Quick Take

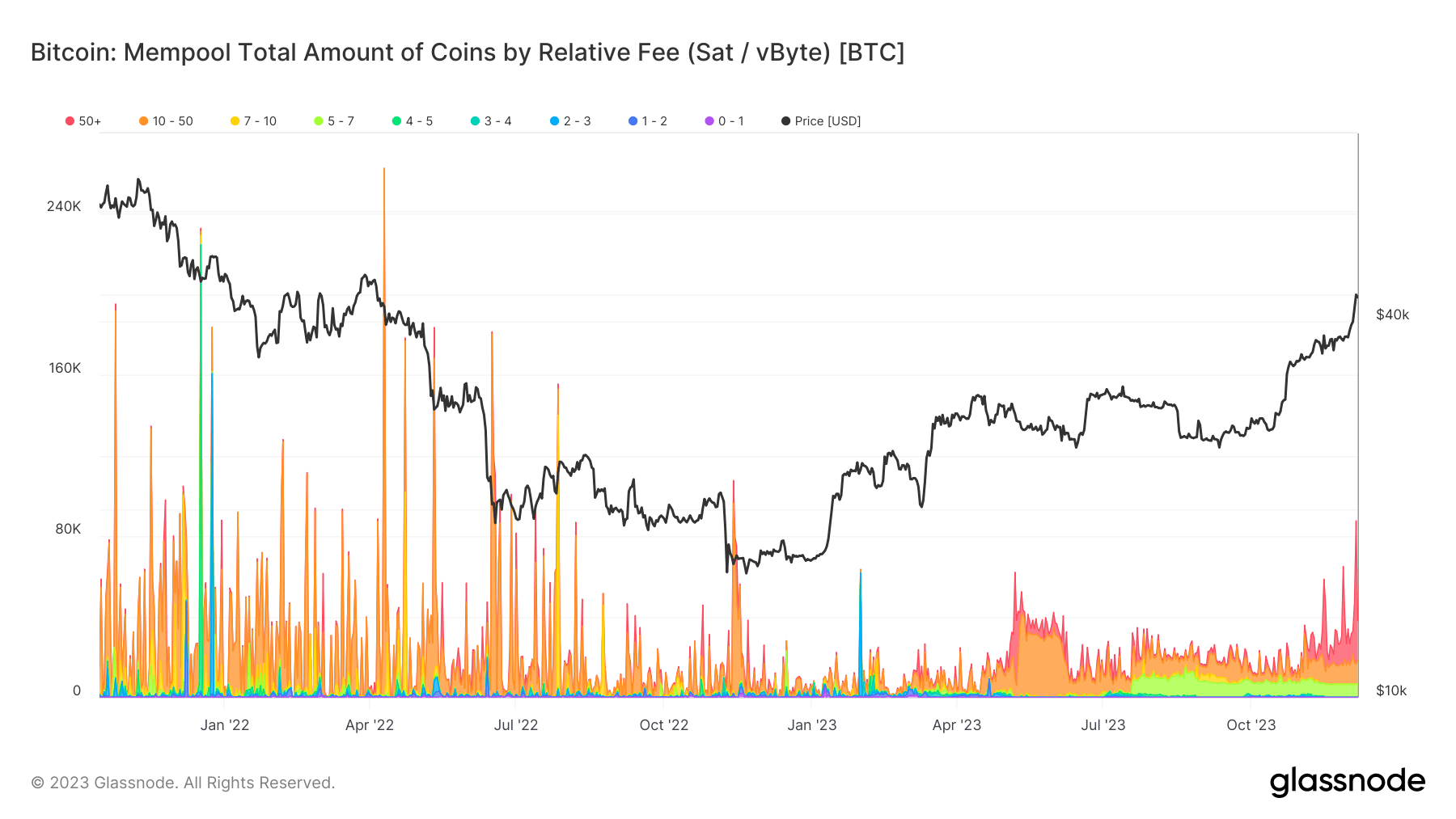

Bitcoin transaction fees have witnessed a significant uptick recently, echoing patterns seen last month during the Inscription frenzy.

This time, however, the catalyst appears to be an increase in transactions awaiting confirmation in the Bitcoin network’s mempool. The volume of coins in transactions held in the mempool reached 88,000 BTC.

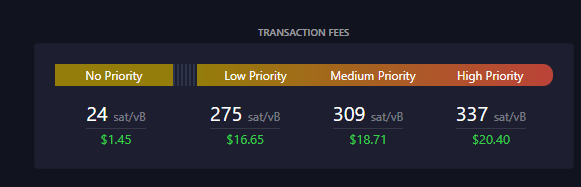

Furthermore, a detailed examination of transactions waiting in the mempool reveals that most fall under the 50+ sat/vByte fee cohort. High-priority transactions reach up to 337 sat/vByte, which converts to approximately $20.

This is paralleled by a surge in Bitcoin fees to roughly $12.5 million. This places Bitcoin fees hot on the heels of Ethereum, which currently tops the chart at $15 million.

| Name | 1 Day Fees | 7 Day Avg. Fees |

|---|---|---|

| Ethereum | $15,005,897.28 | $11,950,187.83 |

| Bitcoin | $12,573,926.34 | $6,358,238.65 |

Source: Cryptofees.info

This data reflects the intricate dynamics linking transaction volumes, waiting times, and fee structures in the Bitcoin network and their effect on overall transaction costs.

The post Bitcoin transaction fees surge, rivaling Ethereum daily gas fee totals appeared first on CryptoSlate.