Quick Take

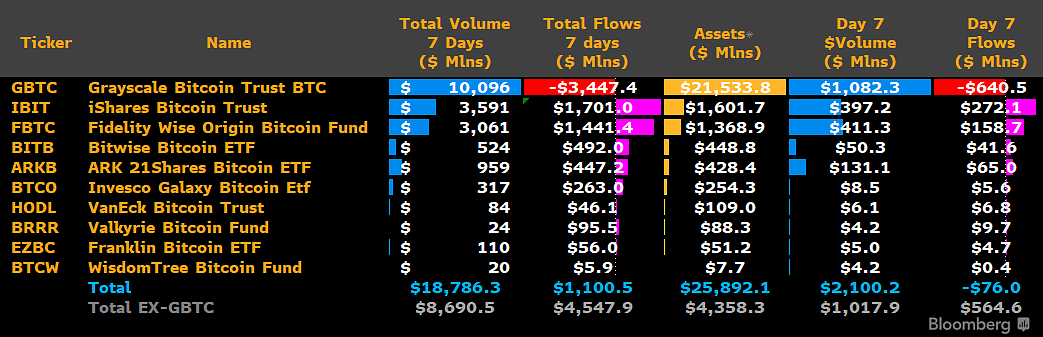

Grayscale Bitcoin Trust (GBTC) experienced an outflow of $640 million on its seventh trading day, the most significant outflow observed since its inception, according to James Seyffart. The total outflow has now reached a staggering $3.45 billion.

On the other hand, Seyffart indicates that BlackRock ETF (IBIT) witnessed a surge in inflows amounting to $272 million, marking its third-largest inflow day. Despite the sizeable influx into IBIT, the overall net outflows for the day stood at $76 million, underlining a shifting dynamic in the Bitcoin ETF market.

In summary, BlackRock ETF (IBIT) has recorded a total net inflow of $1.7 billion, placing it in the lead. Following closely, Fidelity comes in the second position with net inflows of $1.4 billion. Notably, the combined net inflows of the nine ETFs marginally outpace the outflows from GBTC, amounting to a total of $1.1 billion.

The post BlackRock ETF inflows hit $272 million as Grayscale records massive Bitcoin outflow appeared first on CryptoSlate.