Quick Take

As we delve into the data, it’s clear that the digital asset market has seen significant activity over the past year.

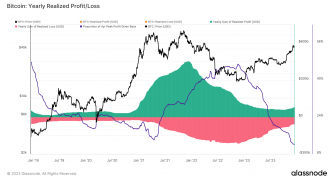

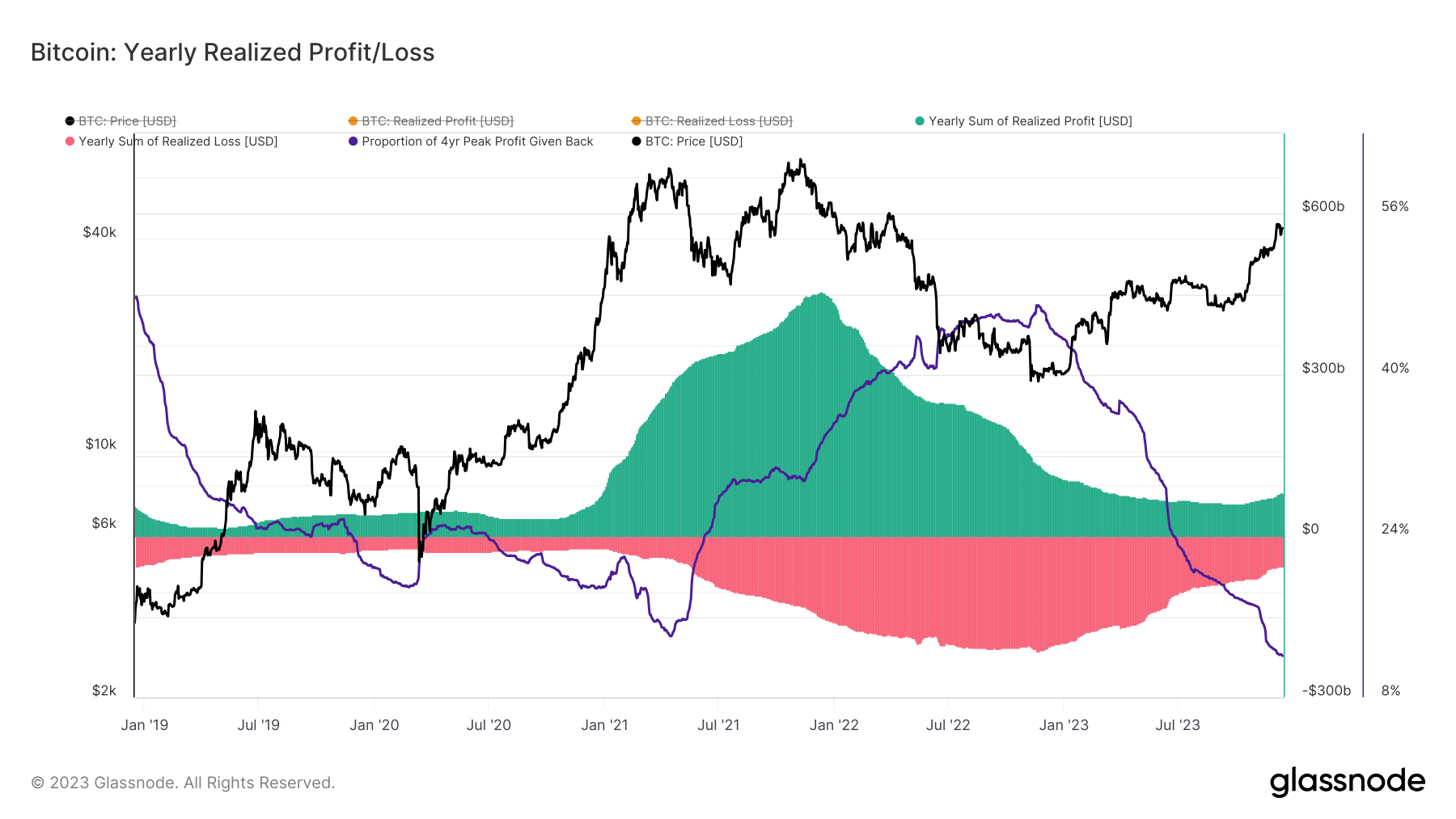

The rolling yearly sum of Realized Profits, where a coin is spent at a price higher than its original acquisition price, reached an impressive $83 billion. In contrast, the rolling yearly sum of Realized Losses, where a coin is sold for less than its purchase price, hit $55 billion.

This disparity underscores the volatility and risk/reward balance inherent in digital asset trading. Moreover, the data reveals that 12% of the peak yearly Realized Profit was ‘given back’ as Realized Losses, indicating a net flow of wealth away from the peak profit holders.

This could point towards a strategic move by investors, offloading their investments during high profit times to mitigate potential future losses.

The post Realized gains and losses reflect a volatile year for Bitcoin appeared first on CryptoSlate.