Analyzing the price of cryptocurrencies on Coinbase, especially compared with other global exchanges, is essential for understanding its impact on global market trends. Although the U.S. market may not always lead in terms of trading volume or liquidity, the pricing on Coinbase often sets a trend that resonates across the global cryptocurrency market, underscoring the importance of monitoring and analyzing its price movements.

Coinbase’s predominantly retail investor base makes it a very useful gauge of retail sentiment in the U.S. Being a regulated exchange in the U.S., Coinbase’s pricing is also significantly influenced by regulatory developments, which is why price volatility on the exchange can be a proxy for political or regulatory events in the country.

The term ‘premium’ refers to the price difference of an asset across different markets or exchanges. For cryptocurrencies, a premium on Coinbase implies that the price of a cryptocurrency, in this case Bitcoin, is higher on Coinbase compared to another exchange such as Binance. This premium or premium gap is quantified by subtracting the price of Bitcoin on another exchange from the price on Coinbase. A more comparative approach involves calculating the percentage difference or the premium index, which provides a clearer view of the premium in relation to the market.

The movements of the premium are critical in understanding market conditions. An increasing premium on Coinbase can suggest a surge in buying activity on the platform, possibly due to an influx of retail investors, or it could be indicative of lower liquidity on Coinbase compared to other exchanges. Geographic factors, such as regulatory news or fiat currency fluctuations affecting Coinbase’s predominantly U.S. user base, might also contribute to an increased premium. Conversely, a decreasing premium may signify an increase in sell orders on Coinbase, potentially by retail investors, or an improvement in liquidity or competitive pricing from other exchanges. It could also indicate market arbitrage, where traders buy on other exchanges and sell on Coinbase, thus narrowing the price gap.

Analyzing these premium movements can help gauge market sentiment and behavior. For example, a consistent premium could suggest strong retail confidence among Coinbase users, whereas a diminishing premium might reflect a bearish sentiment or a shift toward selling. These movements are often interpreted as leading indicators of market trends and arbitrage opportunities.

