Quick Take

The nascent Bitcoin ETF market has been on a remarkable journey in its initial two weeks, sparking an industry-wide discourse on potential capital migration from other assets into these ETFs.

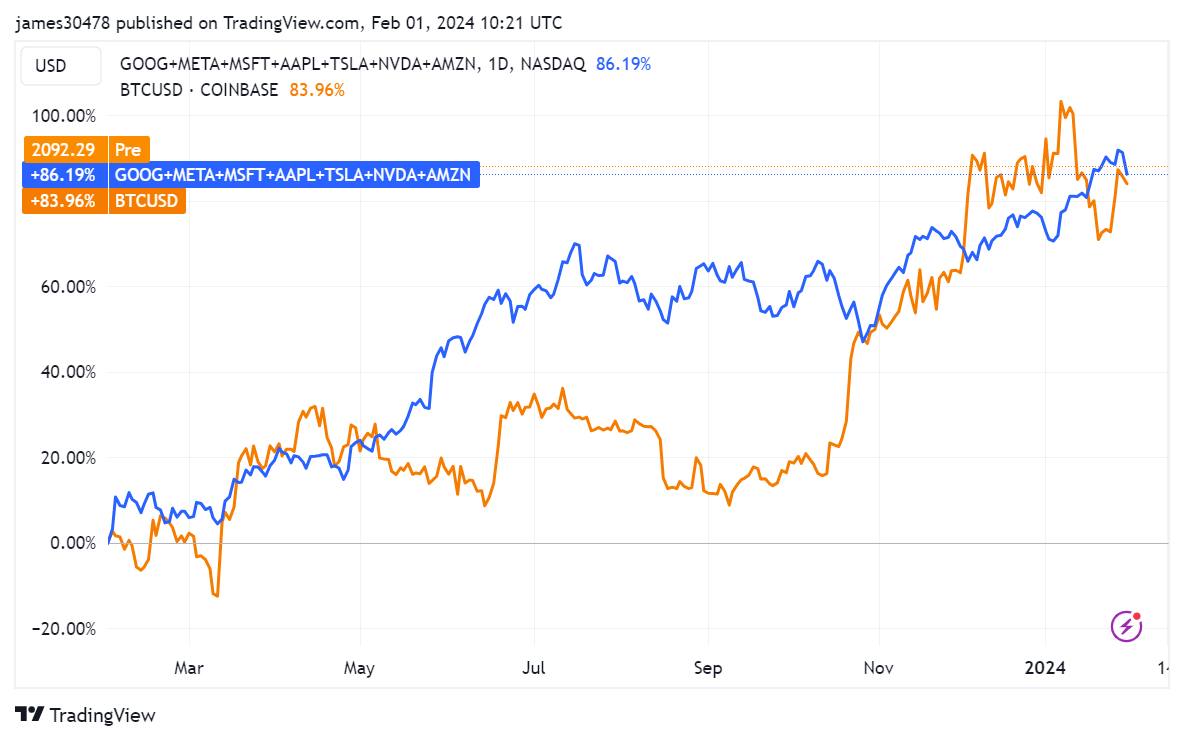

As Bitcoin matures as an asset, such long-term shifts may become more prominent, especially considering the stellar performance of tech stocks over the past year.

A year-on-year analysis reveals a close race, with Bitcoin recording an 84% gain while the ‘Magnificent Seven’ tech conglomerates – Amazon, Tesla, Microsoft, Meta, Nvidia, Apple, and Google – edged slightly ahead with an 86% uptick. Notably, Bitcoin endured a period of underperformance in Q2 and Q3 2023 but rebounded significantly in Q4, fueled by the anticipated launch of Bitcoin ETFs.

In Q1 2024, the tech sector shows a mixed picture following earnings releases. Tesla experienced a notable dip, down 29% from its December peak, while Nvidia remained resilient, down only 2.5% from its all-time high. Google and Microsoft have seen decreases from their peaks of approximately 9% and 3%, respectively. The forthcoming earnings of Apple, Amazon, and Meta will provide additional insights into this narrative after the market closes on Feb. 1.

Bitcoin, meanwhile, is 14% down from its annual high of $49,000, though it had dipped as deep as 20% earlier.

The post Bitcoin challenges ‘Magnificent Seven’ tech giants with 84% annual gain amid ETF buzz appeared first on CryptoSlate.