Quick Take

With the countdown to the Bitcoin halving event of April 2024 underway, the digital asset ecosystem is witnessing notable financial shifts.

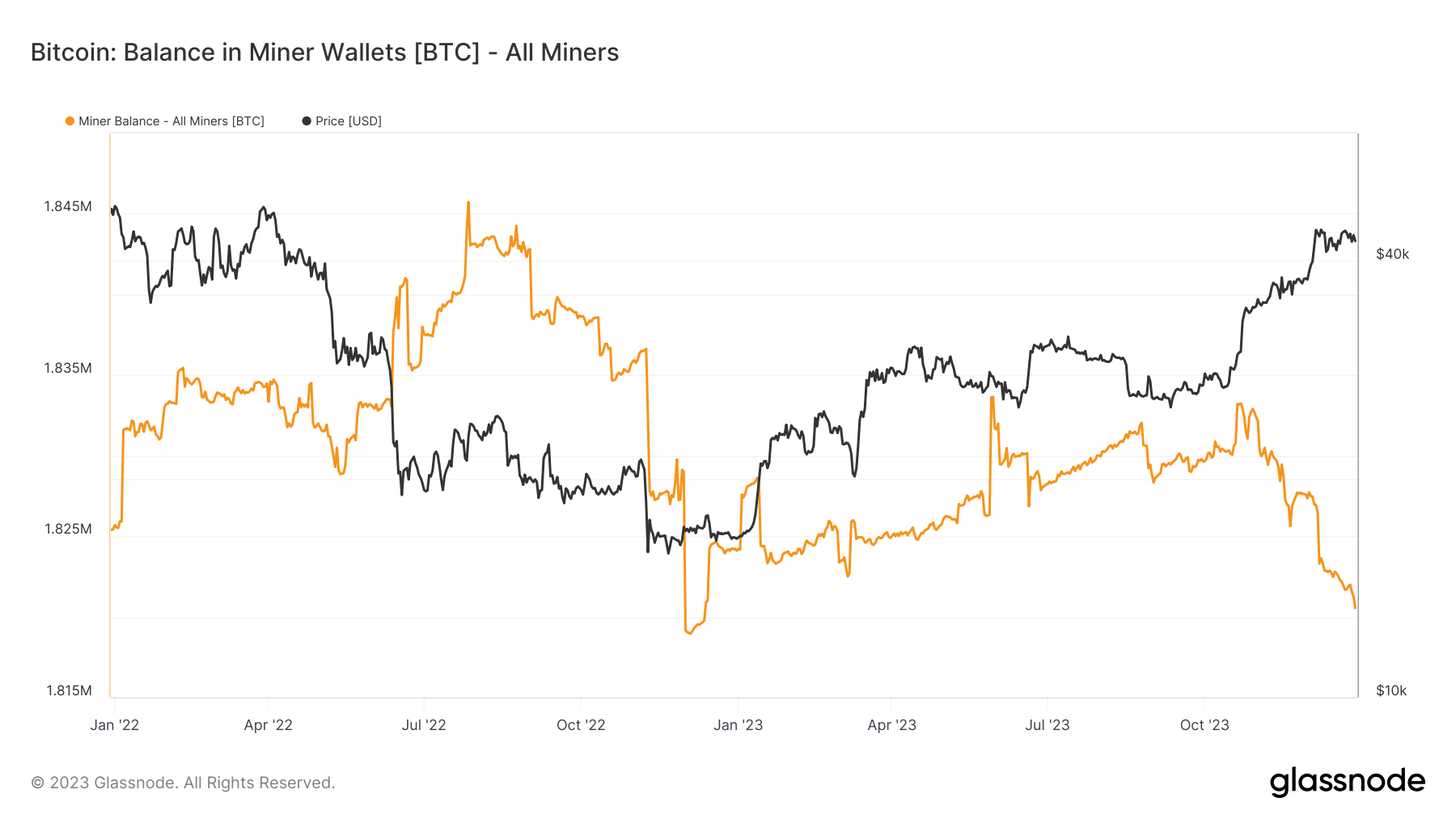

The halving, designed to reduce block rewards by half, is already sparking changes in the miner balance. From an initial 1.833 million Bitcoin held in miner addresses, the balance has dwindled by 13,000 Bitcoin to 1.820 million in the past few months, reminiscent of the state during the FTX collapse in November 2022.

