Quick Take

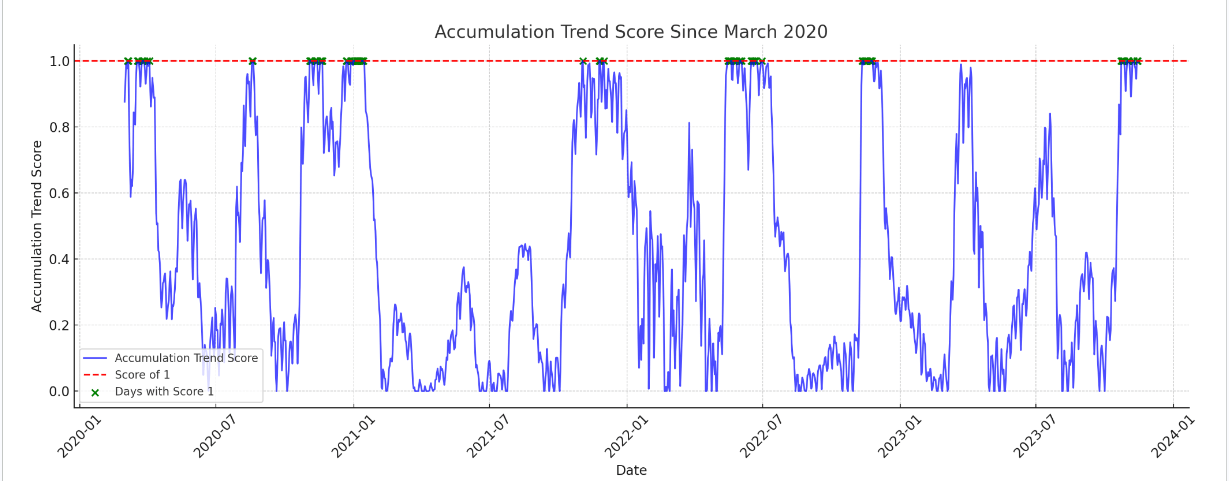

The Accumulation Trend Score, an instrumental indicator of active coin accumulators’ relative size, has recently pointed towards a robust accumulation period for Bitcoin. This pattern of accumulation, representing both the size of the entities’ balance and the volume of new coins procured/sold over the past month, has been paralleled infrequently since March 2020.

Usually, such peaks in accumulation are observable during bear market bottoms of cycles, such as the downturns experienced following the FTX and Luna collapse, the COVID-19 pandemic, or during bull market zeniths like 2021.

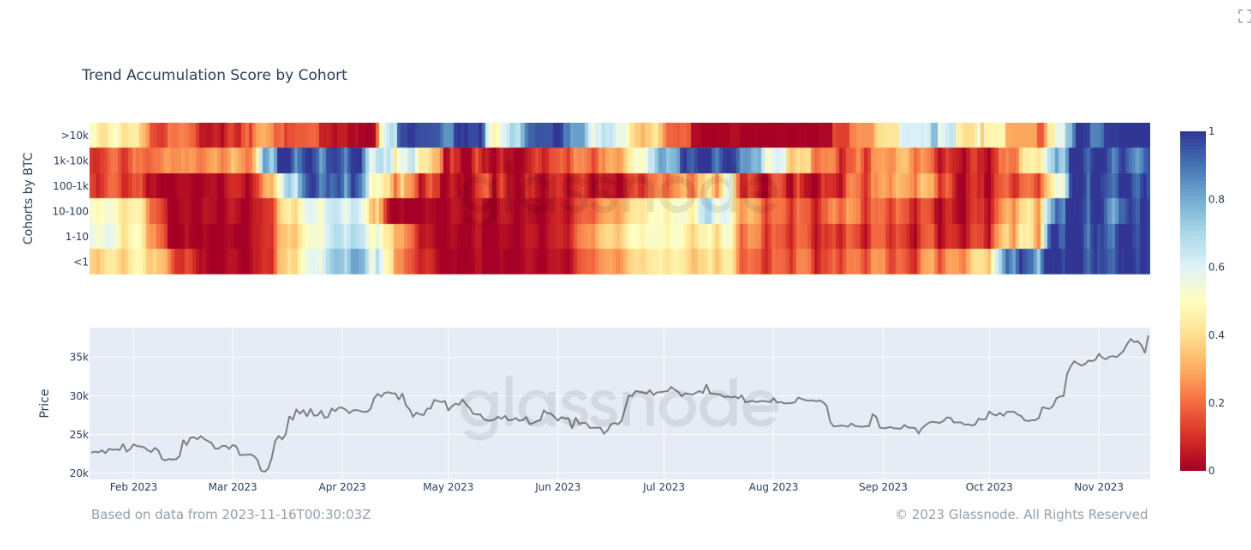

Currently, the Accumulation Trend Score edges closer to 1, suggesting that larger network entities are actively accumulating. This trend provides a glimpse into market participants’ balance size and their accumulation habits over the past month.

Interestingly, an in-depth examination of the accumulation trend score by cohorts further bolsters the narrative of aggressive accumulation by all cohorts. This phenomenon hasn’t transpired all year; all cohorts have moved in concert.

Since Oct. 2023, there have been 12 days recorded where the Accumulation Trend Score reached precisely 1.

Within Bitcoin history, which spans 4,870 days, there have been 449 days where the Accumulation Trend Score has been 1, equating to about 9.22% of the observed period.

The post Recent on chain data points to an all-cohort Bitcoin accumulation appeared first on CryptoSlate.