Quick Take

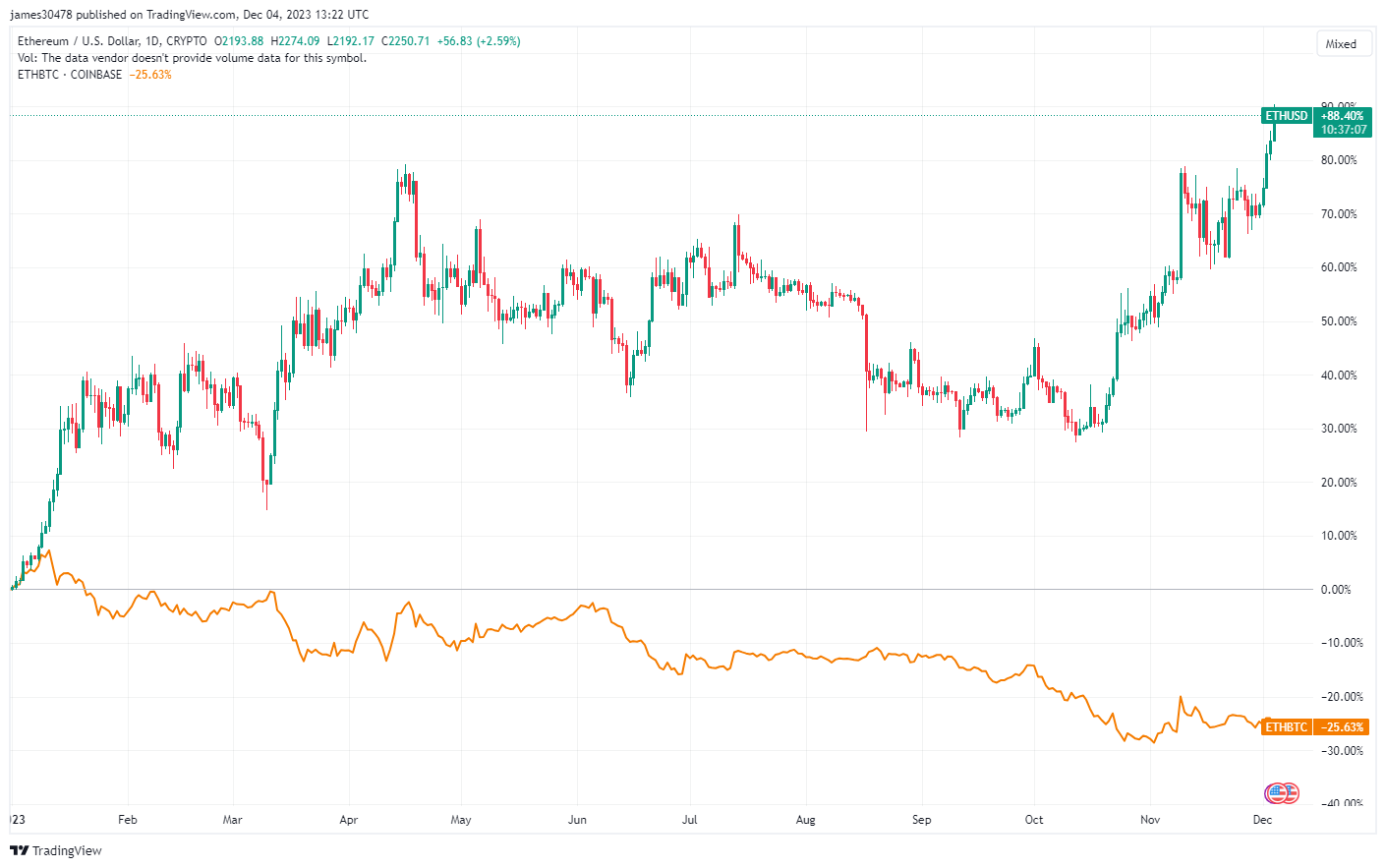

The year 2023 has marked a shift in the Ethereum to Bitcoin ratio. Despite Ethereum’s substantial dollar value growth of 88%, it has significantly underperformed compared to Bitcoin, being down by 25% against the lead digital asset. The ratio currently sits at a precarious 0.053, teetering near year-to-date lows.

