Quick Take

Bitcoin’s market performance over the past week has demonstrated unusual resilience, with the digital asset maintaining a steady ascent despite a whirlwind of short and long liquidations.

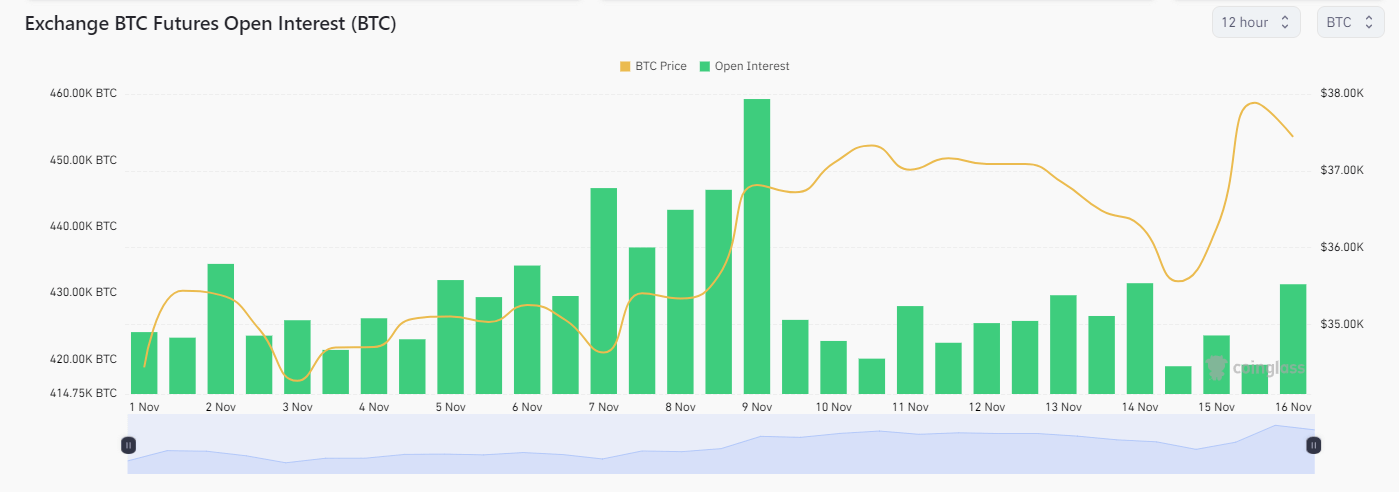

After initially breaching $37,000 on Nov. 9 and fluctuating between lows of $34,500 and highs of $37,900, Bitcoin found a steadier foundation at the same price level on Nov. 16. This stability has prevailed even as open interest, the total USD value allocated in open futures contracts, dipped from 460k BTC to roughly 430k BTC. Significantly, the leadership in open interest has also shifted from Binance to CME, indicating a developing trend toward institutional engagement.

Meanwhile, the average funding rate for perpetual futures contracts, a crucial market indicator, has halved from 0.012% to 0.006%. This adjustment suggests a more balanced market scenario, where long positions are less frequently compensating for short ones.

The post Bitcoin open interest review: Institutional shift at CME reflects enduring market performance appeared first on CryptoSlate.