Quick Take

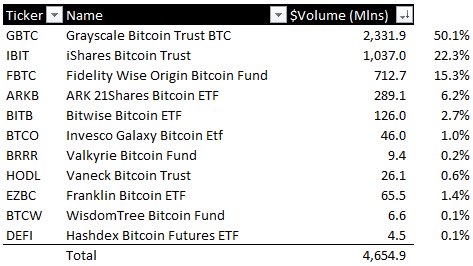

The dawn of Exchange Traded Fund (ETF) spot Bitcoin trading on Jan. 11, 2023, witnessed a voluminous trade worth $4.65 billion. Market dominators Grayscale Bitcoin Trust (GBTC), BlackRock, and Fidelity, spearheaded the activities, accounting for 50%, 22%, and 15% of the total trade, respectively.

GBTC, holding a lion’s share, observed a bifurcated trend with an equal emphasis on redemptions and purchases. This equilibrium between selling and buying pressure kept the Bitcoin price relatively stable throughout the day.

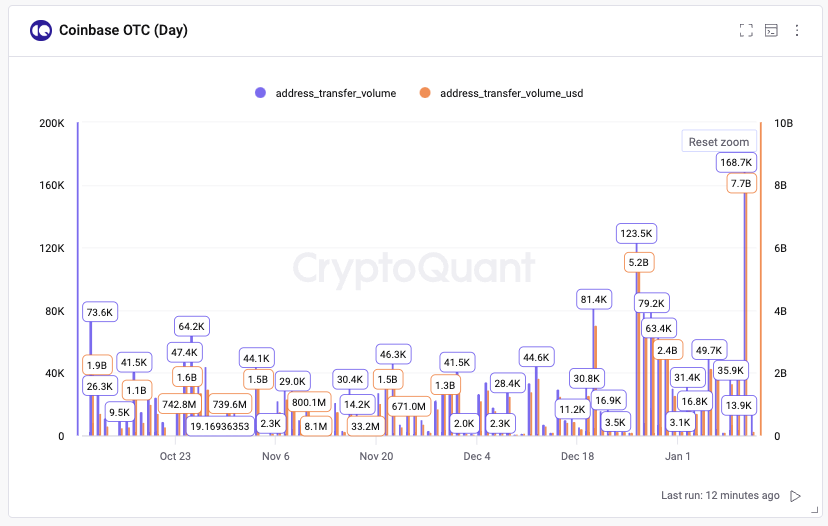

Digital asset enthusiasts and investors are tiptoeing around the new ETF, potentially awaiting more operational weeks to fully understand its impact and stability. The inaugural day also highlighted an undercurrent of enormous demand, evidenced by Coinbase conducting whopping Bitcoin transfers amounting to $7.7B (i.e., roughly 168,000 Bitcoins) Over-the-Counter (OTC), according to Founder & CEO of cryptoquant.com, Ki Young Ju.

The magnitude of this latent demand indicates a significant potential influence on Bitcoin prices, the effects of which remain to be seen.

The post Coinbase facilitates massive $7.7B Bitcoin OTC transfer amid $4.65B ETF trading premiere appeared first on CryptoSlate.