Bitcoin (BTC) rallied over 10% in the past week, extending gains and reaching levels not seen since the Terra collapse in May 2022. This surge is attributed to increased institutional activity, particularly in the United States.

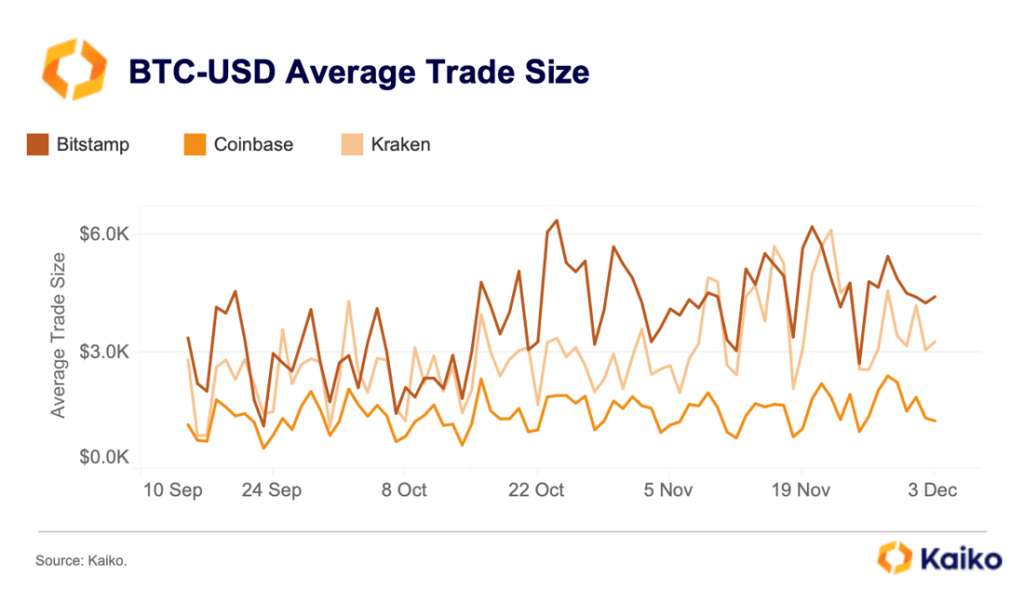

Average Bitcoin Trade Size Rising In U.S. Exchanges

According to Kaiko data on December 5, the average trade size on United States exchanges like Coinbase, Bitstamp, and Kraken has rapidly risen since September 2023. If this data guides, it indicates that institutions are making larger block trades, doubling down on Bitcoin.

The increase in average trade size coincides with the expected approval of the first batch of Bitcoin ETFs in the United States. In the coming weeks, the Securities and Exchange Commission (SEC) will rule on several Bitcoin ETF applications, including those made by BlackRock and Fidelity. Analysts predict the SEC will authorize multiple derivatives in early Q1 2024.

Analysts view the green lighting of the spot Bitcoin ETFs as a significant catalyst for institutional adoption of Bitcoin and crypto, validating coins as a new asset class. Authorizing these complex derivatives would provide institutions with a regulated and accessible way to get exposure in Bitcoin, reducing hurdles that have previously held them back.

Shift In Monetary Policy, Tapering Volatility Driving BTC Demand

Besides the ETF anticipation, the improving risk environment contributes to Bitcoin’s rally. The USD has been weakening over the past few months. At the same time, risk-free rates have stabilized, making Bitcoin a more attractive investment.

Last year, as the Federal Reserve steadily increased interest rates to curb rising inflation–which had soared to record levels–Bitcoin and crypto assets plunged. In a shift in monetary policy, the central bank has paused rate hikes due to falling inflation.

However, any change from the current dovish state could significantly impact Bitcoin and crypto, potentially leading to a move towards risk-free treasuries and the USD.

As Bitcoin roars, printing new 2023 highs above $42,000, its superiority shows through its risk-adjusted returns versus other traditional asset classes. Kaiko notes that Bitcoin’s Sharpe ratio exceeds that of gold and technology stocks and indices like Tesla and NASDAQ.

The blockchain analytics platform also notes that Bitcoin volatility, measured by the Sharpe Ratio, which shows returns investors received while accounting for volatility, is at multi-year lows, propping up the coin. Usually, lower volatility makes the asset, in this case, Bitcoin, a less risky investment. In turn, this makes it more appealing to institutions who can then consider it for diversification.