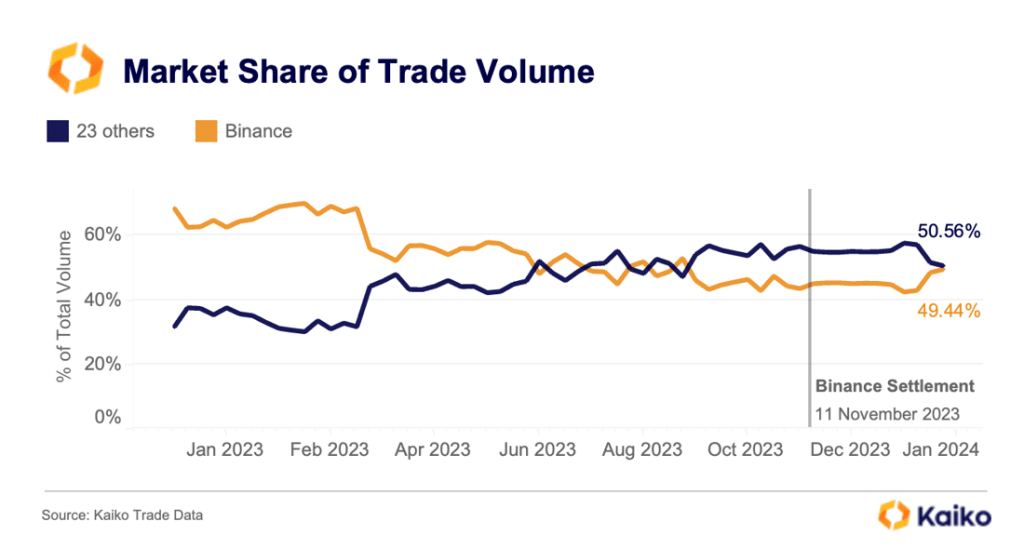

Binance has regained its position as the world’s most dominant crypto exchange, capturing nearly 50% of the global market share, according to data from Kaiko. The analytic data provider revealed that Binance’s market share has rebounded to almost 50% in the two months following its settlement with the United States Department of Justice (DoJ).

Binance Rising, Claims Nearly 50% Of Market Share

In a post on X, Kaiko pinned Binance’s resurgence to a spike in trading volume fueled by its zero-fee promotion in December 2023. BNB, Dogecoin (DOGE), and Solana (SOL) were among the coins supported. They were all paired with FUSD, a stablecoin.

The data provider also said the hype surrounding the United States Securities and Exchange Commission (SEC) approving several spot Bitcoin exchange-traded funds (ETFs) helped Binance claw back market share losses.

This decision proved worthwhile for Binance, considering many network users expected crypto prices to continue trending higher after their bounce from November 2023 lows. Institutional investors can easily gain Bitcoin exposure with the United States SEC now permitting the trading of regulated spot Bitcoin ETFs.

Regulatory Challenges Behind: Will BNB Float Above $340?

Binance’s recovery is a major milestone for the exchange, which faced regulatory scrutiny in the United States following its initial expansion into the country. The SEC sued the exchange in June 2023, alleging that Binance listed and enabled the trading of unregistered securities, including, among others, Cardano (ADA) and The Sandbox (SAND).

At the same time, the agency claimed the platform was involved in market manipulation, violating multiple securities laws in the country.

The settlement with the DoJ cleared the way for Binance to resume operations in the United States and regain its footing in the global crypto market. As part of this deal with the United States government, the exchange paid $4.3 billion to multiple regulators, including the SEC and Commodity Futures Trading Commission (CFTC).

Changpeng Zhao, the founder of Binance, also had to step down as the CEO. Richard Teng, the former Global Head of Regional Markets, has since replaced Zhao as the CEO.

BNB prices have since recovered steadily from November lows, looking at the candlestick arrangements in the daily chart. The coin is up 35% from November lows, finding support at around $290. For the uptrend to be validated, BNB must close above $340 and December 2023 highs, ideally with rising trading volume.