Fifteen years ago, on January 3, 2009, the Bitcoin network came into existence with the mining of the first block, known as the Genesis Block. This monumental event marked the beginning of a new era in digital currency and decentralized finance.

The Genesis Block holds a significant place in cryptocurrency history, not just for initiating the BTC blockchain but also for its embedded message – a headline from The Times: “Chancellor on brink of second bailout for banks.” This message was seen as a political statement and a reflection of Bitcoin’s counter-establishment ethos.

Amidst the 2008 Great Financial Crisis, Satoshi Nakamoto introduced Bitcoin, envisioning a currency independent of traditional banking systems. The Genesis Block contained the first 50 BTCs, and the reward from this block was sent to the address 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa.

Fun fact: This address has become a kind of digital monument, accumulating over 72 BTC to date, as enthusiasts continue to send small amounts to pay homage to Satoshi Nakamoto, Bitcoin’s pseudonymous creator.

Breaking Barriers: How Bitcoin Evolved

Over the past 15 years, BTC has evolved from a novel concept to a mature asset class. Its journey is marked by overcoming skepticism, gaining mainstream acceptance, and evolving into a critical player in the global financial system.

Major corporations like MicroStrategy and Tesla have integrated BTC into their balance sheets, considering it a viable store of value and a hedge against inflation. Countries like El Salvador and the Central African Republic (CAR) have even adopted Bitcoin as legal tender, showcasing its potential in national economies.

Bitcoin has also seen significant improvements through Improvement Proposals (BIPs) like Segregated Witness (SegWit) and Taproot. These updates have enhanced transaction speed, cost efficiency, privacy, and smart contract capabilities, contributing to Bitcoin’s resilience and zero-hack record. Moreover, the introduction of features like Ordinals, allowing for Non-Fungible Tokens (NFTs) creation, has expanded Bitcoin’s role in the Decentralized Finance (DeFi) economy.

With over 575,000 daily transactions (according to blockchain.com data), BTC’s adoption continues to soar. One of BTC’s remarkable transitions is its shift from being perceived as a “money laundering instrument with no intrinsic value” to an asset that is now on the verge of being offered as an ETF by some of the world’s largest asset managers like BlackRock and Fidelity. This change in perception underscores Bitcoin’s growing acceptance and legitimacy in the financial world.

The criticism of the energy-intensive nature of mining has flattened out as supporters have proven Bitcoin’s potential to be the first carbon-negative asset in the world. BTC is already the greenest industry in the world.

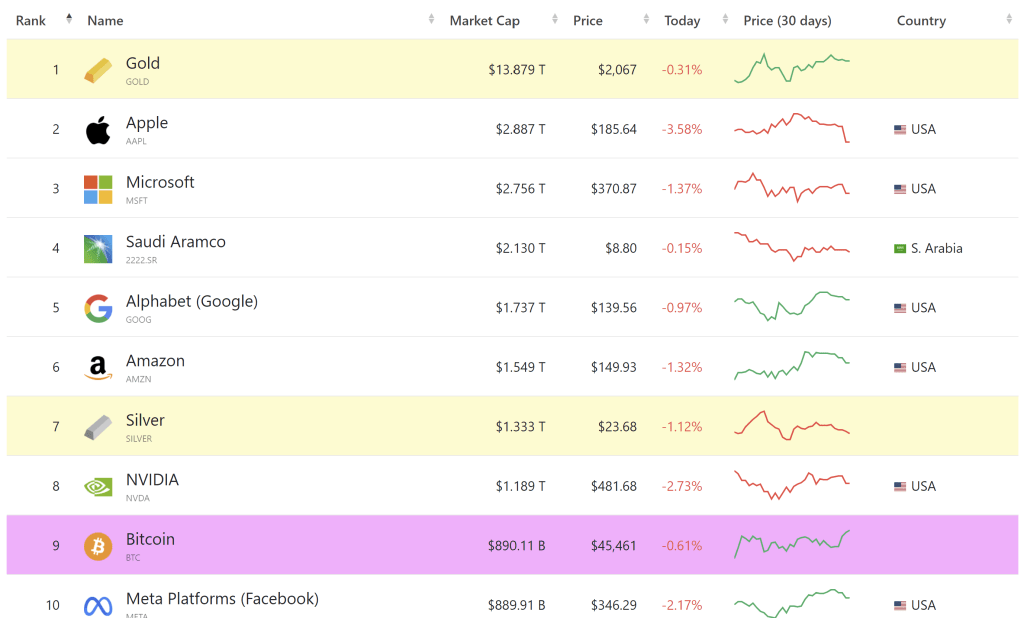

As Bitcoin marks its 15th anniversary, it has also achieved a significant milestone in terms of market capitalization, now ranking as the 9th largest asset globally. This remarkable position places it among leading entities like Gold, Apple, Microsoft, Saudi Aramco, Alphabet (Google), Amazon, Silver, and NVIDIA, which currently have higher market caps.

Gold, holding the top spot, boasts a staggering market capitalization of $13.879 trillion. To put BTC’s growth into perspective, its current market cap of $890.11 billion would need to increase around 15 times to match the market cap of gold.

In summary, Bitcoin’s 15th anniversary is not just a celebration of its longevity but a testament to its impact on redefining money, finance, and trust. It symbolizes a decentralized future, where financial inclusion knows no borders, and power is distributed algorithmically.

Probably the most important achievement in the spirit of Satoshi Nakamoto, however, was highlighted by Ross Stevens, founder of Stone Ridge Asset Management ($20 billion AUM) and NYDIG, in his latest investor letter:

In a world of State money increasingly debased, censored, and surveilled, Bitcoin represents optimism, fairness, justice, truth, and beauty. As the People’s money, Bitcoin is unstoppable by borders, devaluation, censorship, or mass surveillance.

At press time, BTC traded at $45,167.