The United States Securities and Exchange Commission (SEC) has announced an extension in the decision-making process for Fidelity’s proposed Ethereum exchange-traded fund (ETF). According to the official statement released on January 18, 2024, the SEC has decided to prolong the review period by 45 days. This extension is to ensure that the SEC has “sufficient time to consider the proposed rule change and the issues raised therein.”

The Fidelity Ethereum Fund, filed under the self-regulatory organization Cboe BZX Exchange, Inc., seeks to trade shares under BZX Rule 14.11(e)(4), specifically focusing on Commodity-Based Trust Shares. Initially published for comment on December 6, 2023, the proposal has now moved its crucial decision date to March 5, 2024, as the SEC utilizes the full extent of its designated period for a more thorough review.

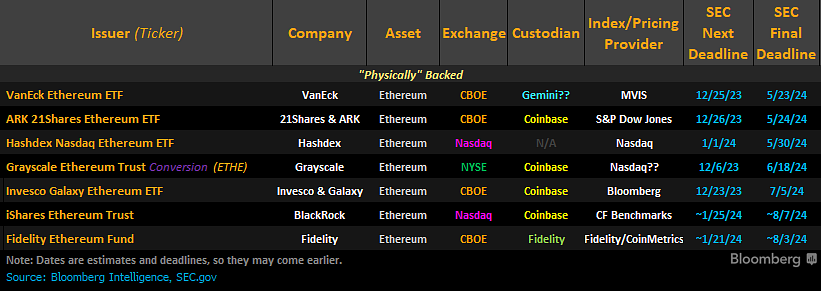

James Seyffart, a Bloomberg ETF analyst, did not express surprise at this development. In his Jan. 18 X (formerly Twitter) post, he stated, “Fidelity Ethereum ETF delayed just now. Completely expected. Dates that really matter are late May in my view,” while also emphasizing the importance of late May as the critical period, particularly referencing the SEC’s final deadline of May 23 for VanEck’s Ether ETF.

Ethereum ETF Approval Has Good Chances

While some analysts remain hopeful about the SEC’s potential simultaneous approval of multiple spot Ether ETFs just before the first final deadline, mirroring its strategy for spot Bitcoin ETFs, skepticism persists. Bloomberg’s Eric Balchunas projected a 70% likelihood of an Ethereum spot ETF approval in May, considering the multiple applications awaiting the SEC’s verdict.

Digital asset lawyer Joe Carlasare expressed confidence in the eventual approval of an Ethereum spot ETF within the year. In a detailed analysis on X, he outlined key factors that should theoretically favor an approval: “ETH Futures are already trading on the CME. The SEC has already approved ETH futures ETFs. The CME has identical surveillance sharing agreements for the BTC futures and ETH futures. The correlation of ETH futures to spot is over 90% (just like BTC).”

According to him the regulated futures market of significant size is the primary reason the SEC approved the spot Bitcoin ETFs. “Therefore, it would be arbitrary and capricious to treat the ETH futures and spot markets differently (See Grayscale v SEC),” he Carlasare claims, adding that the “SEC doesn’t like to pick winners. I think they would prefer two digital asset spot ETFs rather than just one.”

Adding to the discussion, Nate Geraci, President of the ETF Store and co-founder of the ETF Institute, commented on the necessary components for a spot ETH ETF approval, saying, “CME-traded ether futures + CME-traded ether futures ETF approval + Grayscale court victory + spot bitcoin ETF approval = spot ether ETFs should be approved.” This statement suggests a positive outlook, considering all parts of his formula are already in place.

Contrasting these optimistic perspectives, Will Clemente III introduced a note of caution last week, reflecting on a recent statement by SEC Chairman Gary Gensler: “Gensler just said in his statement that BTC is the only crypto commodity, so not nearly as high of expectations for an ETH ETF getting approved – but the market loves narratives to grasp onto.”

At press time, ETH traded at $2,470.