As one of the leading layer-1 blockchains, Solana offers an insightful proxy for analyzing the broader L1 ecosystem. Its unique combination of high throughput, low transaction costs, and a rapidly growing ecosystem makes it an ideal case study for understanding trends in blockchain adoption, user behavior, and transactional dynamics.

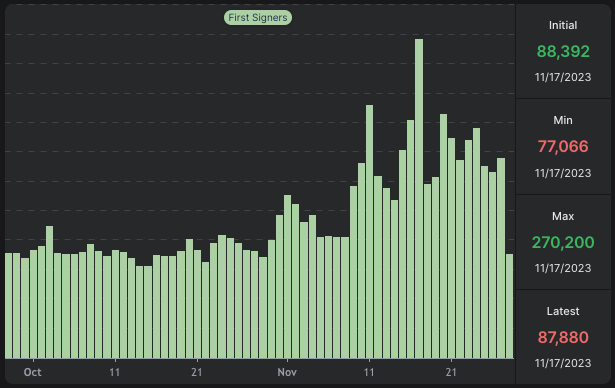

The total number of unique, first-time initiators of transactions, or first signers, is a key metric for gauging new user engagement. On Nov. 1, there were 138,000 first signers, a figure that significantly increased to 270,000 by Nov. 17, indicating a strong influx of new users. However, this number decreased to 169,000 by Nov. 27, suggesting a stabilization or a temporary ebb in new user activity.

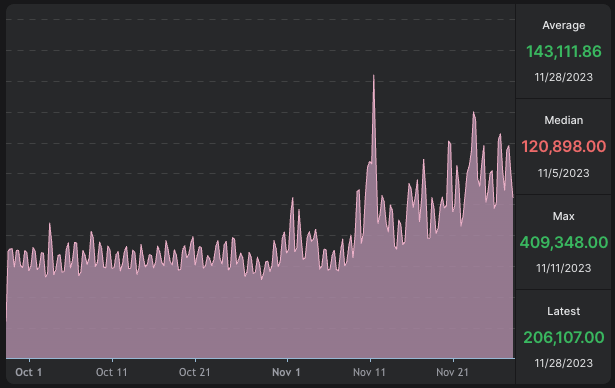

The number of distinct wallet addresses that sent Solana’s native cryptocurrency, SOL, also offers insights into transactional activity. From a count of 10,916 on Nov. 1, there was a remarkable jump to 409,000 by Nov. 11. This was followed by some variability, with the count standing at 209,000 on Nov. 17 and rising again to 252,000 by Nov. 27. These fluctuations point to a highly active network with consistent, yet varied, user participation.

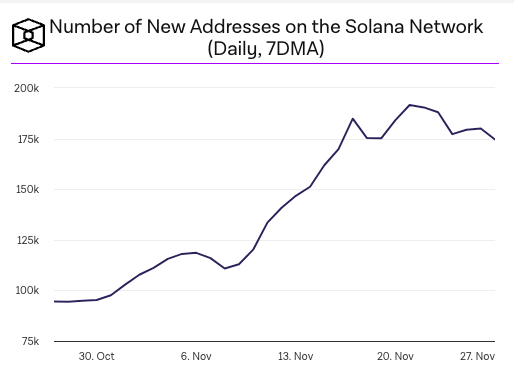

The daily creation of new addresses on the network averaged over seven days and sheds light on the network’s growth. There was a steady rise in new addresses from 102,870 on Nov. 1 to a peak of 191,580 on Nov. 21, before slightly reducing to 174,580 by Nov. 27. This trend indicates an expanding network with a consistent influx of new participants.

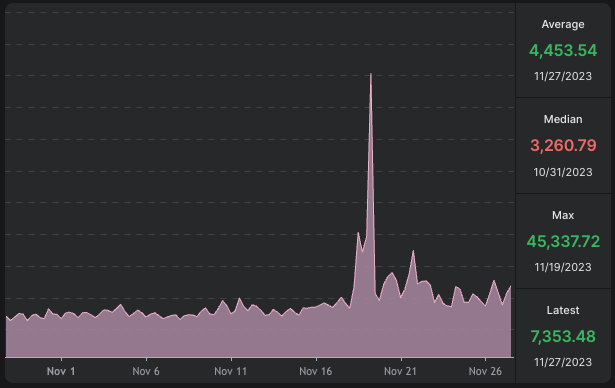

Analyzing the average SOL balance in wallets that initiated transactions reveals insights into the financial behavior of users. The average balance saw a notable increase from 1,906 SOL on Nov. 1 to an extraordinary 45,337 SOL on Nov. 19 before moderating to 7,353 SOL by Nov. 27. This pattern suggests significant transactional shifts, possibly reflecting the entrance of wealthier users or large-scale transfers during this period.

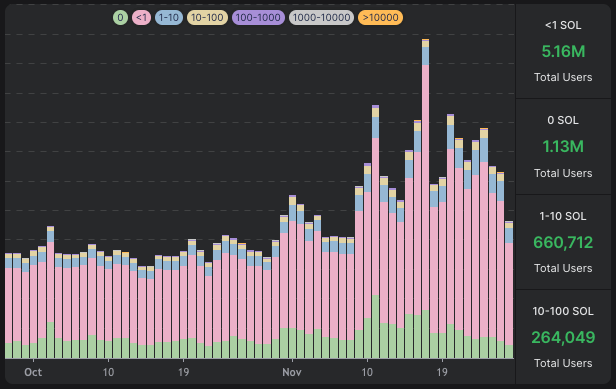

The number of daily active users, categorized by their SOL wallet balances, provides a perspective on user diversity. Over 3 million users had less than 1 SOL, and about 700,000 had zero balance, indicating a substantial base of casual or entry-level users. Meanwhile, the numbers decline for higher balance cohorts, a typical pattern in cryptocurrency holdings.

Solana’s November data reveals a period of heightened user interest and diverse transactional behavior characterized by new user influx, consistent network expansion, and varied financial activities. The diverse user base, from casual participants to more substantial investors, reflects a multifaceted ecosystem indicative of Solana’s maturity.

The post Solana’s user engagement surges with influx of new participants appeared first on CryptoSlate.