Quick Take

MicroStrategy’s recent Bitcoin purchase for $615 million marks a significant stride in the company’s Bitcoin accumulation.

This recent acquisition, which outstrips its previous buy in November, valued at $593 million, ranks as MicroStrategy’s third-largest Bitcoin purchase to date. With this procurement, the company added an impressive 14,620 Bitcoin to its holdings.

However, this latest purchase falls short compared to the company’s second-largest order, which was executed in December 2020 and added nearly 30,000 Bitcoin to its portfolio for a similar purchase amount. Bitcoin was trading roughly at $25,000 at the time.

| Purchase Date | Bitcoins Purchased | Amount (USD) |

|---|---|---|

| 2021-02-24 | 19,452 | $1,026,000,000 |

| 2020-12-21 | 29,646 | $650,000,000 |

| 2023-12-26 | 14,620 | $615,700,000 |

| 2023-11-30 | 16,130 | $593,300,000 |

| 2021-09-13 | 8,957 | $419,000,000 |

| 2021-11-28 | 7,002 | $414,000,000 |

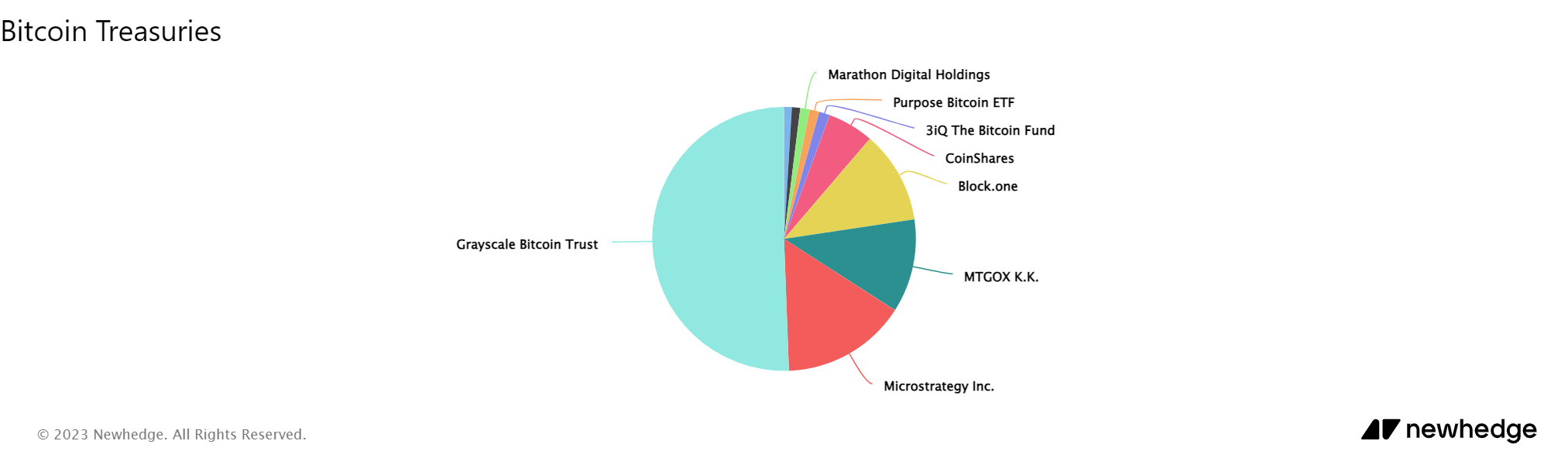

The result of its accumulation strategy is that MicroStrategy now holds a total of 189,150 Bitcoin, which equates to an ownership of approximately 0.9% of the entire Bitcoin supply, leaving the firm just 0.1% shy of commanding a full 1% of the total available supply.

This brings the company’s holdings closer to that of the U.S. government, which reportedly holds around 210,000 Bitcoin. It appears MicroStrategy has its sights set on reaching this 1% mark, a significant milestone in the world of Bitcoin holdings.

The post MicroStrategy controls almost 1% of the total Bitcoin supply appeared first on CryptoSlate.