An analyst has explained when the next Bitcoin bull run peak might appear, if the same pattern as in previous cycles repeats this time as well.

This Is What Previous Bitcoin Cycles Suggest Regarding Bull Run Top

In a new post on X, analyst Ali has discussed about how the last two Bitcoin bull runs line up against each other and what it could mean for the current cycle of the cryptocurrency.

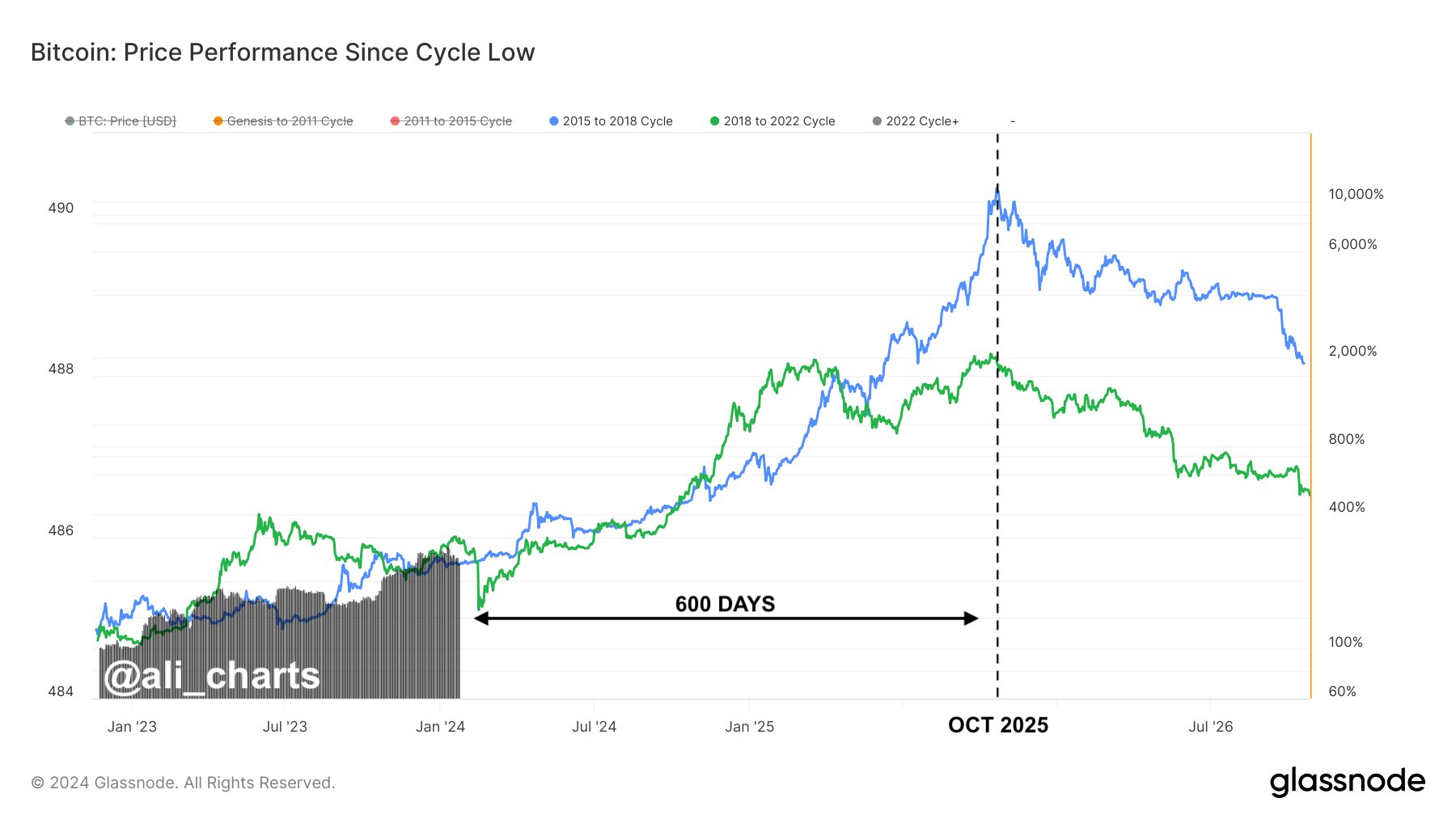

To make the comparison, the analyst has cited a chart that shows the price trend in each of the cycles with the cyclical bottoms being the common start-point for all of them.

From the graph, it’s visible that the peaks of the last two Bitcoin bull runs took shape at roughly the same amount of time since the bottoms of the respective cycles.

For the current cycle, the low that followed the FTX collapse in 2022 has been chosen as the bottom. If the current cycle is lined up against these other two starting from this bottom, then it would still have roughly 600 days before it reaches the same point as when the last couple of bull runs hit their tops.

“If Bitcoin mirrors past bull runs (2015-2018 & 2018-2022) from their respective market bottoms, projections suggest the next market peak could land around October 2025,” says Ali. “This implies BTC still has 600 days of bullish momentum ahead!”

