Quick Take

As we approach 2024, the financial market remains in suspense over the potential approval of a Bitcoin spot ETF, with the deadline for any amendments ending today, Dec. 29.

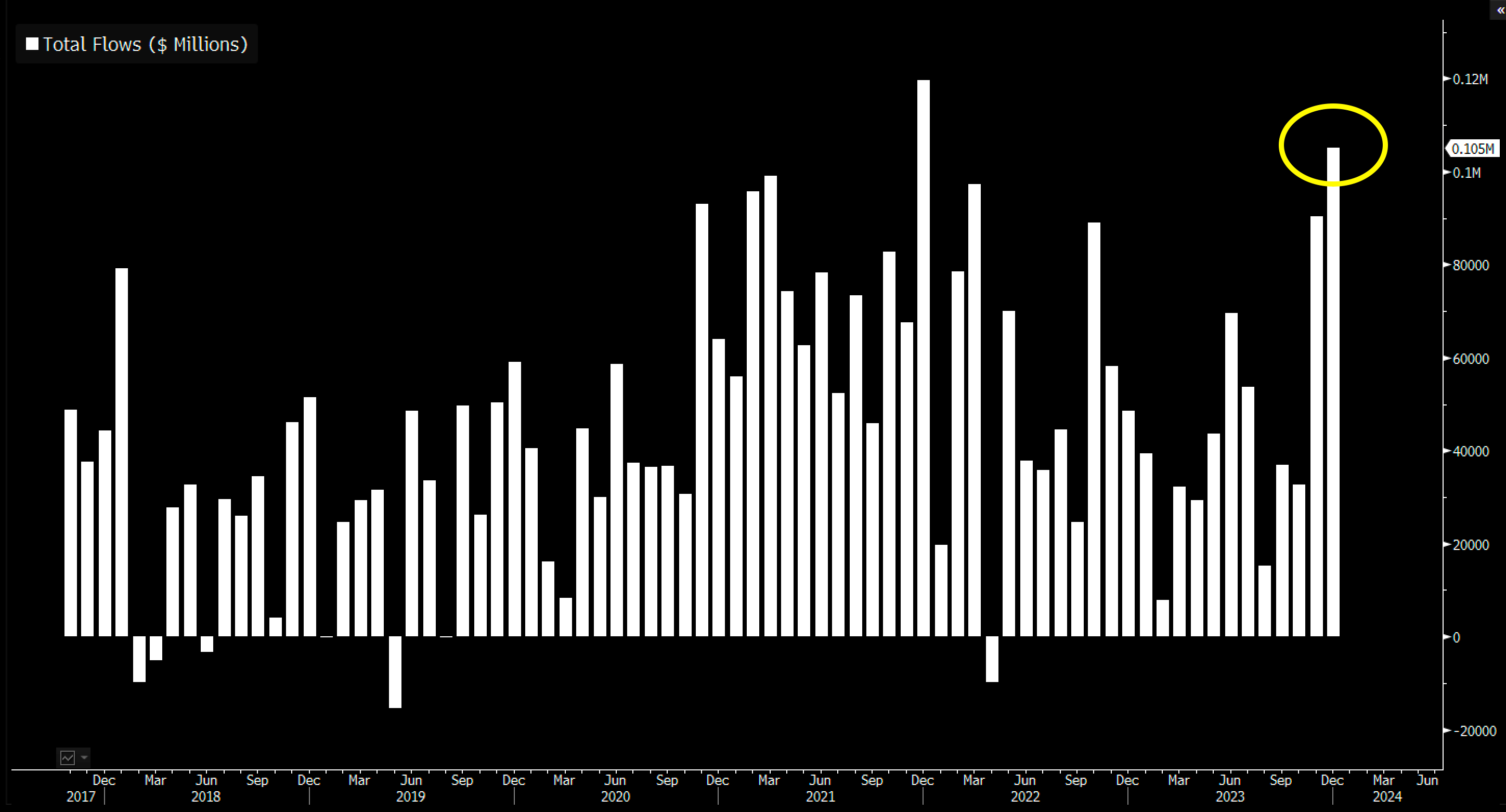

According to Bloomberg ETF analyst Eric Balchunas, ETFs have seen significant inflows, which only bodes well for a potential Bitcoin spot ETF.

ETFs flows are +$105b in Dec so far, have decent shot to break all-time monthly record set in Dec 2021 and at $567b YTD a decent shot to have 2nd best year ever passing last year’s $594b. $SPY still on top w/ $49b (which if it holds would be all time record for single ETF)

Instead of a Bitcoin spot ETF, the market has seen the introduction of various leveraged and futures ETFs. According to Nate Geraci, president of the ETF Store, these include leveraged gold, bitcoin futures, wet freight futures, auto industry, and Tesla ETFs, as well as Ether futures ETFs and a 4X leveraged S&P 500 ETN.

Despite the uncertainty surrounding Bitcoin spot ETFs, the diversification and growth in the ETF space indicates a vibrant marketplace ready to adapt and evolve.

The post Financial markets on edge as Bitcoin spot ETF decision looms, ETF inflows surge appeared first on CryptoSlate.