Despite starting the year strong, MKR has encountered a choppy path in recent weeks, leaving investors with a mixed bag of signals to decipher. While the decentralized finance (DeFi) leader has maintained its position above key support levels, concerns have emerged surrounding a prominent wallet’s sizeable token sale and a declining trading volume.

Maker Resilience Faces Uncertain Shadows

On the bright side, Maker has demonstrated resilience amidst broader market downturns. After a notable surge on January 24th, the token has held its ground, defying predictions of a deeper correction. This steadfastness has fueled optimism among some analysts, who predict a continued upward trajectory for MKR throughout 2024.

However, a recent development has cast a shadow of uncertainty. Data from on-chain analytics firm Spot on Chain revealed that a well-known wallet, reportedly associated with a MakerDAO co-founder, unloaded a hefty 2,235 MKR over the past two days. This translates to a staggering $4.5 million at press time, sparking fears of a potential “whale dump” that could trigger a price slump.

Wallet 0xa58 (linked to @RuneKek, #MakerDAO cofounder) has sold 2,235 $MKR for 4.542M $DAI at $2,032 on average in the past 2 days.

Currently, the wallet still holds 2,430 $MKR ($4.92M), and may keep selling.

The $MKR price has been down ~3.39% (2D), since the first sale.

Want… pic.twitter.com/iW2A0pMLHx

— Spot On Chain (@spotonchain) January 28, 2024

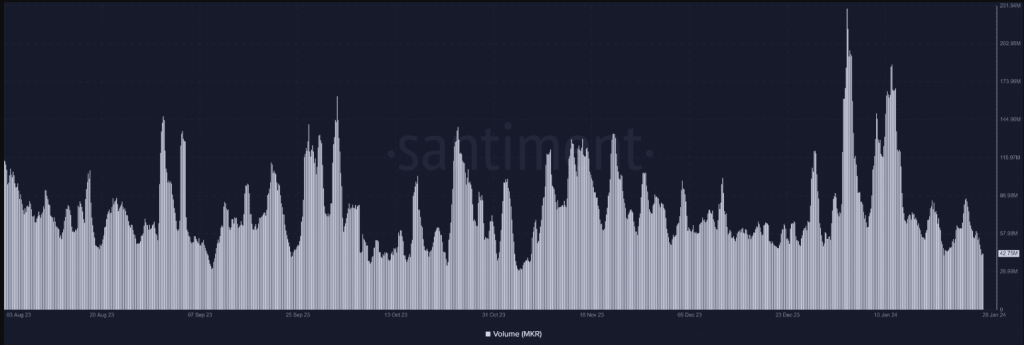

Adding to the mixed picture is a decline in trading volume. After reaching a high of $84 million on January 25th, activity has steadily dwindled, currently hovering around $43 million. This dampened trading enthusiasm could indicate waning investor confidence or simply be a temporary lull.

A glimmer of hope emerges when examining exchange netflow. Despite the sizable wallet sale, the overall flow of MKR has been dominated by inflows, suggesting that more tokens are being withdrawn from exchanges than sold. This trend, while not as pronounced as the previous outflow witnessed on January 25th, hints at potential accumulation by longer-term holders.

MKR Technical Struggles Ahead

On the technical front, Maker’s daily chart paints a picture of recent struggle. Following the January 24th gains, prices have embarked on a descent, shedding over 3% by January 27th. This marks the steepest decline since the downtrend began two days prior. The continuation of this selling pressure, particularly if fueled by further whale offloads, could pose a significant challenge for MKR’s immediate future.

At the time of writing, MKR was trading at $1,939, down 2.6% and 0.7% in the last 24 hours and seven days, data from Coingecko shows.

Maker’s early 2024 journey has been characterized by both encouraging signs and potential pitfalls. While the token’s resilience and positive long-term outlook offer reasons for optimism, the recent whale sale and declining volume inject a dose of caution.

Featured image from iStock, chart from TradingView