Quick Take

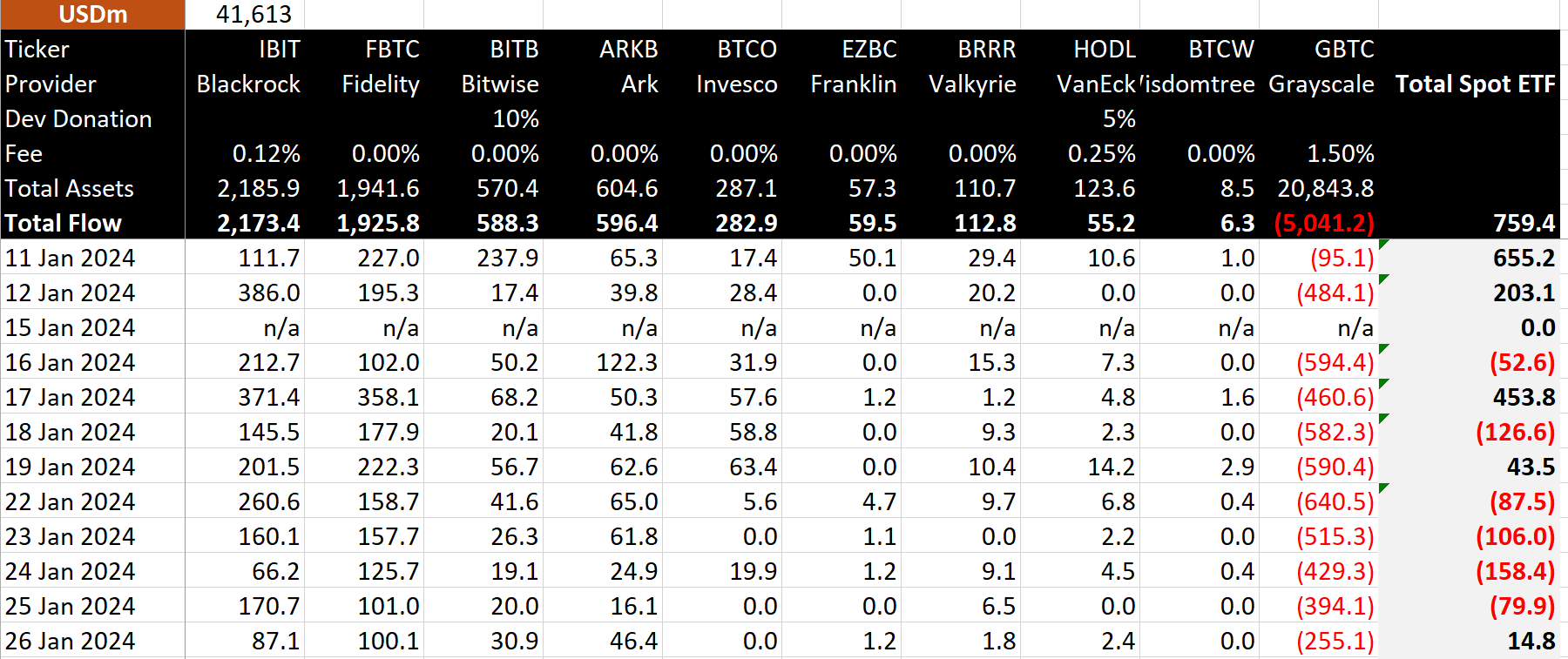

The eleventh trading day marked a significant milestone for the spot Bitcoin ETFs, registering a $14.8 million net inflow, according to BitMEX Research.

This represents the first daily net inflow since Jan. 19, as GBTC saw its outflows moderating to $255 million, the lowest recorded since Jan. 11. However, GBTC’s total outflows continue to loom large at over $5 billion.

