Quick Take

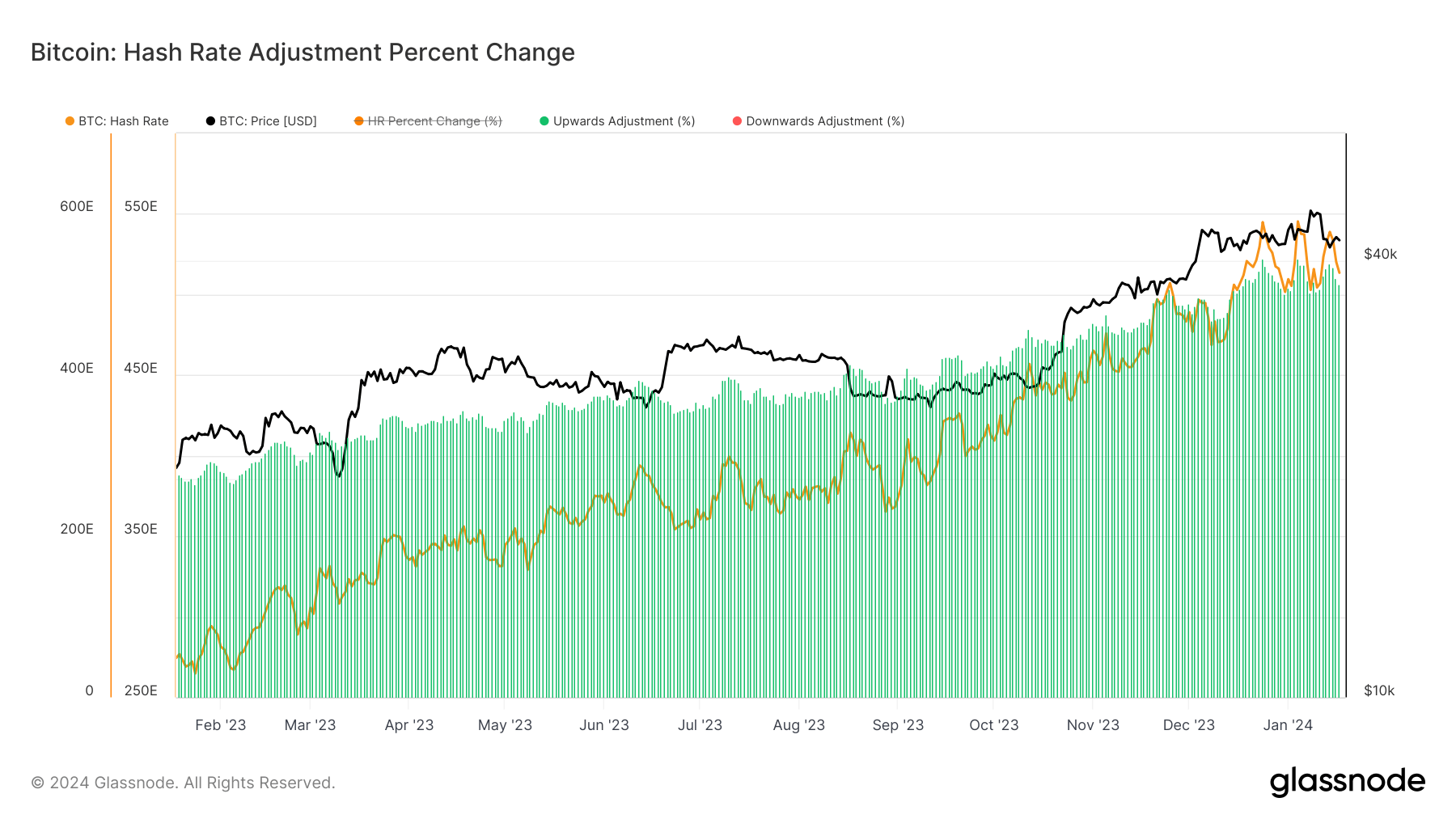

Bitcoin’s hash rate is currently experiencing a 6% dip from its all-time high of approximately 545 eh/s. On a 7-day moving average, it stands at around 513 eh/s.

This noticeable downturn can likely be attributed to the freezing temperatures in Texas leading to power adjustments, as Pierre Rochard, VP of Research at Riot Platforms, observed. To cope with these low temperatures, Texas’ natural gas power plants increased their output to 50 GW. At the same time, Bitcoin miners scaled back their operations to compensate for the low wind production, according to Rochard.

