On-chain data shows the Bitcoin long-term holders haven’t reacted much to the crash as their supply has stayed near all-time highs.

Bitcoin Long-Term Holder Supply Has Continued To Rise Recently

According to data from the market intelligence platform IntoTheBlock, the Bitcoin long-term holders (LTHs) have recently been in a phase of accumulation.

The LTHs refer to those investors who have been holding onto their coins since at least one year ago (as defined by IntoTheBlock; other analytics firms usually go with a period of around 155 days) without having sold or transferred them on the blockchain.

A statistical fact is that the longer holders keep their coins still on the network, the less likely they become to move them at any point. As such, the LTHs, who remain dormant for considerable periods, are the least likely section of the market to participate in selling.

Whether the market is going through a crash or rally, these HODLers generally remain quiet. This strong resolve of these investors has earned them the popular name “diamond hands.”

The Bitcoin holders who haven’t yet matured into this age band (that is, those who bought within the past year) are included in the “short-term holder” (STH) group.

As the LTHs rarely sell, the few times they participate in a selloff can be ones to watch for, as they can have implications for the wider market. One way to track whether this cohort is selling or not is by tracking the total supply that they are carrying in their combined wallets.

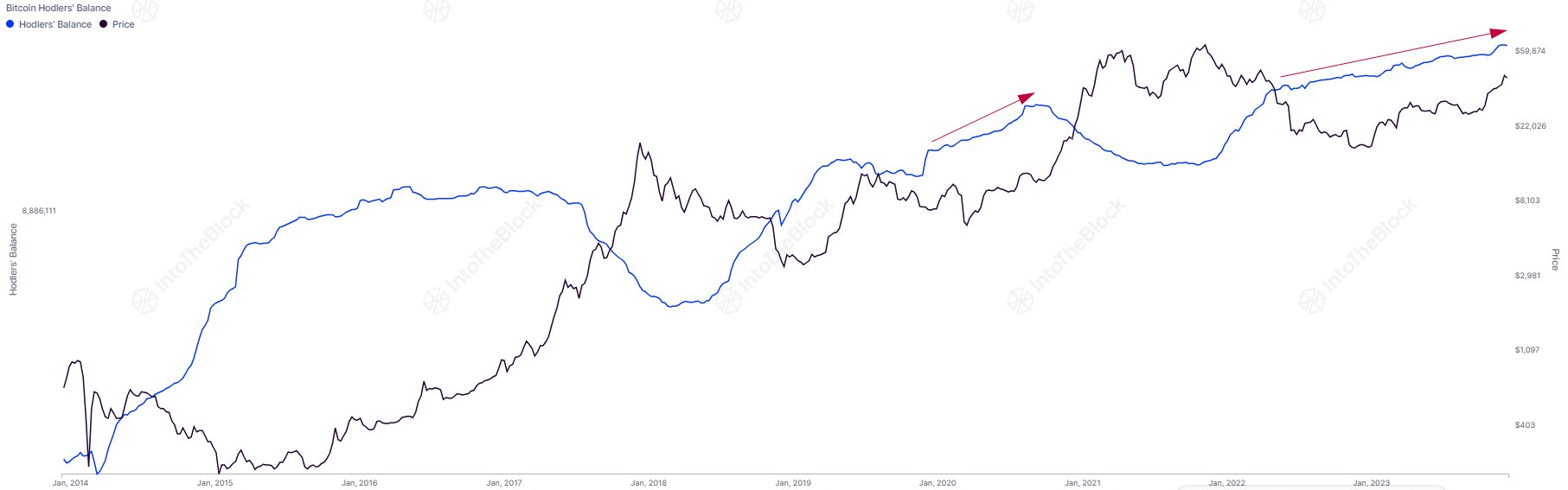

Now, here is a chart that shows the trend in the balance of the Bitcoin LTHs over the last several years:

As displayed in the above graph, the Bitcoin LTH supply has been riding an uptrend for quite a while now. This suggests that these HODLers have constantly been accumulating.

Something to note is that while selling from these investors is instantly captured by the chart (as coins reset their age to zero as soon as they move on the chain), buying isn’t the same.

Coins are only added into this supply after they have stayed dormant for a year, so whenever the indicator’s value goes up, it’s a sign that some buying took place a year ago, and those coins have matured enough to belong in this cohort.

The chart shows that these investors haven’t reacted to the latest plunge in the price of cryptocurrency as their supply has been moving flat.

“Prior to the bull market, long-term holders accumulate Bitcoin consistently and only start selling as we approach bull market tops,” explains IntoTheBlock. “Currently, long-term holders are still accumulating.”

This could suggest that these LTHs don’t think the top is near. Once these investors start selling, that could be when Bitcoin starts becoming overheated for real.

BTC Price

Bitcoin continues to make a recovery from the crash as it has now surged above the $44,000 level.