Introduction

The realized price and the true market mean price are critical indicators in Bitcoin’s on-chain data analysis, each providing essential insights into the valuation and investor behavior within the cryptocurrency landscape.

Understanding the distinction between these two metrics is crucial for a comprehensive grasp of Bitcoin’s valuation, as they collectively shed light on both the broader holder base’s sentiment and the current market enthusiasm.

Realized price

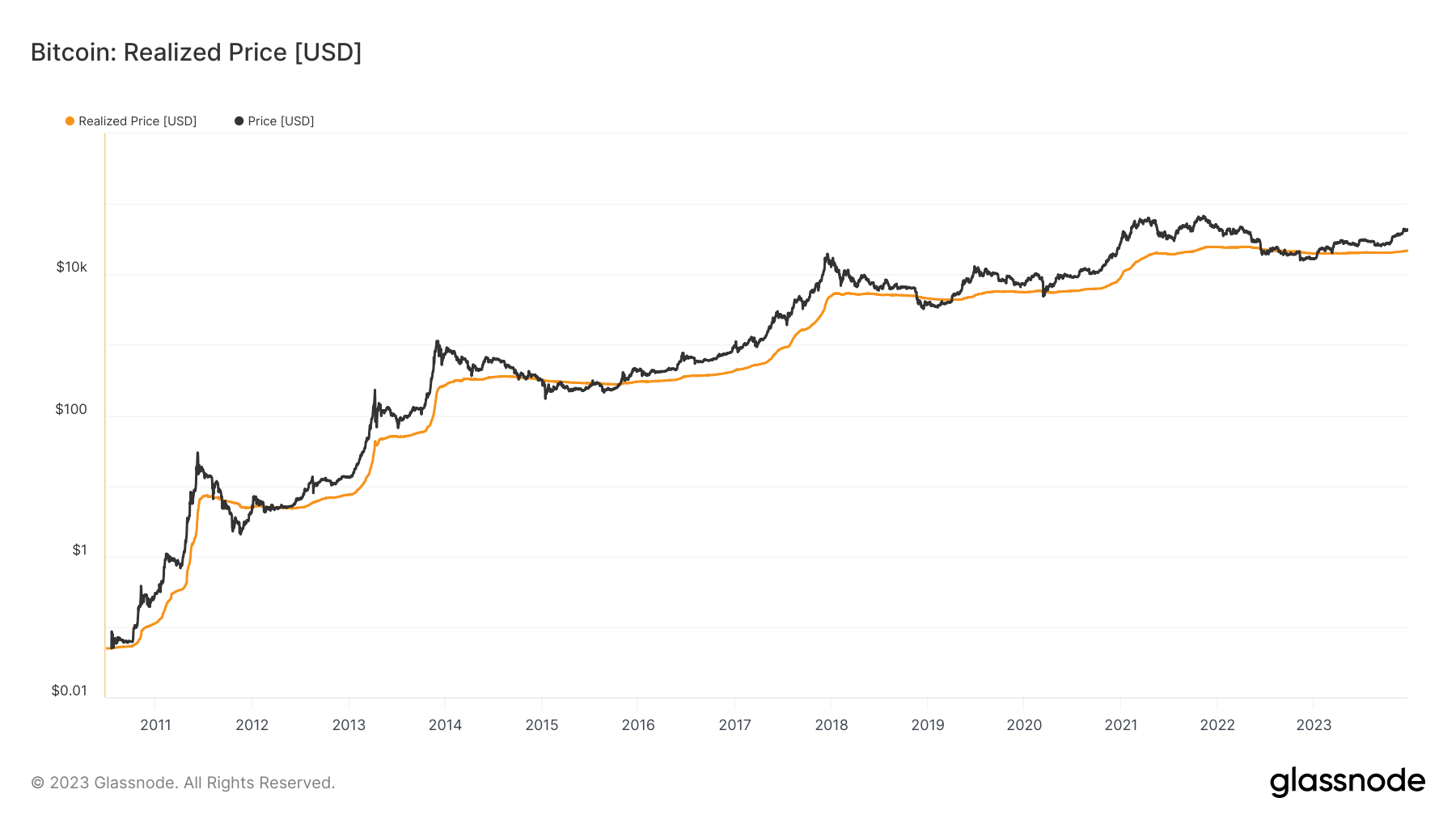

Realized price is a more complex metric compared to the market price, which is simply the current trading price on exchanges. It is calculated by dividing the realized capitalization by the current supply of Bitcoin. It encompasses all coins in circulation, regardless of origin (mining or secondary market transactions). This comprehensive approach ensures that the metric reflects the total economic weight of all bitcoins, giving a fuller picture of the network’s value. Realized capitalization is the sum of the value of all Bitcoins at the price they were last transacted on-chain. This calculation provides a weighted average price of all Bitcoins based on the last time each Bitcoin changed hands.

