After the Bitcoin spot ETF approval, Ethereum Classic (ETC) has been ripping up, as its price has shot up more than 35% over the last 24 hours.

Ethereum Classic Takes Off Following Bitcoin ETF Decision

The US SEC has finally approved all the Bitcoin spot ETFs and so far, the event hasn’t proven to be a sell-the-news one, as the market has reacted rather positively to it, with coins across the sector shooting up.

One asset that has immediately stood out even among these flying altcoins has been Ethereum Classic. ETC is a hard fork of Ethereum and its main aim has been to preserve how the ETH blockchain originally was.

Unlike Ethereum, which has transitioned toward a proof-of-stake (PoS) consensus mechanism, Ethereum Classic is still operating on proof-of-work (PoW). The latter mechanism, where validators called miners handle the processing of the blockchain, is also used by networks such as Bitcoin and Litecoin.

PoW has often been the main point of criticism against these cryptocurrencies, however, as mining involves the usage of a high amount of computing power, which can pose negative effects on the planet’s environment. This is one of the reasons why ETH switched towards an environment-friendly form in PoS.

The last time ETC had seen some significant renewal of interest was in the buildup to Ethereum’s Merge, the event where the blockchain’s mainnet made its flip to PoS.

Ethereum Classic couldn’t keep up its rally then, however, as the asset plunged back down to earth after the Merge actually went through. It would appear that the investors have suddenly started paying attention to the coin once more now, as its price has shot up about 46% in the past day.

With these significant profits, Ethereum Classic has emerged as the best performer among at least the top 100 cryptocurrencies by market cap and has touched levels not observed since September 2022, the month of The Merge.

Now, the question on the minds of the investors must be: can ETC keep up this run? Some underlying metrics may provide some hints, at least in the short term.

Ethereum Classic Trading Volume Has Shot Up, Sentiment Is Still Neutral

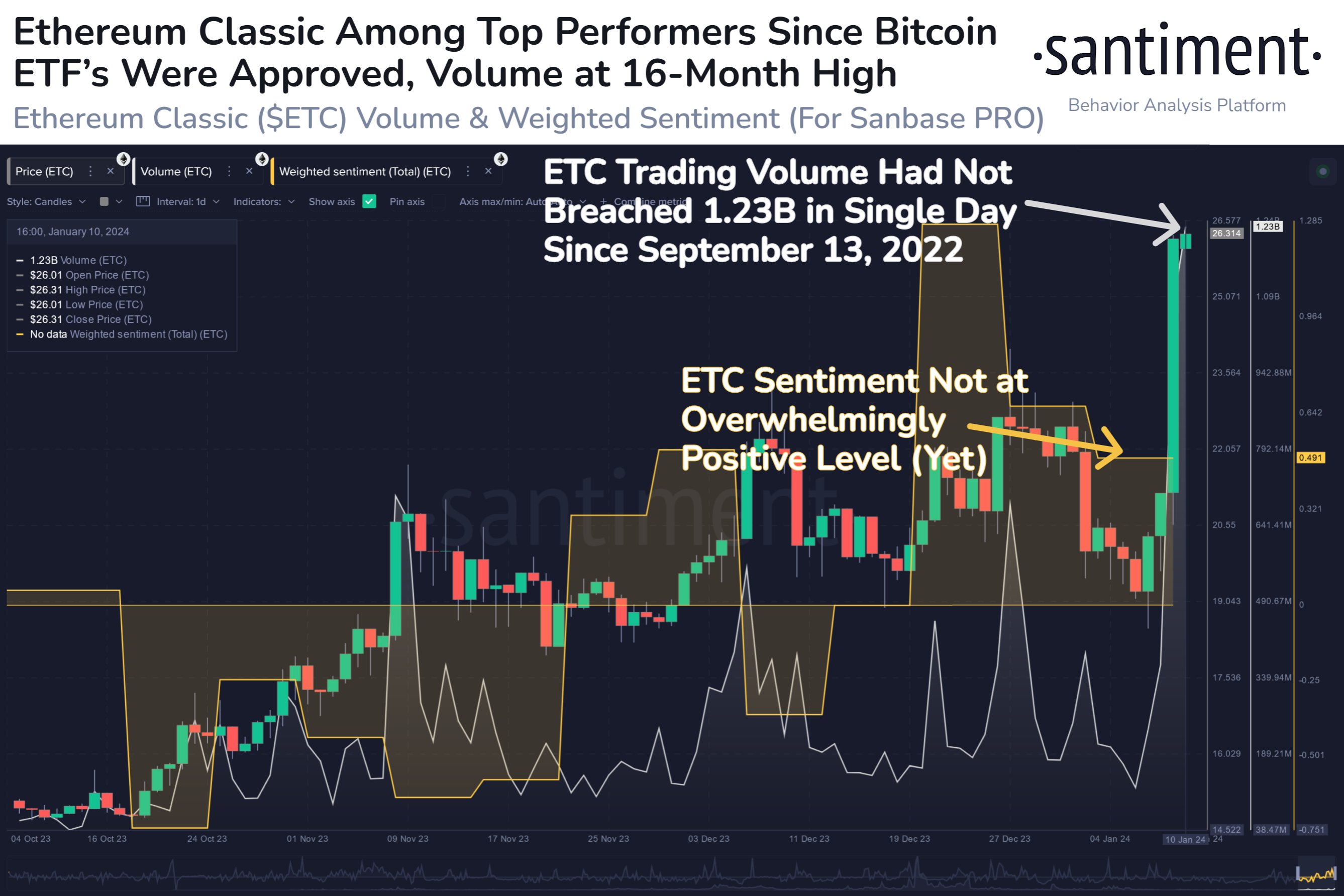

In a new post on X, the analytics firm Santiment has shared some data regarding Ethereum Classic following its sharp rally. The first indicator of relevance here is the “trading volume,” which keeps track of the amount of the asset being involved in trades on the centralized exchanges.

As is apparent in the chart below, the ETC volume has surged to some pretty high levels in the past day, a sign that investors are showing high interest in the cryptocurrency:

A high volume may not necessarily imply the continuation of the bullish trend by itself, as selling moves also equally contribute towards the metric, but it’s still generally a requirement for any rally to be sustainable.

The other metric Santiment has attached to the chart is the Ethereum Classic weighted sentiment, which basically tells us about the sentiment around the coin on social media platforms.

This metric is only at slightly positive levels currently, which can be an optimistic sign, as too much positive sentiment has historically been something that has resulted in tops.