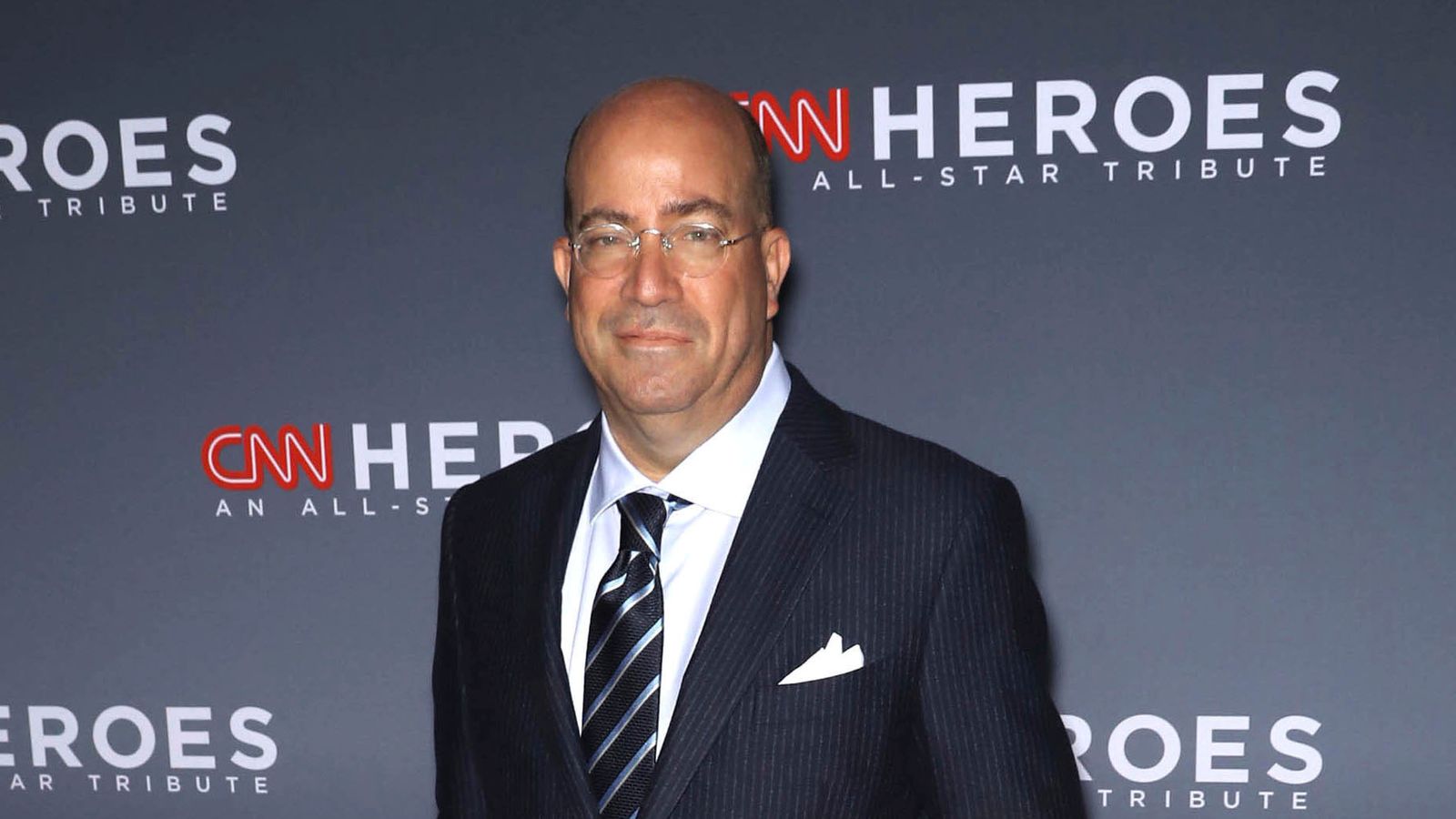

The former CNN president Jeff Zucker will fly into London this week amid mounting controversy over the Abu Dhabi-backed takeover of The Daily Telegraph he is spearheading.

Sky News understands that Mr Zucker, the boss of RedBird IMI, will hold meetings with key stakeholders as expectations grow that the government will launch a public interest probe into its potential acquisition of the broadsheet newspaper.

A source close to RedBird IMI suggested that Mr Zucker was unlikely to hold direct talks with ministers or Whitehall officials given the quasi-judicial nature of the investigation that could be launched within days.

Last week, he told the Financial Times that other parties interested in owning the Telegraph titles and The Spectator magazine were “slinging mud and throwing darts” in an effort to undermine the RedBird IMI deal.

The Abu Dhabi-backed vehicle includes funding from Sheikh Mansour bin Zayed Al Nahyan, a member of Abu Dhabi’s royal family and owner of Manchester City Football Club.

In recent weeks, MPs and peers principally linked to the Conservative Party have raised concerns about what they argue would amount to the ownership of two of Britain’s most influential newspapers by a foreign government.

Lucy Frazer, the culture secretary, confirmed a Sky News report last week that she was “minded to” trigger a Public Interest Intervention Notice (PIIN), which would lead to an investigation carried out by Ofcom, the media regulator.

Revolution Beauty founder Minto in £3m settlement talks

Ladbrokes and Coral owner Entain agrees to pay £585m after bribery investigation

Almost half of women transport workers sexually harassed in last year, RMT union survey suggests

RedBird IMI has moved into pole position to take control of the Telegraph by offering to repay £1.16bn owed to Lloyds Banking Group by the Barclay family, the newspapers’ long-standing owners.

The prospective owners have pledged to give a legal undertaking to the government that Sheikh Mansour’s IMI group would be a passive investor.

It would also establish a separate editorial advisory board to oversee the media assets.

On Friday, Sky News revealed that Lloyds and RedBird supported a proposal to retain the Telegraph’s independent directors during the PIIN process.

Rival bidders led by the hedge fund billionaire and GB News shareholder Sir Paul Marshall have been agitating for a government inquiry into a RedBird IMI deal.

Sky News reported last week that Ed Richards, the former boss of media regulator Ofcom, is acting as a lobbyist for RedBird IMI.

Flint Global, the business Mr Richards co-founded with former Foreign Office mandarin Sir Simon Fraser, has been hired because of Mr Richards’ track record of involvement in government probes which have the power to block or unwind corporate deals.

The Telegraph auction has also drawn interest from the Daily Mail proprietor Lord Rothermere and National World, a London-listed local newspaper publisher.

A bid deadline this week has been postponed until December 10.

Until June, the Telegraph newspapers were chaired by Aidan Barclay – the nephew of Sir Frederick Barclay, the octogenarian who along with his late twin Sir David engineered the takeover of the Telegraph 19 years ago.

Lloyds had been locked in talks with Barclays for years about refinancing loans made to them by HBOS prior to that bank’s rescue during the 2008 banking crisis.

The family’s debt to Lloyds also includes some funding tied to Very Group, the Barclay-owned online shopping business.

A spokesman for RedBird IMI declined to comment.