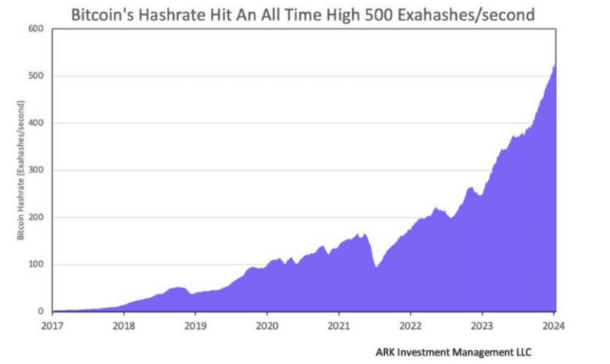

In an impressive display of computational might, the Bitcoin network has shattered its all-time high hash rate, surpassing a staggering 500 exahashes per second. This unprecedented surge signals a robust increase in the raw processing power securing the king of cryptocurrencies, sending ripples of excitement and cautious optimism through the industry.

For the uninitiated, hash rate essentially measures the muscle behind Bitcoin’s digital fortress. It reflects the number of complex calculations the network can perform every second, acting as a formidable barrier against potential attackers. This recent leap signifies a dramatic beefing up of security, making it exponentially harder for anyone to tamper with the blockchain.

Thriving Ecosystem: Bitcoin Hash Rate Soars

But the implications extend far beyond just enhanced security. A rising hash rate is often viewed as a barometer of growing network participation, suggesting a thriving ecosystem brimming with enthusiastic miners. This influx of computational power strengthens Bitcoin’s backbone, paving the way for future scalability and resilience.

Historically, a robust hash rate has often gone hand-in-hand with increased confidence and a bullish market surge. While not a guaranteed prophecy, it certainly doesn’t hurt Bitcoin’s long-term outlook.

Analysts like Yassine Elmandjra from ARK Invest are particularly impressed, highlighting the sheer scale of computational power now wielded by the Bitcoin network. To put it in perspective, processing at this rate is akin to performing billions of calculations for every single star in our galaxy. Talk about putting traditional supercomputers to shame.

Bitcoin’s hash rate hit an all time high 500 exahashes/s this month.

To highlight the enormity of this number:

– For every star in our galaxy, the Bitcoin network is calculating 5 billion computations per second.

– It would take ~2000 years for the entire global population,… pic.twitter.com/Ki4jOxmliO— Yassine Elmandjra (@yassineARK) January 19, 2024

This milestone truly underscores Bitcoin’s dominance in the realm of decentralized computing, echoes Anthony Pompliano of Pomp Investments. For investors, it’s a powerful testament to the network’s strength and reliability, further solidifying its position as the world’s most powerful computing force.

Bitcoin Network Shows Mettle

However, seasoned market watchers urge caution against hasty pronouncements of a guaranteed bull run. BTC’s price, ever the fickle beast, exhibits a more nuanced response. While some see the hash rate surge as a bullish harbinger, others point to a complex interplay of factors, including regulatory headwinds and ongoing geopolitical tensions, that could dampen any immediate price upswings.

The king coin’s hash rate hitting warp speed is undeniably a significant achievement. It speaks volumes about the network’s growing strength, security, and potential. While the immediate price impact remains a guessing game, one thing is clear: the digital gold digger’s shovel just got considerably sharper, and that bodes well for the long-term health of the Bitcoin ecosystem.

Meanwhile, the recent price changes of the BTC/USD market indicate a mixed response, despite the bullish implications of a high hash rate. Concurrently, support at the intra-day low of $41,446 held firm despite a bull-bear struggle for supremacy in the Bitcoin market during the last day.

Featured image from Pixabay