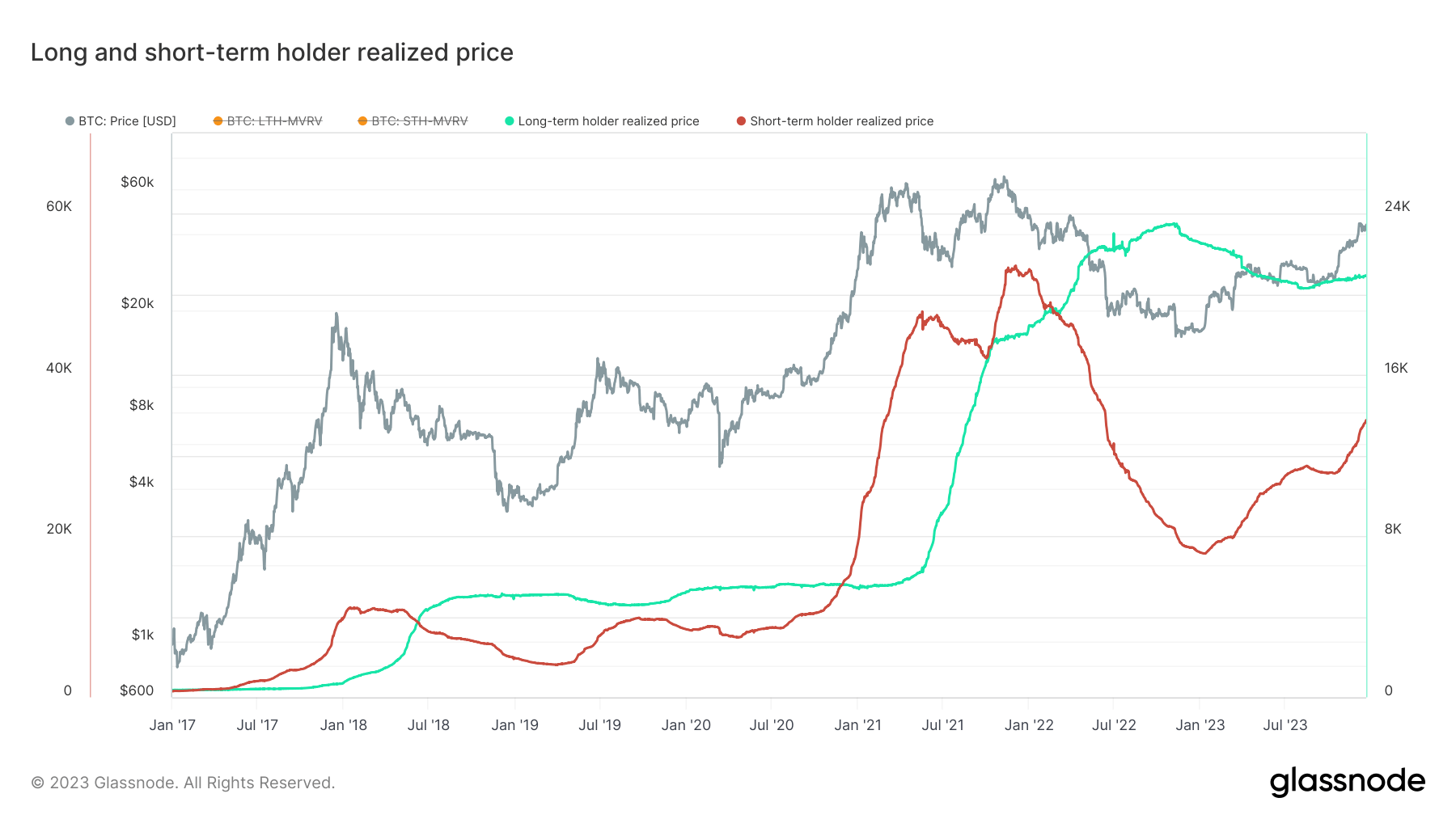

The realized price can be divided into two types: those held by long-term holders (LTH) and those held by short-term holders (STH). LTH realized price is calculated considering only those coins that haven’t moved in at least 155 days, whereas STH realized price accounts for coins moved within this period. This distinction allows analysts to understand the behavior and sentiment of different investor cohorts. The LTH realized price often reflects a price level that long-term investors entered at, serving as a support level during bear markets. In