BTC Has Been At Risk Of Slipping Below A Historical Line Recently

While BTC may have a bullish outlook for the long term, its short-term price trend has been painful for investors, as the cryptocurrency has seen a notable drawdown since the spot ETFs found approval from the US SEC.

The cryptocurrency had earlier even slipped down towards the $38,500 mark before making some recovery back around the $40,000 level that it’s still trading around.

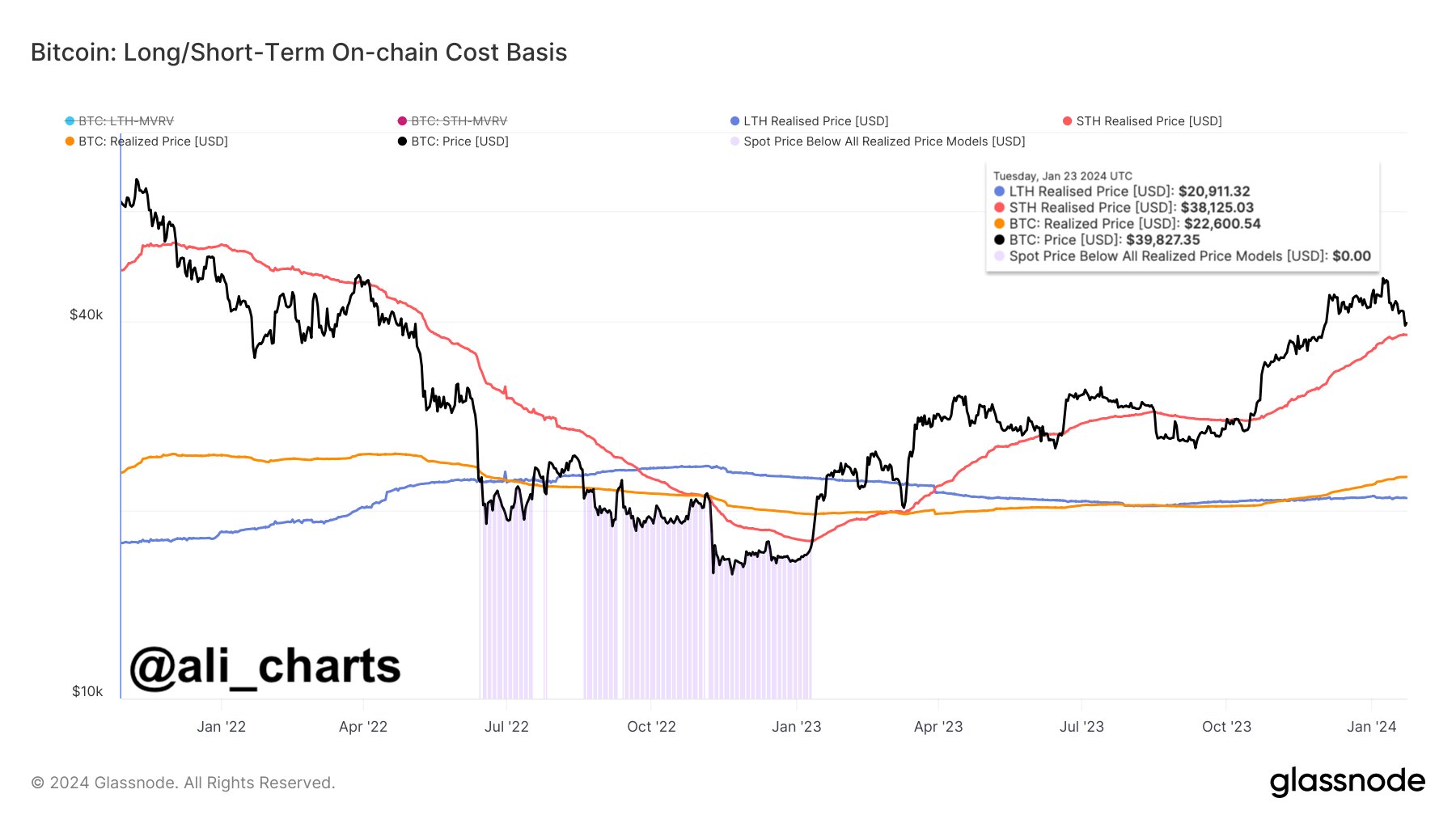

In this latest plunge, Bitcoin came dangerously close to retesting the “short-term holder realized price,” a level that has been significant for the asset throughout history.

The “realized price” is a metric that keeps track of the price at which the average investor in the Bitcoin market acquired their coins. The spot price being above this value naturally implies the average holder in the sector is carrying profits, while it being under the line implies the dominance of losses.

As Ali has pointed out in another X post, the “short-term holder” group will find themselves underwater if the cryptocurrency’s price slips under the $38,130 level.

Short-term holders (STHs) refer to the Bitcoin investors who purchased their coins within the last 155 days. At the moment, their realized price stands at the $38,125 level. Historically, a sustained break below this line has often meant an extended stay for the coin below it.

So far, BTC has avoided a retest of this line, but if the current correction continues, it might even slip under it. “This potential BTC dip might trigger a new wave of panic selling as these holders will seek to minimize losses,” explains the analyst.