On Monday, February 12, Bitcoin price surged past the $50,000 barrier on several exchanges, with Binance reporting a peak of $49,990. This remarkable rally can be attributed to three critical factors: the influx of spot Bitcoin ETF inflows, bullish signals from the options market, and supportive trends in the futures market.

#1 Spot Bitcoin ETF Inflows

The notable rise in Bitcoin’s price past $50,000 has been significantly influenced by the surge in spot Bitcoin ETF inflows, a trend marked by increasing institutional demand. Outflows from Grayscale continue to slow, while ETF inflows for BlackRock, Fidelity and the others remain massive.

According to Arkham, on February 12 at 22:14 UTC+8, 2,044 BTC were transferred from Grayscale to Coinbase Prime Deposit, which corresponds to a value of approximately $98 million and once again confirms the decreasing selling pressure from Grayscale. In the meantime, Coinbase Premium is clearly trending up again, which points to further high inflows to the ETFs.

Bernstein analysts Gautam Chhugani and Mahika Sapra have highlighted this shift, noting, “Bitcoin ETFs have emerged as clear price catalysts. The decrease in Grayscale Bitcoin Trust’s outflows to around $50 million, coupled with nearly $1 billion in inflows into new ETFs over two days, has markedly improved market sentiment.” This shift signifies a broader acceptance of BTC among institutional investors, facilitated by the convenience of ETFs for adding Bitcoin to traditional investment portfolios.

Furthermore, Bernstein’s commentary suggests that while the market reacted swiftly to ETF approvals, the full impact of these inflows and the resulting Bitcoin scarcity is yet to be fully realized. “We are witnessing a Bitcoin FOMO rally driven by ETFs, setting the stage for potential record highs,” say Chhugani and Sapra. This analysis points to a significant turning point in Bitcoin investment, with ETFs playing a pivotal role in shaping its price trajectory and highlighting a growing optimism for BTC’s future performance.

#2 Options Market

The options market has been a clear indicator of bullish sentiment, with investors positioning for higher prices. Kelly Greer from Galaxy Digital noted a significant trend in the market, stating, “It’s happening again, bullish options positions building around a strike, in November it was 40k, now it’s 50k. Apr-June 50-75k calls have been printing, 2k btc traded in the past 2hrs.”

This observation highlights a growing confidence among investors, betting on BTC’s price to reach between $50,000 and $75,000 in the coming months.

it’s happening again

bullish options positions building around a strike, in november it was 40k, now its 50k

apr-june 50-75k calls have been printing, 2k #btc traded in past 2hrs

options markets on number go up mode https://t.co/sflG9xxPBf pic.twitter.com/acsVOmgn0U

— Kelly Greer (@kellyjgreer) February 12, 2024

#3 Futures Market

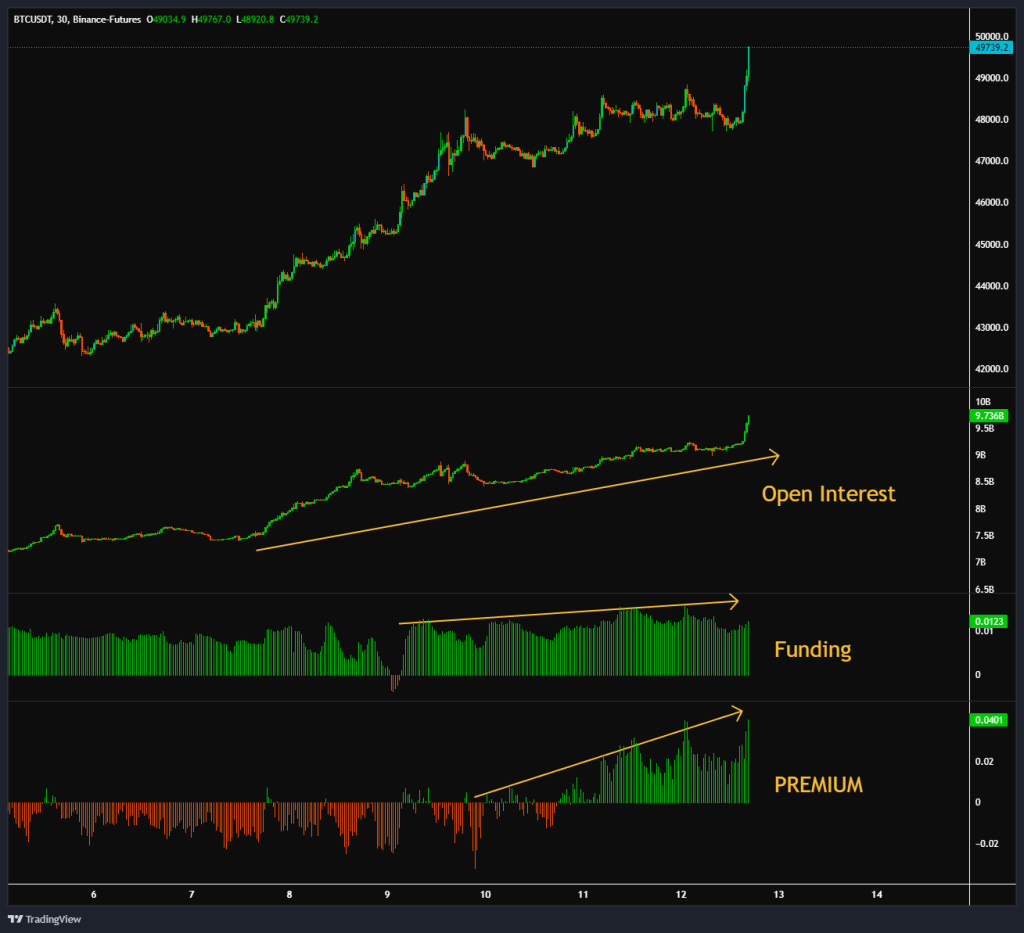

The futures market has provided further evidence of bullish momentum, with a notable increase in open interest and positive premium shifts. Crypto analyst Furkan Yildirim pointed out, “Bitcoin is driven towards $50,000 with a tailwind from the futures markets. Premium has slipped into positive territory and open interest is at its highest level since December 2021.”

Yildirim also highlights the current market dynamics, “Momentum remains positive and further [short] liquidations could take place above $51,000.” However, he cautions that a countermovement to correct overleveraged long positions could be beneficial for the market’s health. “However, a countermovement to flush out overleveraged long positions would not be amiss.”

At press time, the BTC price declined slightly to $49,765.