contrast, the STH realized price can indicate recent market sentiment and potential resistance levels in bull markets.

True market mean price

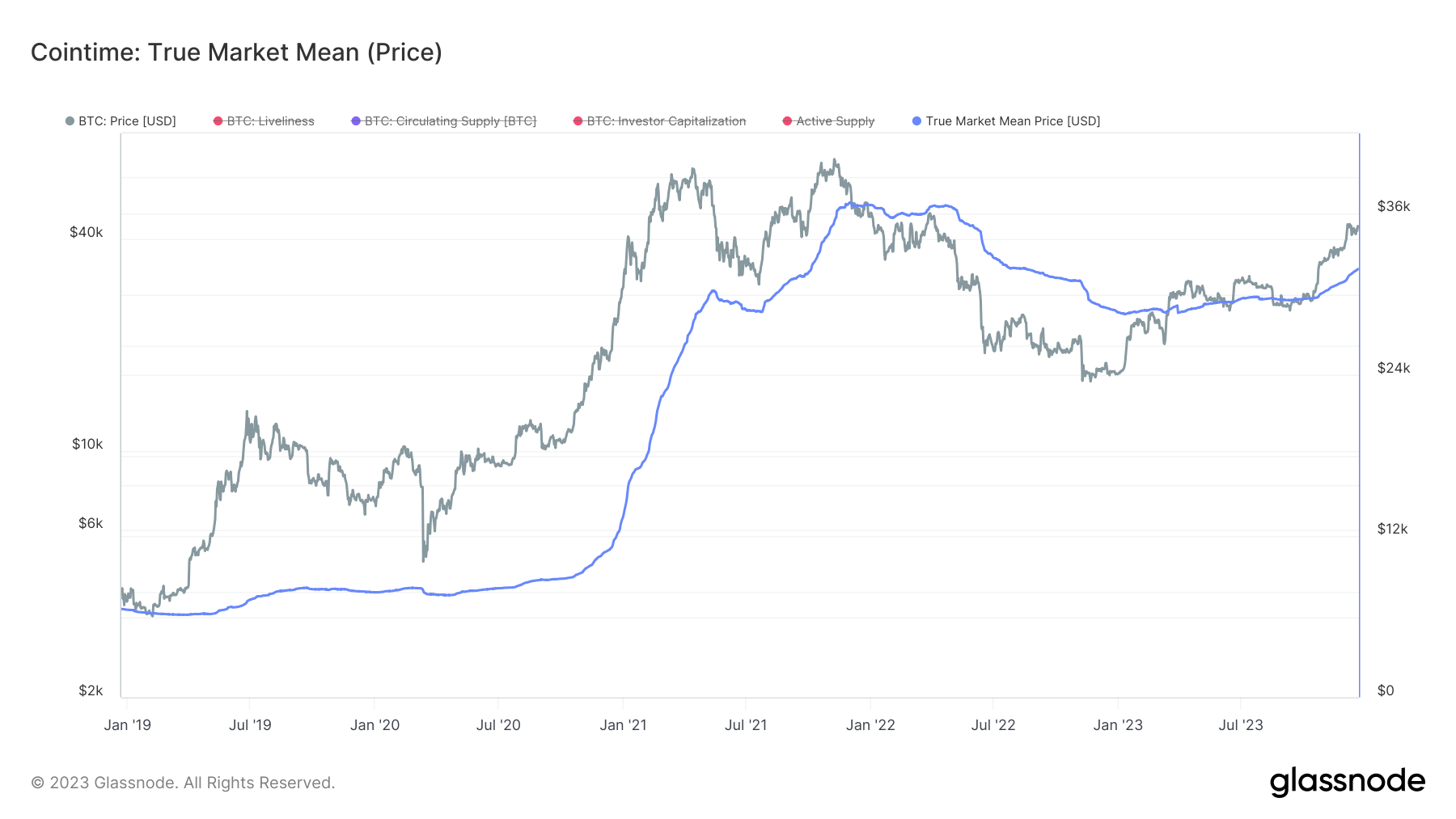

The true market mean price, a relatively new concept introduced in Glassnode’s Cointime Economics report earlier this year, offers a different lens for understanding Bitcoin. This metric focuses exclusively on coins that have been actively traded, excluding Bitcoin’s thermocap. Thremocap represents the total cumulative revenue miners have earned, including block rewards (newly minted coins) and transaction fees.

