In a shocking turn of events, Binance CEO Changpeng Zhao has agreed to step down from the crypto exchange and has plead guilty to “violating US anti-money laundering requirements.”

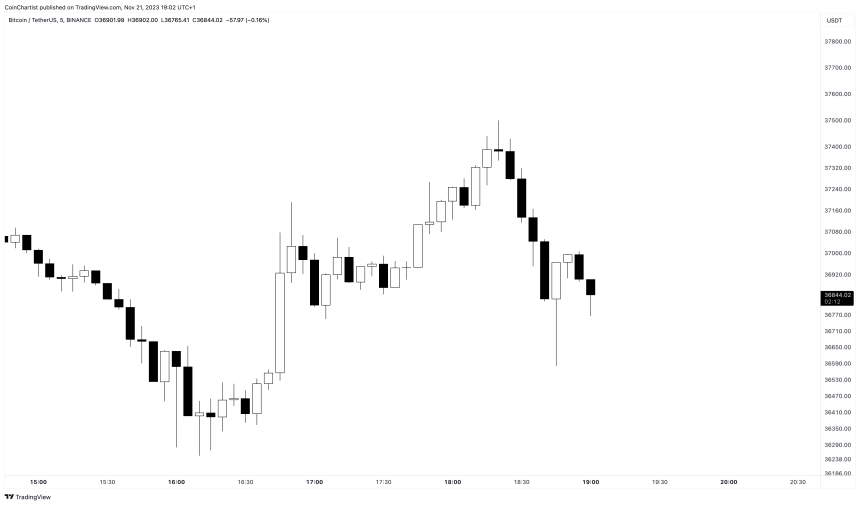

The news is currently being priced into the crypto market, leading to extreme volatility in Bitcoin and altcoins, plus a lot of chatter on social media. Let’s take a closer look at how the market and speculators are reacting so far.

CZ To Step Down, Pleads Guilty, Company Charged $4B In Fines

Earlier today, the US Department of Justice revealed it would be announcing action against a cryptocurrency company. The most dominant cryptocurrency exchange, Binance, was the target of the enforcement action, and was ordered to pay $4.3 billion in fines.

Binance CEO Changpeng “CZ” Zhao stepped down as a result, and plead guilt to US anti-money laundering charges. The crypto market sank in the earlier hours today in anticipation of the news.

However, as soon as the Wall Street Journal revealed the information publicly, Bitcoin price bounced back and so did the altcoin market. Moments later, most of the upside price action was wiped out. Price as traded within roughly a 4% range today, but has traded across that several times since the news broke, highlighting powerful intraday volatility.

The Crypto Market Reacts To The Binance News

While the market tries to price in what just occurred, volatility will continue to ensue in the near term. On X (formerly Twitter), notable figures are speaking out in regards to CZ’s departure from Binance.

On-chain analyst and market commentator Will Clemente points out it is “just a matter of weeks until Bitcoin ETF approval now” with Binance out of the way. The company has long been cited as a key reason for the SEC remaining hesitant to pull the trigger on a spot BTC ETF application approval.

Messari Crypto CEO Ryan Selkis calls it one of the “biggest catalysts we could have in crypto” between ETFs, crypto-friendly legislation, and this $4 billion settlement helping crypto be viewed as a “real industry.”

Economist Alex Kruger reveals that the settlement is ranked the 7th in financial compliance history, next to names like JP Morgan, Bank of America, Goldman Sachs, Wells Fargo, and several others.