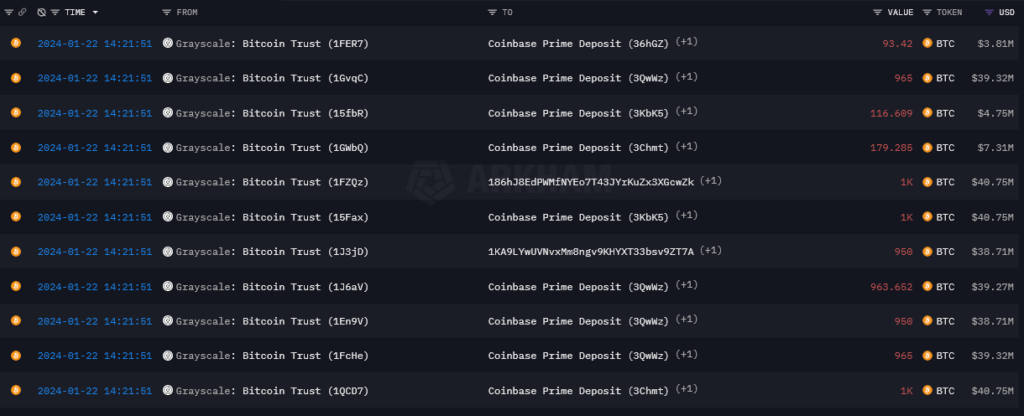

Data from Arkham Intelligence shows Grayscale has continued its daily Bitcoin outflows, which have occurred daily shortly before the U.S. market opened each day since its conversion to a spot Bitcoin ETF.

With famously high fees, the trust continues to see investors leave the fund seeking lower fees or to lock in profits. The trust traded at a 48% discount to its underlying Bitcoin until it converted into a spot Bitcoin ETF. The discount is now a mere -0.27%, meaning investors can leave the fund with an equivalent return to that of investing in Bitcoin, within 37 basis points.

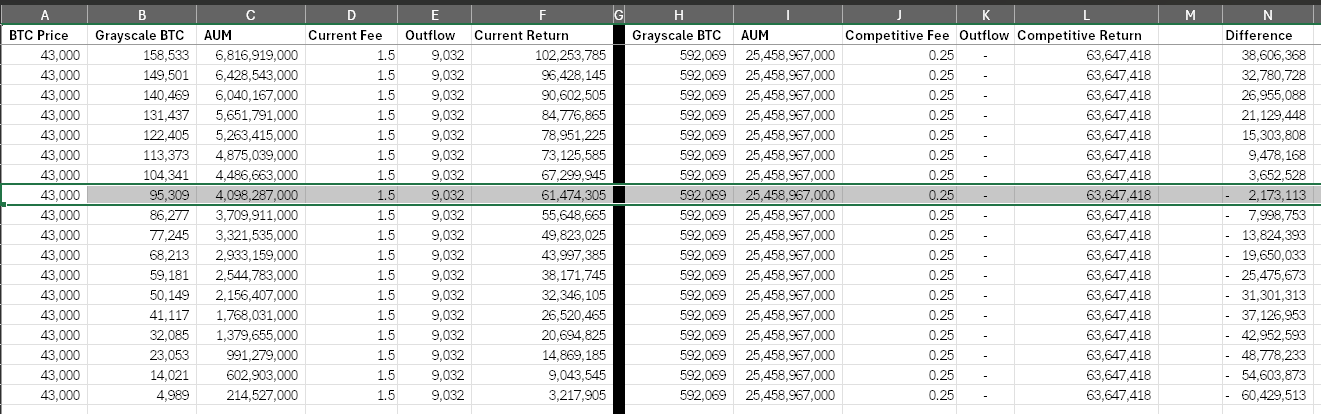

Grayscale appears to have little motivation to alter its high fee structure as its returns will remain higher than its competitors by some margin due to the significant discrepancy. Grayscale charges 1.5%, generating around $381 million in revenues, while many competitors charge under 0.5%.

With this in mind, if Grayscale allowed outflows to continue until its current ~560k BTC fell to around 95k BTC, it would still generate fees of over $60 million annually.

This is important to note as if it dropped its fees today and subsequently stemmed the outflows, its revenue would fall to $63 million, similar to if it held 95k BTC at 1.5%.

BlackRock currently has around $1.2 billion in assets under management. At a return of 0.25%, that calculates to around $3 million in revenue, meaning Grayscale returns almost 400x that of BlackRock for now.

The post Grayscale offloads further 13k BTC as revenues still way above competition appeared first on CryptoSlate.