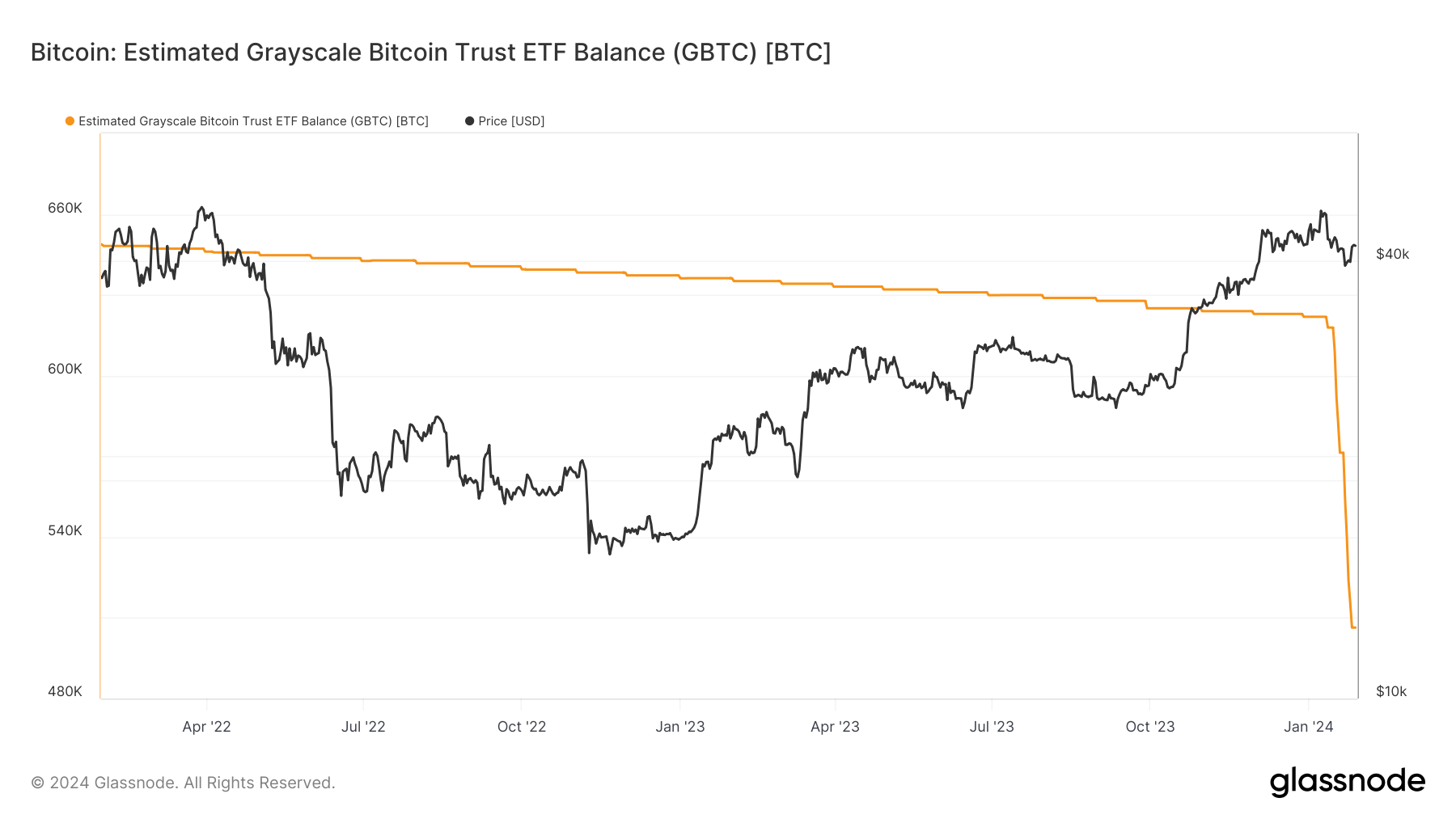

Prior to the launch of the ETF on Jan. 11, Grayscale’s GBTC held approximately 621,000 BTC. According to recent data from Glassnode, the fund’s Bitcoin balance has been reduced to approximately 506,000 BTC. This represents a decrease of nearly 20% since the ETF’s inception.

BlackRock’s IBIT has emerged as a beneficiary, logging net inflows of $87 million on Jan. 26 and taking its total to $2.2 billion, according to BitMEX Research.

Adding to the positive trend, Fidelity saw another net inflow of $100 million, taking the firm’s total to $1.9 billion. Notably, Fidelity’s FBTC ETF has consistently attracted at least $100 million of net inflows every trading day, according to BitMEX Research.

Altogether, total net inflows now stand at $759.4 million, according to BitMEX Research.

The post Spot Bitcoin ETFs hit $14.8 million daily net inflow, first in 5 trading days appeared first on CryptoSlate.