Ethereum (ETH) prices have been languishing below the $2,500 mark despite the strong performance of other cryptocurrencies like Solana (SOL) and Cardano (ADA).

Taking to X on December 22, the CEO of Lumida Wealth, Ram Ahluwalia, has offered a theory on why ETH prices are likely to recover and reverse losses, possibly outperforming the world’s most liquid coin, Bitcoin (BTC).

ETHE Discount Rapidly Closing

To illustrate, the CEO pointed to the ETHE chart, whose discount has been steadily closing over the past few trading months. Ahluwalia observed a 4% gain on December 22, further reducing the discount.

Based on the CEO’s analysis, this development suggests that institutional investors, most of whom chose to buy the regulated ETHE product by Grayscale to gain exposure in a regulated manner to ETH, are now opting to buy ETH on the spot market, not through a derivatives product.

This shift from ETHE to ETH spot, Ahluwalia added, could be explained by the “cheapest-to-deliver” contract theory. In the derivatives market, this theory states that a derivatives product like ETHE is the cheapest way for institutional investors to gain exposure to the underlying asset, in this case, ETH.

This is because the derivative in question, ETHE, is a futures contract that tracks the price of ETH via a regulated exchange, in this case CME.

Will Capital Flow To Spot Ethereum And Lift ETH To $3,500?

Therefore, based on this theory, the CEO continued that it is likely that as the ETHE discount closes, marginal flows will go to the ETH spot to capture the staking yield. For this reason, institutions are not likely to pour more funds into ETHE since “big gains” are done.

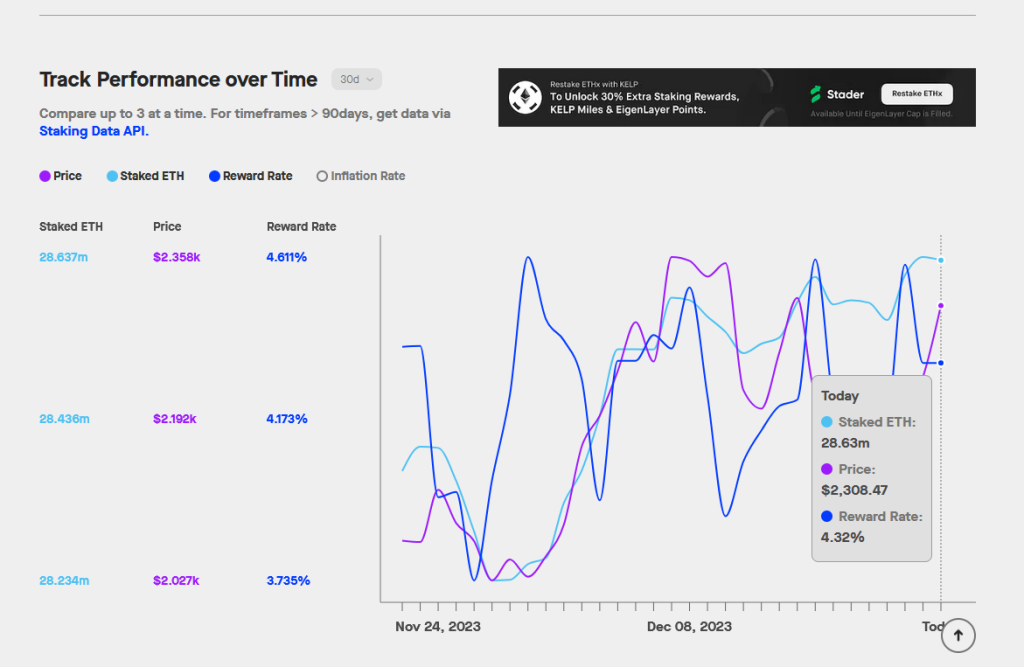

As a proof-of-stake (POS) project, users can stake ETH, helping secure the network, and as compensation, Ethereum distributes a yield of around 4.3% to validators. These operators must lock at least 32 ETH to validate a block of transactions and earn block fees. Since they have to stake, they also earn a yield.

As of December 22, there were over 28.6 million ETH staked, with the reward rate or yield at 4.32%, according to Staking Rewards. Considering how staked amount and yield are correlated, the more users choose to stake physical ETH, the lower the reward rate, or yield, is.

This dynamic will now come into play as ETHE discounts close and institutions or big players rotate funds into ETH via the spot market, possibly lifting prices.

Looking at the ETH price action in the daily chart, buyers have the upper hand. However, a comprehensive close above $2,400 could lift ETH to $2,500 and later to $2,500 in a buy trend continuation pattern.