A second successive chunky fall in the rate of inflation is unarguably good news, all the better for being unexpected, that may yet change the economic and political path for the year ahead.

While prices are emphatically not falling, they are rising less fast than they were, offering some hope that better times, if not yet here, may be less distant than they looked at the start of the year when prices were rising by double-digits.

When the consumer price index fell by 1.1% in October, taking it below 5%, it was largely anticipated.

We knew there would be a large correction for sliding energy prices, governed by the Ofgem price cap.

The further drop revealed today, down 0.7% to 3.9%, is well ahead of expectations, which economists put at around 4.4%.

Historically it is still a high rate, almost double the Bank of England target, but the factors in the decline are instructive and encouraging.

The biggest share of the fall can be traced to transport costs, for which read petrol and diesel, falling at the pump and actually declining in the data, with deflation of -1.4% in November compared to an increase of 0.5% the previous month.

How much more expensive has Christmas got since inflation surged?

Bigger than expected fall in inflation

Ofcom plans to force phone and TV firms to set out contract prices ‘in pounds and pence’

Beyond energy prices, largely determined in international markets and forecast to fall by another 14% in April, domestic sources of inflation slowed across the board.

Food inflation was still 9.2% in November but fell back from 10.1%, alcohol and tobacco 10.2% from 11% and clothing 5.7% from 6.2%.

This broad-based decline was reflected in the rate of “core inflation”, which strips out volatile elements like fuel and food, and dropped back to 5.1% from 5.7%.

With wages still rising at more than 7% consumers may feel a real-terms increase in earnings, though not enough to undo the massive increase in the cost of living built up over the last two years.

Please use Chrome browser for a more accessible video player

Be the first to get Breaking News

Install the Sky News app for free

Some price increases are unlikely to ever go back

The Resolution Foundation point out that food prices are 29% higher than they were in September 2021 and energy prices 66% up on the same period, increases that are unlikely to ever be fully unwound.

The question now is whether interest rates will fall back further and faster than anticipated just a few weeks ago, when the Bank of England governor Andrew Bailey insisted it was too early to think about cuts, let alone do it.

The markets certainly think so, pricing in the first rate cut for March, and falling back from 5.25% to just 4% by the end of 2024.

This is much faster than the Bank has implied, with Mr Bailey pointing out that, with many households yet to fall off fixed deals, only around half of the impact of the current rate rises has been felt.

It may be that the Bank is right and that the easy part of the inflation journey was riding out the extraordinary impact of the war in Ukraine on energy and food prices. To halve the rate again to the 2% target may be tougher.

If markets are to be proved right however the good news for consumers may continue into the New Year, and Downing Street will take note.

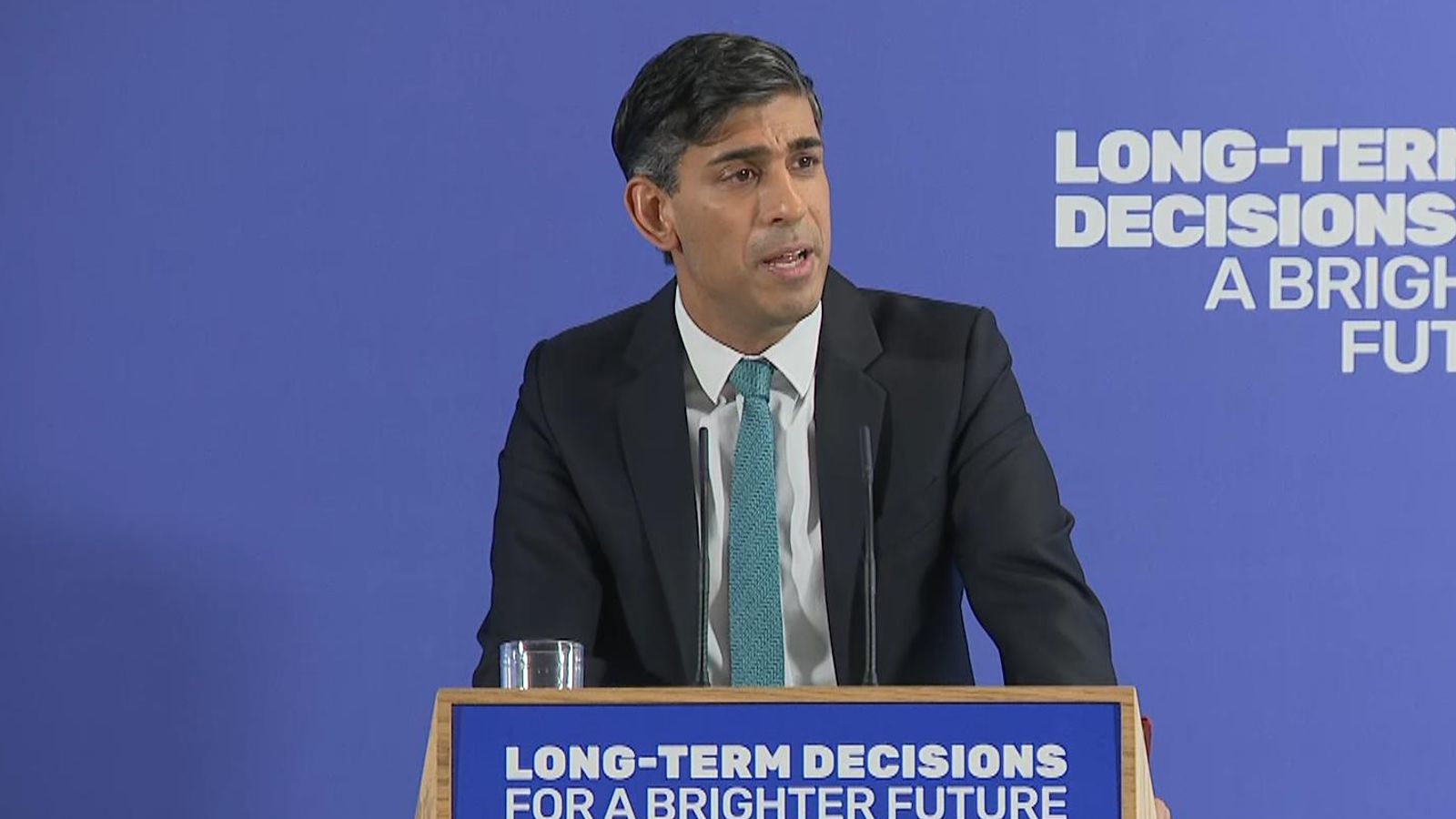

There is a big gap between improved data and the real-world experience of the cost of living, but if inflation and rates fall in unison the electoral calculation for a prime minister running out of time and options may shift.

What price a May election off the back of a tax-cutting budget, with inflation closer to 3% than four, and the Bank of England trimming interest rates?