Texas Governor Greg Abbott said the Electric Reliability Council of Texas (ERCOT) avoided blackouts and scarcity pricing, marking a significant victory. However, these conditions have inevitably affected Bitcoin’s performance, and continuous monitoring of the hash rate and miners’ share prices will be required.

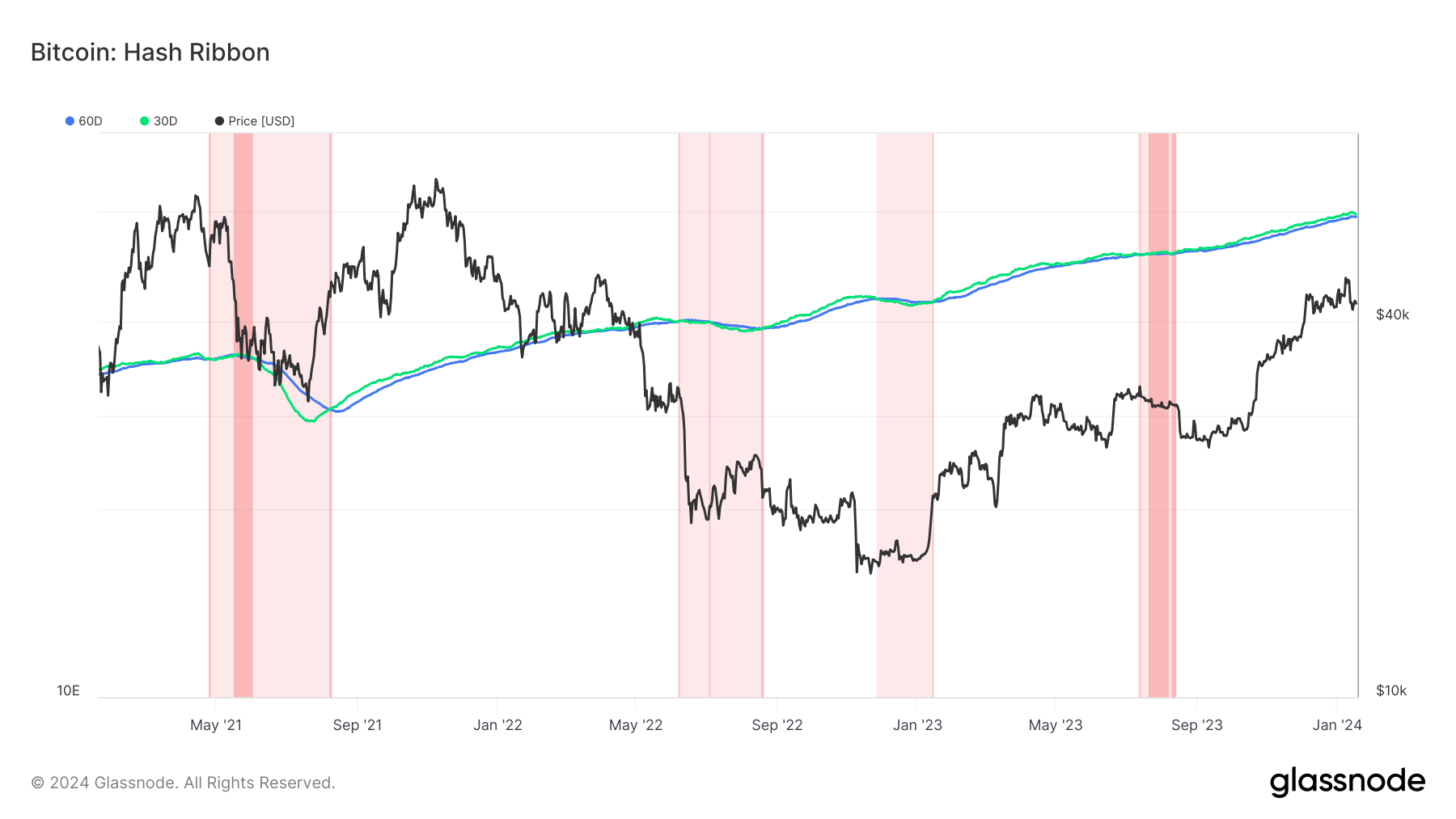

Turning to market indicators, the Hash Ribbon—a tool that presumes Bitcoin hits a low when mining becomes disproportionately costly—suggests that the worst of miner capitulation might be over. This conclusion comes from observing the 30-day MA of the hash rate crossing above the 60-day MA. While there’s no current indication of capitulation, close monitoring of these figures will be critical in predicting future buying opportunities and market behavior.

The post Texas freeze leads to dip in Bitcoin hash rate appeared first on CryptoSlate.