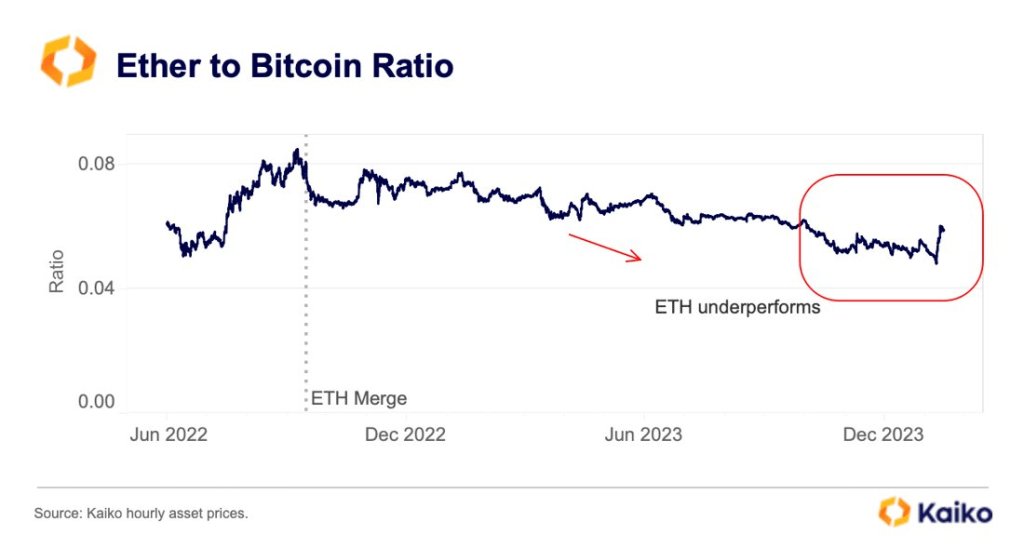

Amidst a volatile crypto market, Ethereum (ETH) is gaining momentum, outperforming its long-time rival Bitcoin (BTC). According to Kaiko data, the ETH/BTC ratio has steadily risen, rebounding from multi-year lows.

ETH/BTC Ratio Rising, ETH Momentum Building

The ETH/BTC ratio technically gauges market sentiment towards these two leading crypto. The recent rebound indicates investors are increasingly bullish on Ethereum’s potential relative to Bitcoin.

This upward trajectory is fueled by growing optimism surrounding the potential approval of spot Ethereum ETFs and the general confidence that markets will trend higher in 2024. The prospect of this product entering the market has also injected fresh energy into the ETH ecosystem, lifting the second most valuable coin by market cap.

Related Reading: Institutional Inflows Into XRP Surges 244% Amid ETF Speculation

After protracted lower lows, the ETH/BTC ratio began rising immediately after the United States Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs last week. This unexpected shift, analysts observe, is primarily because of increasing confidence in the SEC approving a similar product for ETH.

Spot Ethereum ETFs, which would provide direct exposure to the Ethereum market, would make it easier for institutional investors to benefit from the volatility of ETH. So far, the SEC has approved an Ethereum Futures ETF, which, unlike the spot ETF, tracks an index, not the direct price of this asset.

Blackrock is among the leading Wall Street giants interested in issuing a spot Ethereum ETF. Considering its history of success, the decision by one of the world’s leading asset managers to apply for this product is an endorsement of its prospects. Earlier, Larry Fink, the CEO of BlackRock, said Ethereum, despite its scaling challenge, might spearhead the tokenization drive in the years ahead.

US SEC Yet To Clarify Whether Ethereum Is A Commodity Or Security

Even so, the SEC has yet to clarify whether ETH, a coin pre-mined with some assets distributed to the Ethereum Foundation, is a commodity like Bitcoin. Earlier, Gary Gensler, the chairperson of the SEC, was cornered by the United States policymakers to give the agency’s stand on the coin but didn’t.

Nonetheless, with the prospect of spotting Ethereum ETFs and the dominance of Ethereum in decentralized finance (DeFi) and non-fungible tokens (NFTs), ETH will likely continue outperforming BTC in the coming months. Price action data shows that ETH is already up 20% versus BTC in the past trading week.