Quick Take

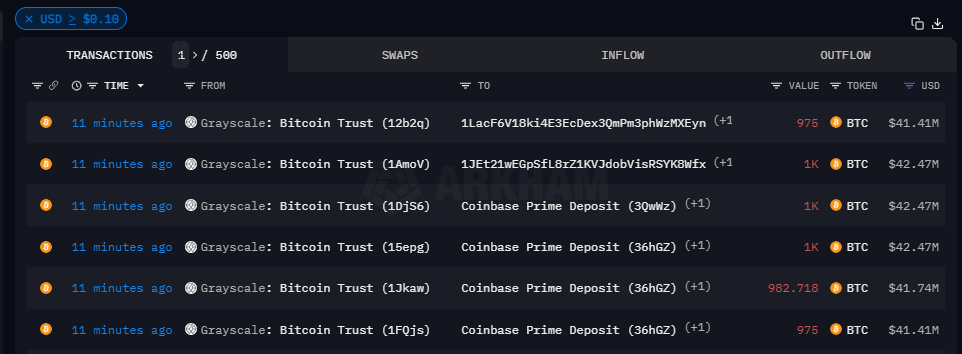

According to Arkham Intelligence data, Grayscale transferred another 18,400 BTC to a Coinbase Prime hot wallet on Jan. 17. Sent in several 1,000 BTC transactions, the Bitcoin was valued at around $800 million as of press time.

On Jan. 16, a similar transfer worth $387 million was also conducted by Grayscale, again to Coinbase Prime. The repetitive nature of these hefty transactions suggests possible redemption activity on Grayscale’s part as investors potentially rotate into lower-fee ETFs.

It’s also worth noting that all these transactions were conducted seconds before the U.S. markets opened at 2:30 PM GMT, possibly hinting at a strategy to leverage global market dynamics.

Given the limited supply of Bitcoin and the nature of Coinbase Prime’s role across multiple spot Bitcoin ETFs, the outflows from Grayscale are likely to be used as liquidity for any potential inflows into other Bitcoin ETFs. Only a handful of venues are available to the ETF Trust to purchase Bitcoin, with Coinbase Prime being the leading player.

The post Grayscale outflows add further $800 million BTC liquidity to Coinbase Prime OTC desk appeared first on CryptoSlate.