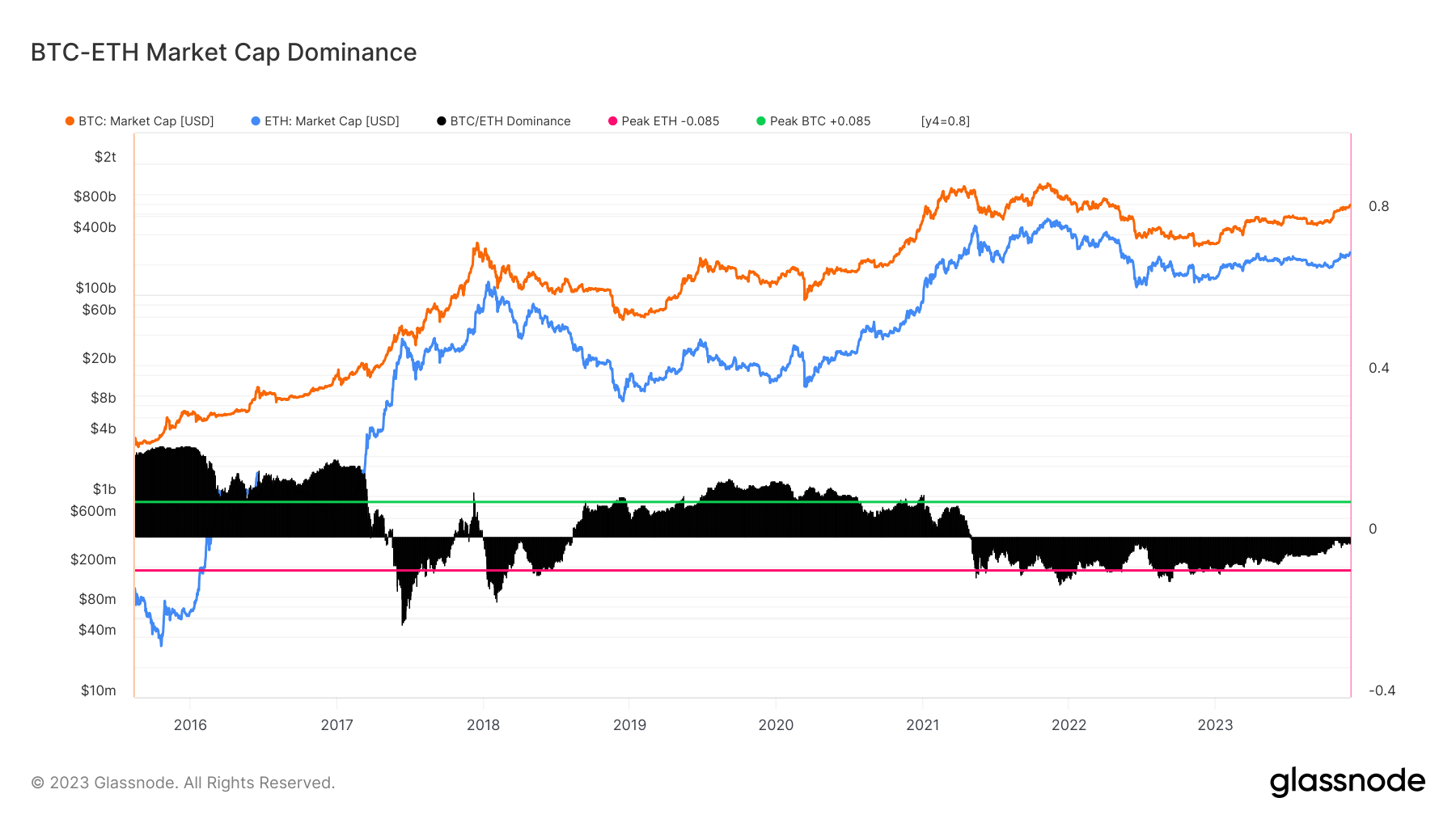

This trend invites speculation as to whether the crypto landscape may soon witness a further dip in Ethereum’s performance. The BTC-ETH Dominance metric, an oscillator that tracks the macro outperformance trends between Bitcoin and Ethereum, provides some relevant insights. It gauges the Bitcoin Market Cap’s dominance over the combined market cap of Bitcoin and Ethereum, normalized around a long-term mean using a 0.765 factor.

Higher values and uptrends point towards Bitcoin outperforming Ethereum, while lower values and downtrends signal Ethereum’s superior performance. Currently, we are technically in an era of Ethereum dominance, with the metric at -0.016, which is the lowest level since Ethereum dominance began in May 2021. Traditionally, Ethereum tends to outperform Bitcoin during bull markets, raising the question: Could this be the first bull market where Bitcoin outpaces Ethereum?

The post Bitcoin primed to outpace Ethereum during bull market for first time next cycle appeared first on CryptoSlate.