Cardano touched the highest levels since April earlier today as on-chain data shows big money interest in ADA has been growing recently.

Cardano Large Transactions Have Grown In Number Recently

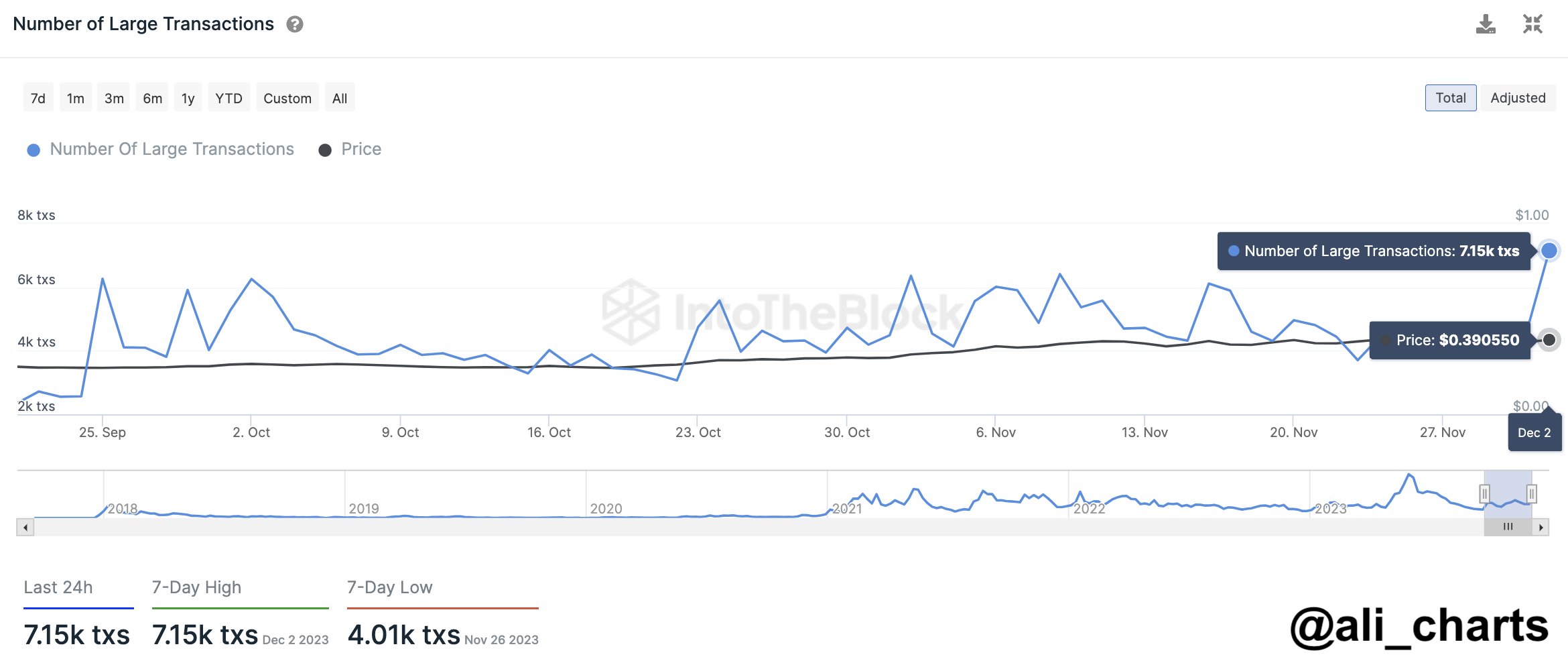

As pointed out by an analyst in a post on X, interest from whales and institutional investors in ADA has surged recently. The indicator of relevance here is the “number of large transactions” metric from IntoTheBlock, which keeps track of the daily total number of Cardano transactions that are over $100,000 in value.

The only entities capable of making such large movements with single transactions are the whales and institutional investors, so the indicator’s value can provide hints about the behavior related to these humongous holders.

When the metric’s value rises, it means that these large investors are increasing their transaction activity on the blockchain. Such a trend may be a sign that interest in the asset has gone up among these cohorts.

On the other hand, decreasing values may imply the whales and institutional holders are losing their interest in ADA, as they are making fewer transactions.

Now, here is a chart that shows the trend in the number of large transactions for Cardano over the past couple of months:

As displayed in the above graph, the number of large Cardano transactions has registered a sharp rise recently, implying that large entities have been on the move.

Interestingly, the indicator hasn’t spiked only now, it has actually been doing so for the past three months, suggesting that the whales and institutional investors have had their eyes on ADA for a while now.

From this indicator alone, it’s generally hard to say just what kind of activity these investors are taking part in, as both selling and buying transactions count under its value.

Since the surge in the transaction activity of these humongous entities has started, though, Cardano has only rallied up, suggesting that these humongous entities have been accumulating in this period and helping fuel the surge.

As is visible from the chart, the latest spike in the indicator has been particularly large, taking it to higher levels than any seen during this period. This naturally suggests that these cohorts have become especially active now.

After this latest spike, too, Cardano observed some uptrend at first, as it broke past the $0.41 level and reached price levels not seen since April of this year. As the below chart shows, though, the asset has since seen some setback, as it has retraced back towards $0.40.

It’s possible that the whales have now pivoted towards selling, which is why the pullback has occurred. However, given the consistent accumulation behavior that these entities have shown in the last three months, it’s more likely that the setback is just because of a few impatient investors participating in profit-taking, rather than a loss of conviction among the majority.