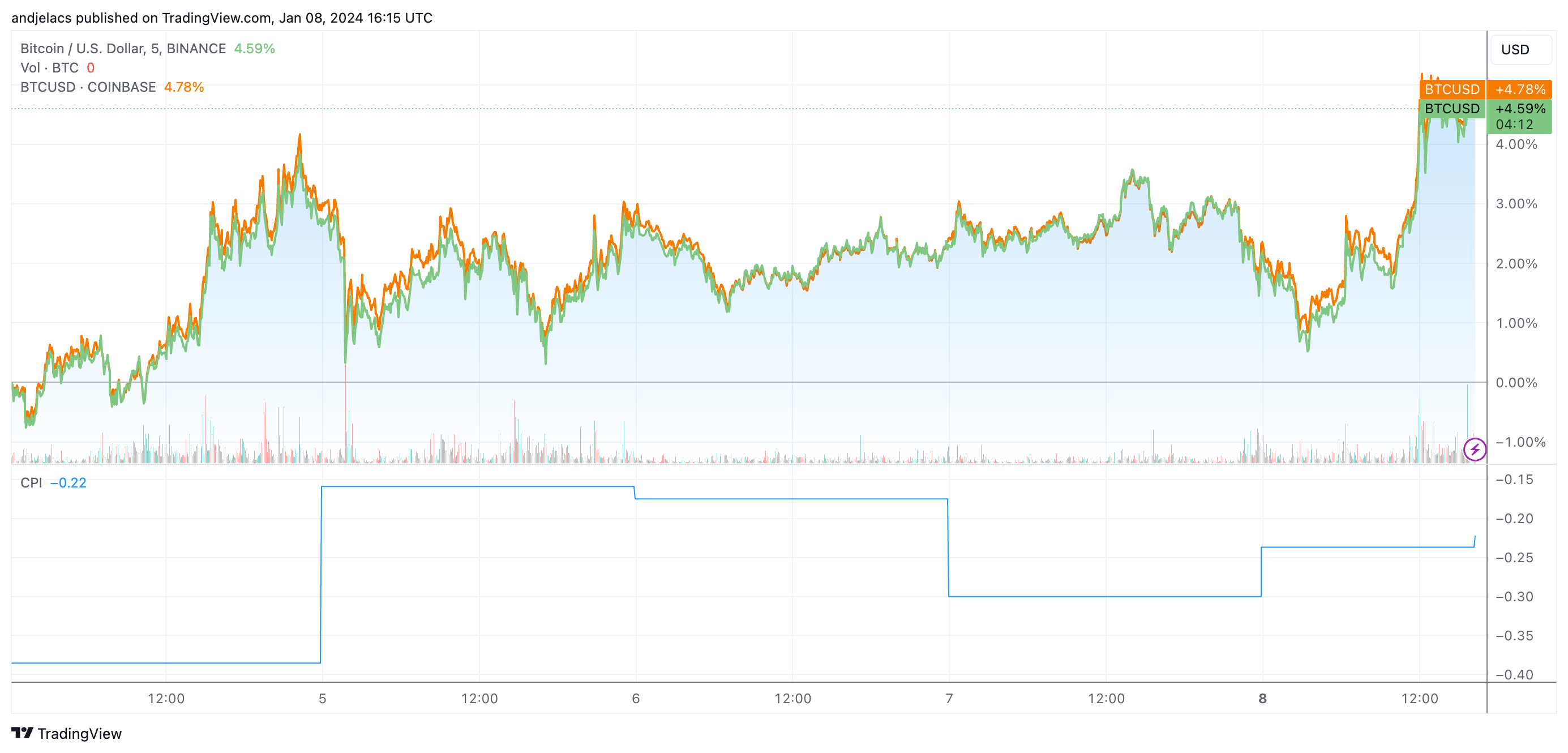

Analyzing Bitcoin’s price movement on Coinbase and Binance shows that BTC/USD posted a 5-day increase of 4.78% on Coinbase and 4.59% on Binance on Jan. 8. The slightly higher increase on Coinbase compared to Binance suggests a slightly stronger buying pressure coming from Coinbase users. This difference, though subtle, could indicate heightened expectations among U.S. investors (Coinbase’s primary user base) regarding the potential approval of the spot Bitcoin ETF this week.

The Coinbase premium has been negative throughout the last quarter and has remained negative into 2024 as well. The negative premium values indicate that Bitcoin is trading at a slightly lower price on Coinbase compared to Binance. This is unusual given the general expectation of a positive premium on U.S.-based exchanges due to regulatory compliance and investor profile. However, a closer look at the premium trend shows a notable decrease, with the premium shifting from -0.37 to -0.22 over a day and a half. This suggests the price gap between the exchanges is closing, most likely due to a growing buying interest on Coibase or reduced selling pressure compared to Binance.

The overall increase in the price of Bitcoin on both exchanges is likely reflecting market optimism and speculative interest, particularly due to the SEC’s upcoming decision on the spot Bitcoin ETF. A positive decision is likely perceived as a legitimizing factor for Bitcoin, as the market expects it to increase institutional participation.

The gradual decrease in the negative premium suggests that Coinbase’s prices are slowly aligning more closely with Binance’s. This could mean that U.S. investors are cautiously optimistic, buying more Bitcoin in anticipation but not as aggressively as international markets (possibly due to regulatory concerns). It could also mean that there is a reduction in selling pressure on Coinbase, possibly due to holders waiting for the outcome of the SEC decision.

If the ETF gets approved, there might be a sudden shift in this trend, potentially triggering a surge in buying on Coinbase and leading to a positive premium. Conversely, a rejection could widen the negative premium due to a potential sell-off by disappointed investors.

The post The Coinbase premium is increasing ahead of the ETF appeared first on CryptoSlate.