By excluding Thermocap, the true market mean price focuses solely on the coins traded or transferred between investors. Thermocap includes coins most likely held in miner reserves, which might not reflect active market participation.

Mining activities are fundamentally different from investment or trading activities. Miners receive Bitcoin as a reward for validating transactions and securing the network, independent of market conditions. These coins might be held irrespective of market sentiment or price, which can skew the average cost basis if included. By excluding these coins, the true market mean price offers a metric that more accurately reflects investor-driven market dynamics.

While the realized price provides a broad view of the market’s average cost basis, it includes all coins, irrespective of their current economic activity. This broad inclusion can sometimes mask specific investor behaviors, especially during periods of low on-chain activity. In contrast, the true market mean price offers a more targeted view, focusing on the segments of Bitcoin actively participating in the market. This focus makes it a potentially more acute tool for understanding the immediate market sentiment and investment patterns.

Comparison and insights

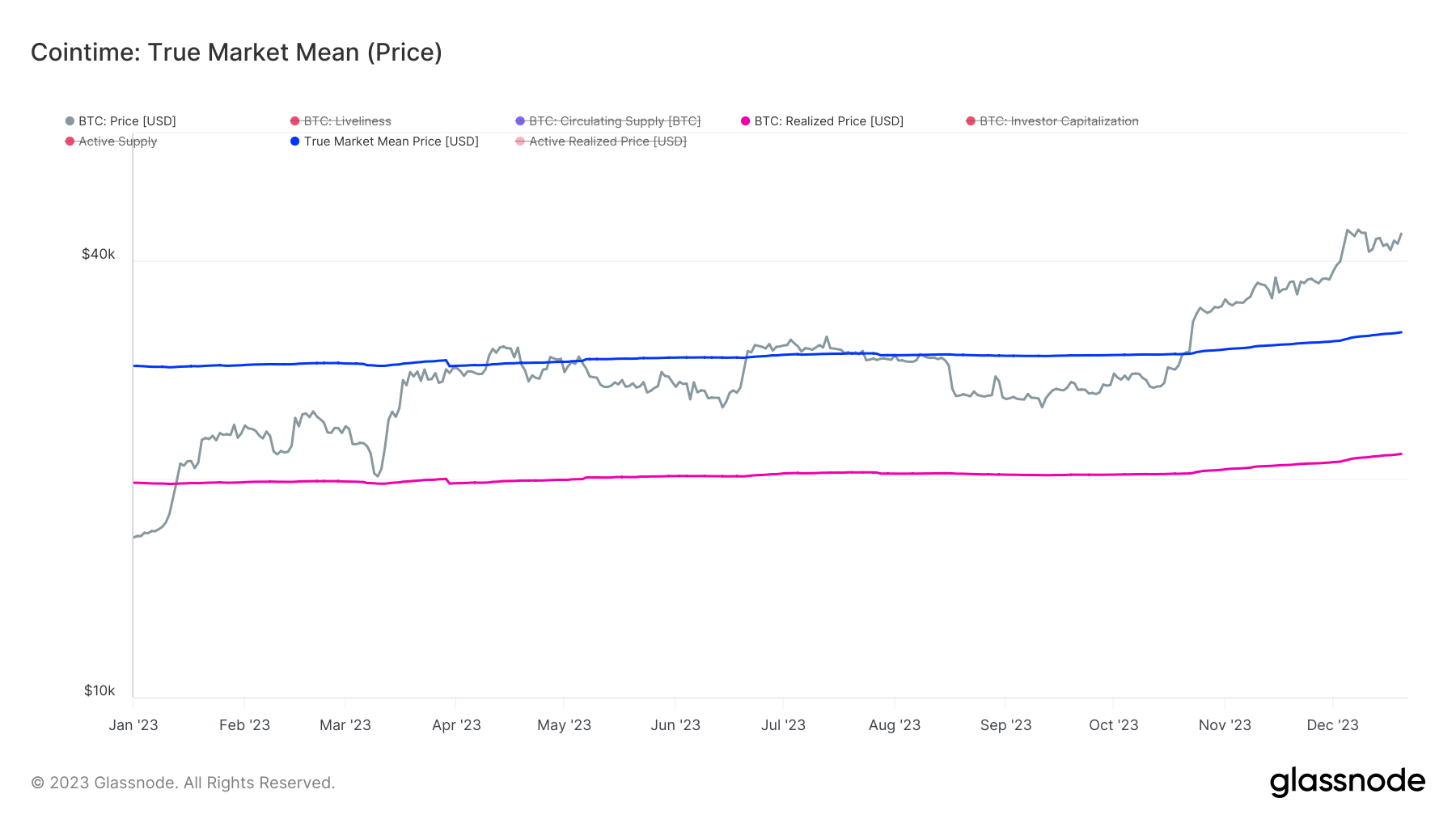

The true market mean price increased from $28,659 on Jan. 1, 2023, to $31,896 on Dec. 20, 2023. This rise suggests that active investors on secondary markets have increased the average acquisition price of Bitcoin by 11%. This indicates increased buying activity at higher prices.

The realized price increased from $19,772 to $21,672 over the same period. This 9.6% increase, while smaller than the true market mean price, also indicates a general upward movement in the average cost basis of all Bitcoin holders. This could mean more Bitcoin was moved or sold at higher prices, increasing the realized capitalization.

The market price of Bitcoin rose significantly from $16,620 on Jan. 1 to $43,629 on Dec. 20. The large gap between the market price and both the true market mean price and the realized price implies that current trading levels are much higher than the average acquisition prices. A prolonged period of high divergence could indicate a potentially overvalued market ripe with speculation. However, given that Bitcoin’s spot price has been above the true market mean price for only about 60 days, it indicates a rising bullish sentiment in the market.

The comparison between the increases in the true market mean price and the realized price of Bitcoin, while similar in percentages and dollar terms, carries different implications due to the nature of the metrics.