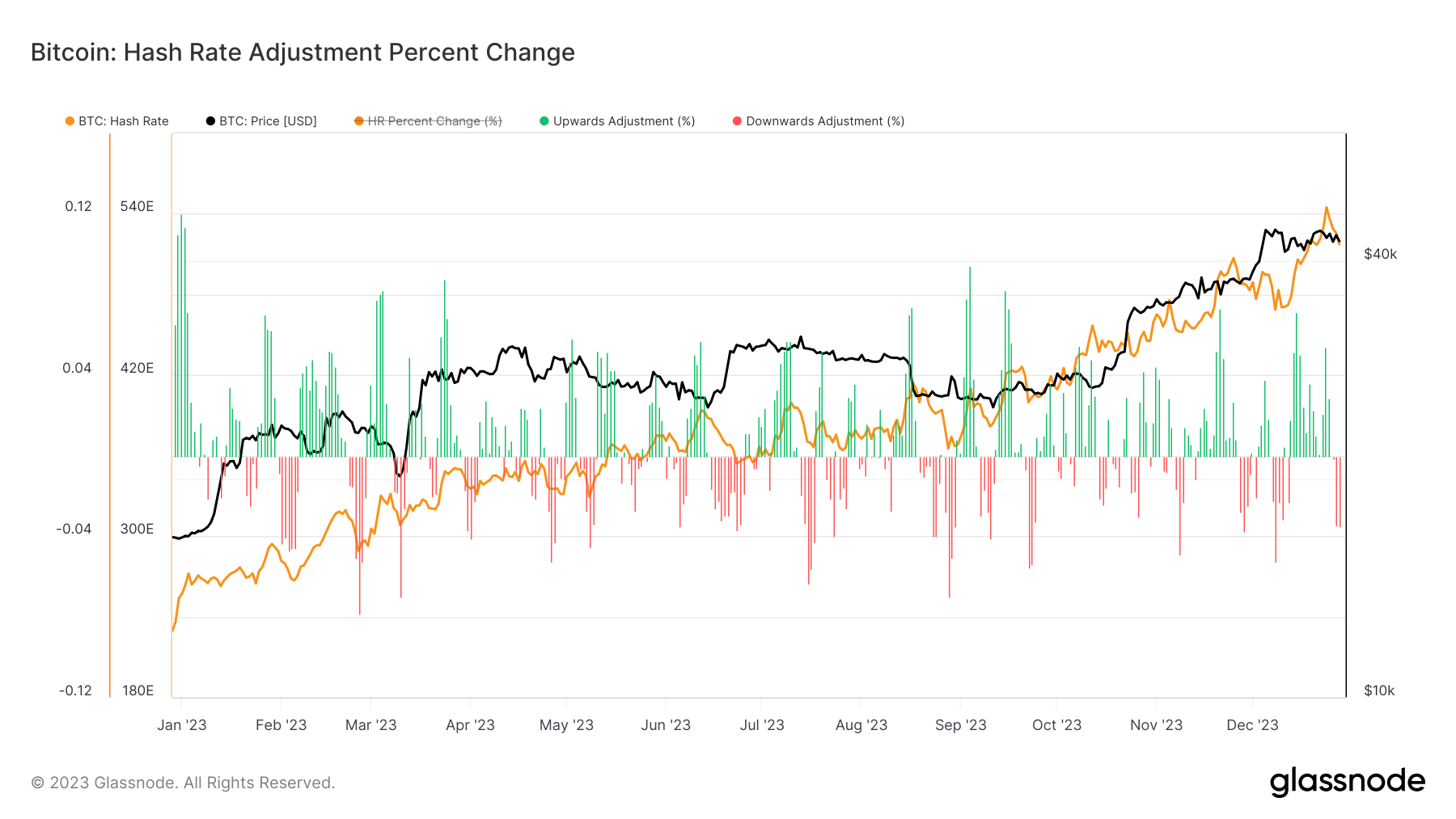

While this drop could suggest a sell-off, there’s no clear indication that miners have offloaded their Bitcoin holdings, as the miners-to-exchanges transfer remains at a local low. However, the seven-day moving average (7 DMA) for the hash rate presents a different narrative, declining from 544 exahashes per second (eh/s) to 517 eh/s.

