Quick Take

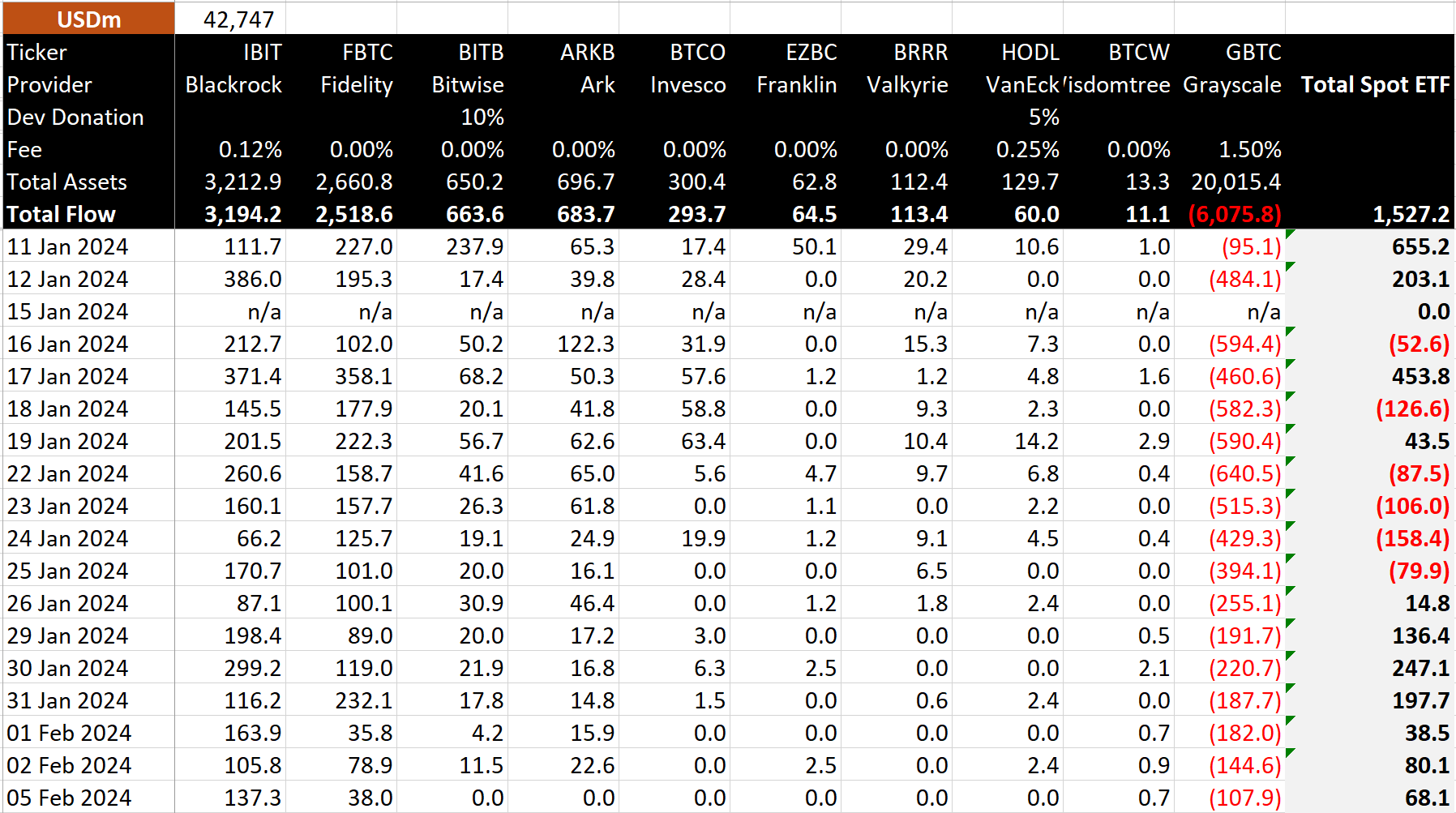

Net inflows into Bitcoin ETFs are seeing a slight uptick for the seventh straight trading day, emphasizing their growing appeal among investors. BlackRock IBIT is leading the pack, with an additional $137 million net inflow, taking its aggregate to an impressive $3.2 billion, according to BitMEX Research.

However, seven of the ten ETFs recorded zero inflows for the day as of press time, the only date where more than four ETFs have not reported inflows. Notably, only Grayscale Bitcoin Trust (GBTC) has reported outflows on any day since the SEC’s spot Bitcoin approval, with the Newborn Nine ETFs yet to report a day of outflows.

Further, GBTC observed its outflows tapering down to $108 million, the lowest since the first day of trading, pushing the total net outflows past $6 billion. However, the day saw a slower uptake of net inflows across other ETFs.

Since the inception of the ETFs, the sector has seen $1.5 billion of net inflows, which translates to a BTC equivalent of approximately 33,611 BTC. This data reflects positive momentum toward Bitcoin ETFs.

The post BlackRock reaches $3.2 billion as Bitcoin ETFs continue to draw investor interest appeared first on CryptoSlate.