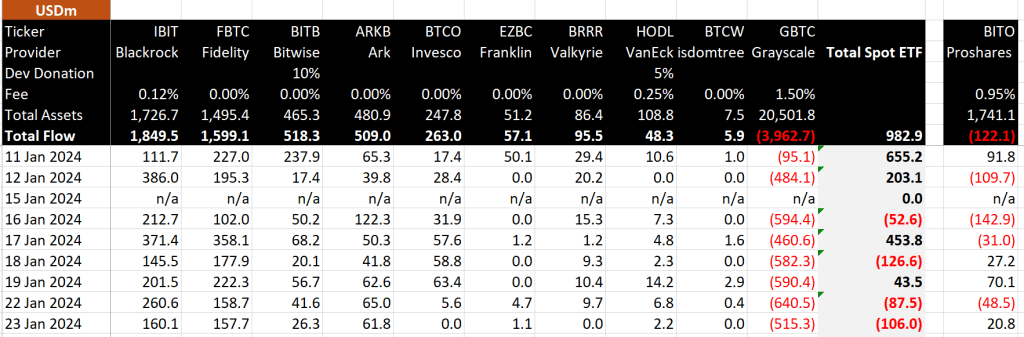

Outflows from the Grayscale Bitcoin ETF (GBTC) continue to be the dominant story of the market. The numbers of outflows continue to be enormous. Yesterday, on Tuesday, $515 million flew out of GBTC, for a total of $3.96 billion. Meanwhile, the “newborn 9” saw $407 million in flows. Thus, day 8 closed with a net outflow of $106 among all 10 spot Bitcoin ETFs.

The detailed breakdown from BitMEX Research (after day 8) reveals that Blackrock is still leading the charge with a positive inflow of $1,849.5 million, followed closely by Fidelity at $1,599.1 million, and Bitwise at $518.3 million.

The market’s fluctuating dynamics are further highlighted by the four days of net inflows and four days of net outflows observed over this period. The total inflow for all 10 ETFs (with Grayscale) stood at 21,362.5 BTC, while GBTC alone saw a massive outflow of 98,296 BTC.

Providing a potential glimpse of optimism, BitMEX Research added, “While today’s GBTC outflow of $515 million is less than the $640 million from yesterday, and the discount to NAV has also reduced significantly, these could be early signs of easing selling pressure on GBTC.”

When Will Grayscale’s Bitcoin Outflows End?

The good news of the last few days was that the market absorbed the selling of 22 million GBTC shares valued close to $1 billion by bankrupt crypto exchange FTX. However, despite this massive sell-off, GBTC’s outflows continued over the subsequent two days.

Bloomberg analyst Eric Balchunas, in an attempt to gauge market expectations, conducted a poll which indicated varied opinions on the future scale of GBTC’s outflows. He queried, “GBTC has bled 13% of its shares outstanding. How high do you think that number will get before the mass exodus stops?”

The poll, with 9,288 votes (at press time), resulted in the following: 21.5% voted for under 20%, 48.7% for 35-50%, 16.4% for 50-80%, and 13.4% for over 80%. Balchunas commented, “FWIW James Seyffart and I are both in the 25% range, but this is a highly uncertain scenario with many unknowns.”

GBTC has bled 13% of its shares outstanding. How high do you think that number get before the mass exodus stops?

— Eric Balchunas (@EricBalchunas) January 23, 2024

Adding to this, Seyffart stated, “My number is above 20% and below 35% for GBTC’s asset exodus.” Remarkably, only 42 trading days are left until GBTC reaches 0 BTC if outflows continue at the same pace.

Only 42 trading days left till $GBTC reaches 0 BTC lol pic.twitter.com/5Kwako4u9A

— NLNico (@btcNLNico) January 24, 2024

Crypto analyst Fabian D. pointed out a noteworthy trend, emphasizing, “Today’s trading volume for GBTC was the lowest since its launch, totaling around $760M. This downtrend, if it continues, may signal a decrease in outflows, potentially pushing the market valuation back above the $40k mark as investors recognize the deceleration in the rate of change.”

Fred Krueger provided an analytical perspective on the outflows, highlighting their strategic implication: “The capital withdrawing from GBTC primarily consists of short-term, weak holders, including the FTX estate and presumably some from DCG.”

He added that this transition is shifting the market composition towards the “newborn 9”, characterized by their “ultra-sticky asset allocation,” adding “This shift is likely to fortify the market’s foundation, paving the way for a more robust and stable future.”

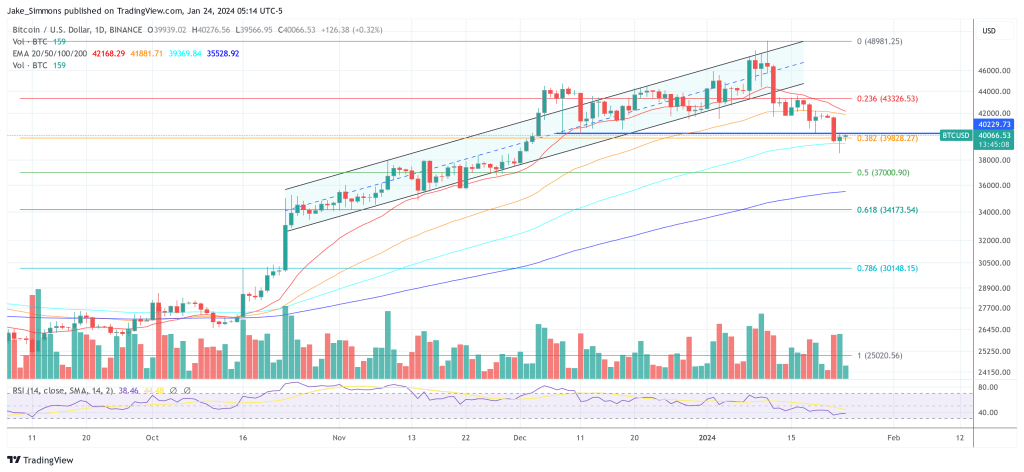

At press time, BTC was trading at $40,066, putting it below the key resistance zone at $40,200 to reclaim the previous trading range.