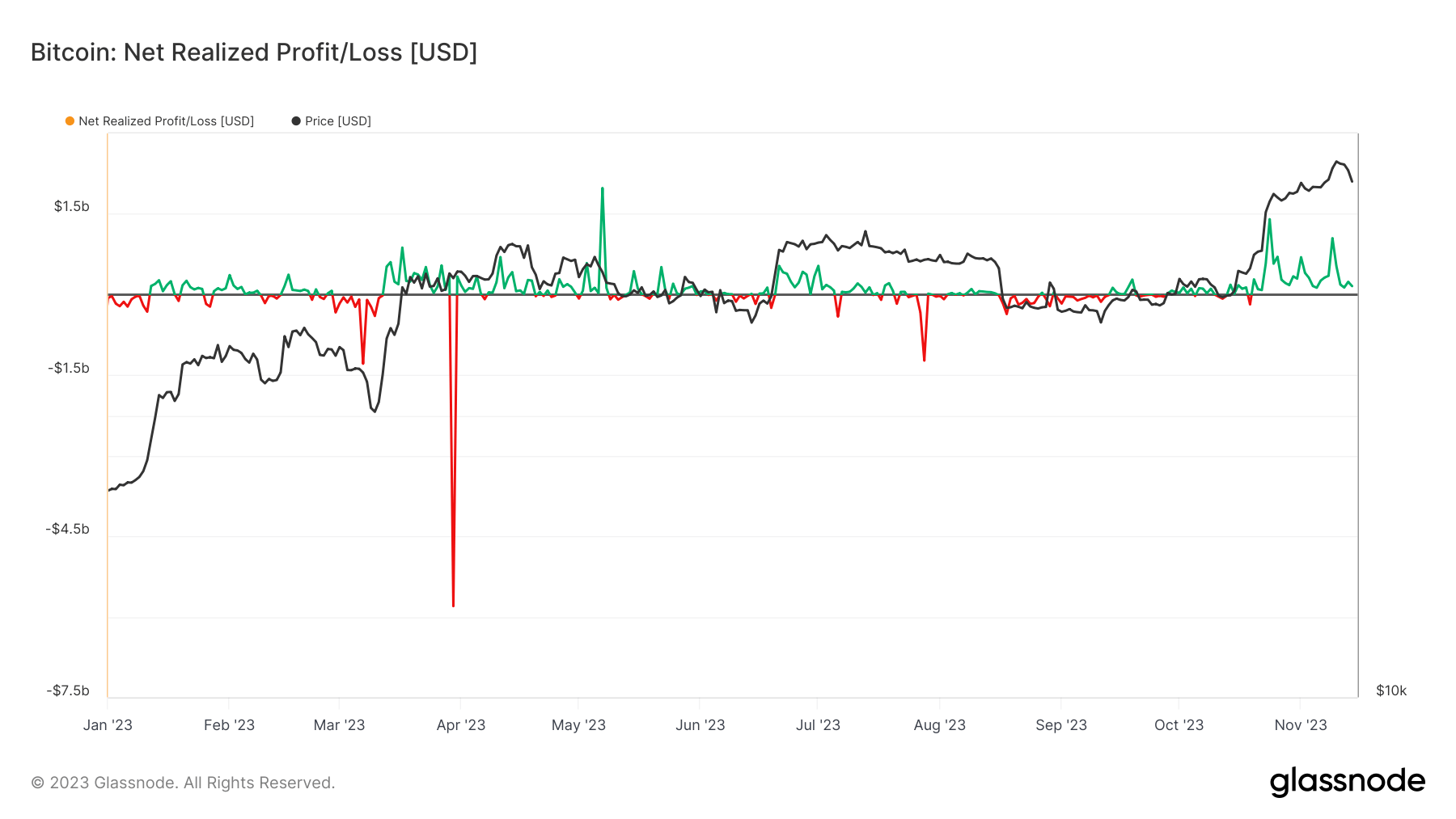

Net Realized Profit/Loss represents the overall profit or loss resulting from all transactions involving the movement of coins. It is calculated as the difference between Realized Profit and Realized Loss. Despite various transactions, there was an aggregate realized profit of $156 million yesterday, Nov. 14.

The post Market maturity: Bitcoin investors stay calm amid 5% value fluctuation appeared first on CryptoSlate.