In 2021, the COVID-19 pandemic pushed the world government to inject liquidity, positively impacting Bitcoin and legacy markets. Today, the financial world might be on the cusp of experiencing a similar capital injection, potentially setting the stage for a crypto bull run.

China’s Play Could Benefit Bitcoin And Crypto Prices

According to a report from Bloomberg, Chinese authorities are exploring injecting capital into their stock market. Chinese equities have been on a downtrend for several weeks. The bearish momentum has pushed authorities in the country to take “forceful” steps, per a high-ranking government official.

In that sense, Bloomberg claims that China could inject around $300 billion to create a “stabilization fund” to restore investor confidence. The Chinese government could also spend around $30 billion buying onshore shares.

These measures highlight the emergency faced by the Asian giant. Its CSI 300 Index, which tracks the biggest companies in China, reached a five-year low. A crisis in the real estate sector has been driving the downward price action.

During the COVID-19 pandemic, governments were forced to inject billions of dollars to prevent an economic disaster. This “Stimulus Package” translated into higher prices for Bitcoin and the crypto market as people sought mechanisms to generate income.

If China follows its strategy, Bitcoin and legacy markets could benefit from the increased liquidity. The co-founders of the crypto analytic firm Glassnode stated the following on China’s decision and its potential to catalyze the prices across the nascent sector:

The Liquidity surge begins. China will try to prop up its markets by massive liquidity. It is very to be the catalyst that will make crypto and equity markets soar into the first part of 2024.

However, unlike in 2021, today, there is a risk of heating inflation, which led the US Federal Reserve and global central banks to tighten their monetary policies. On the possibility that the Fed follows China in providing liquidity for the global market by printing more dollars, the Roscongress Foundation added:

US authorities will not be able to start the “printing press” again this year, because this would lead to another round of inflation (…)

All About Liquidity

In a separate report, the co-founder and former CEO of BitMEX, Arthur Hayes, noted the decline in liquidity in the crypto market. Following the launch of several spot Bitcoin Exchange Traded Funds (ETFs) in the US, the sector experienced a spike in selling pressure.

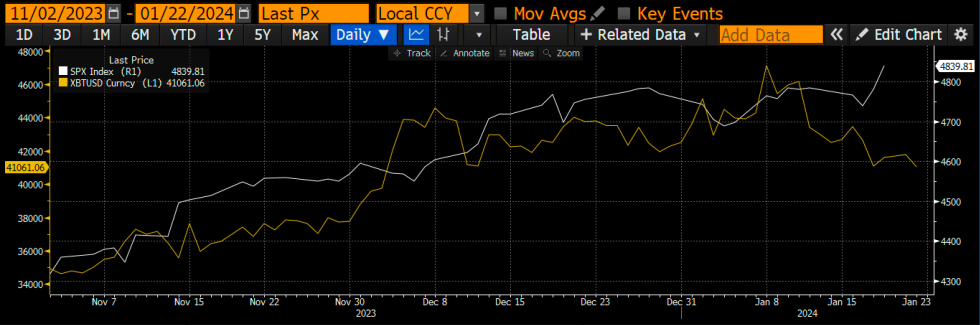

Consequently, the Bitcoin price decoupled from traditional markets in the short term. According to Hayes, the selling pressure in the price of BTC hints at “hiccups” for US dollar liquidity, as seen in the chart below.

In other words, on low timeframes, the crypto founder expects hurdles for the bullish momentum until the next macroeconomic event in the US, set for January 31st, when the Secretary of the Treasury, Janet Yellen, will give a speech. Hayes noted:

$BTC looks mad heavy. I think we break $40k. I went long some 29Mar $35k strike puts. I think we dump into the 31 Jan US Treasury qtly refunding annc (announcement). Is Janet Yellen or Talkin’?

Cover image from Unsplash, chart from Tradingview