Given its exclusive focus on active investors, the increase in the true market mean price suggests a significant level of activity and sentiment change among this group. Since this metric only accounts for coins that have been actively traded, an increase implies that active investors are buying and selling Bitcoin at higher prices. This could indicate a strong bullish sentiment or increased demand among traders and investors actively participating in the market. The increase in this metric, even if numerically similar to the realized price, holds considerable weight because it reflects a concentrated change in the behavior of a specific segment of the market.

On the other hand, an argument can be made that realized price provides a broader view of the market’s average cost basis because it includes all coins — both actively traded and held dormant. In this regard, although the increase in realized price is slightly smaller, it might be more significant considering its broader base. This indicates that the average cost basis of all Bitcoin holders, including long-term holders, is also rising.

However, CryptoSlate’s take is that the increase in the true market mean price holds more weight because it reflects a concentrated change in the behavior of a particular segment of the market. It’s more reflective of the immediate market sentiment, as it directly reflects the actions of active traders, which have historically had a significantly higher impact on Bitcoin’s price action.

Conclusion

The rise in the true market mean price, accentuating the active investor segment’s behavior, underscores a significant shift in market sentiment among this group. Conversely, the realized price’s growth, though slightly less in percentage terms, offers a broad lens through which the entire spectrum of Bitcoin holders is viewed.

The trajectories of these metrics in 2023 show just how complex and multifaceted Bitcoin’s structure is. The true market mean price’s sharper increase highlights the critical role of active traders in influencing Bitcoin’s short-term price movements. Meanwhile, the steady climb in realized price indicates the underlying confidence and a slow and steady change in the attitude of the broader Bitcoin market, as it includes both long-term holders and new participants.

Moving forward, the interplay between these metrics will only increase in importance. Understanding the impact of active trading, as reflected in the true market mean price, alongside the broader market sentiment encapsulated by the realized price, will be crucial for investors, analysts, and traders aiming to navigate the market.

The post Realized price and true market mean: Understanding Bitcoin’s key cost-basis indicators appeared first on CryptoSlate.