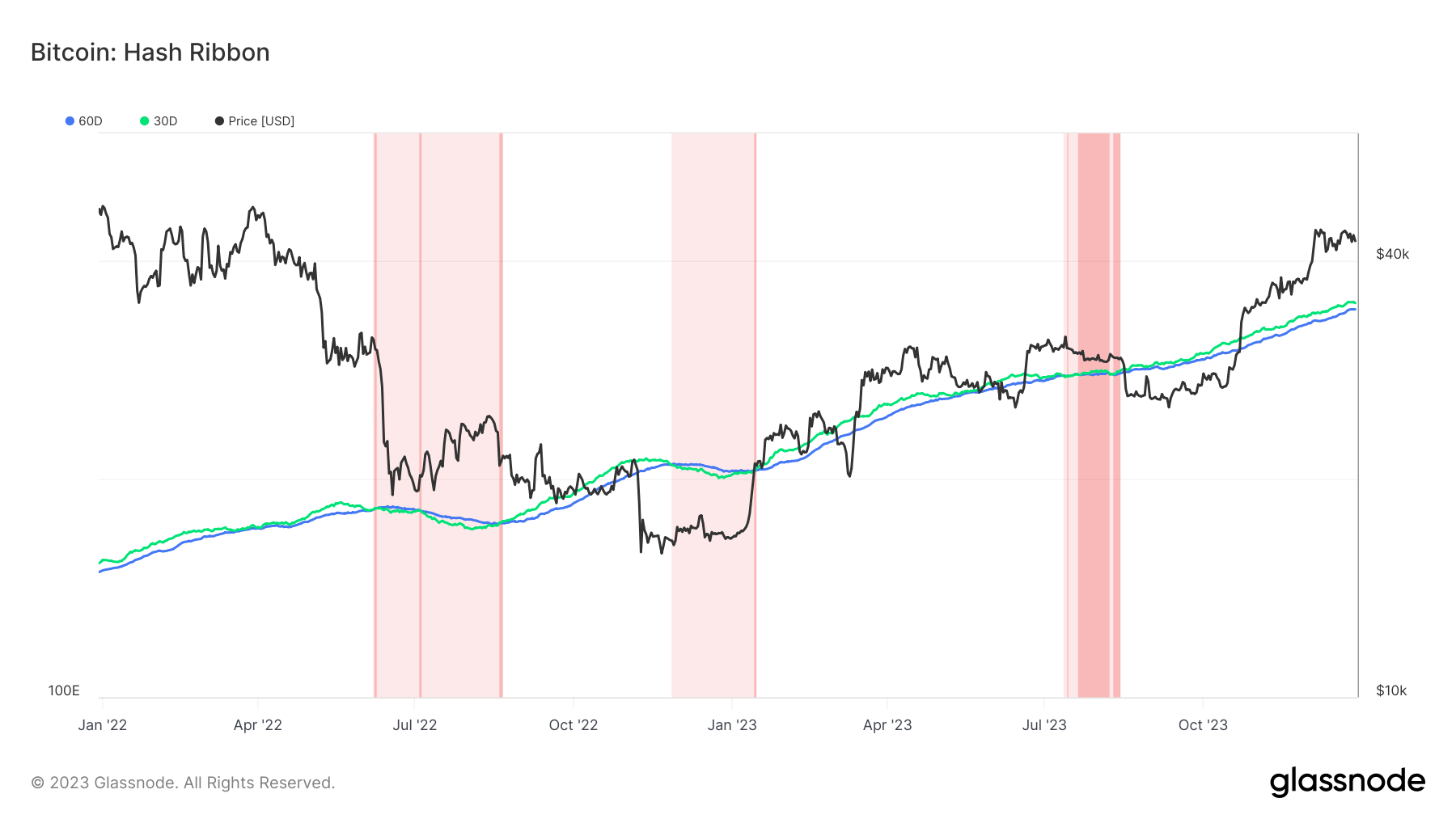

These shifts bring into focus the hash ribbon metric, a market indicator that signals a potential miner capitulation when Bitcoin mining costs outweigh profitability. A positive shift occurs when the hash rate’s 30-day moving average (MA) surpasses the 60-day MA (indicated by a switch from light red to dark red areas). Historically, a subsequent price drop occurs when such a shift coincides with a price momentum switch from negative to positive.

The post The end-of-year decline in hash rate sparks debate over miner sell-offs appeared first on CryptoSlate.