Data shows extreme greed sentiment has made a return among the Bitcoin investors after the cryptocurrency’s price has broken above $50,000.

Bitcoin Fear & Greed Index Now Points Towards “Extreme Greed”

The “Fear & Greed Index” refers to an indicator that tells us about the general sentiment among Bitcoin traders and broader cryptocurrency sectors.

The metric represents this sentiment using a numerical scale from zero to hundred. According to Alternative, its creator, the index calculates this score using five factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

When the Fear & Greed Index has a value of 54 or greater, the investors now share a sentiment of greed. On the other hand, values of 46 or less imply the presence of fear among the traders.

The region between these two ranges (values 47 to 53) corresponds to the territory of “neutral” sentiment. In addition to these three core sentiments, “extreme fear” and “extreme greed” occur at the deep ends of the fear and greed ranges.

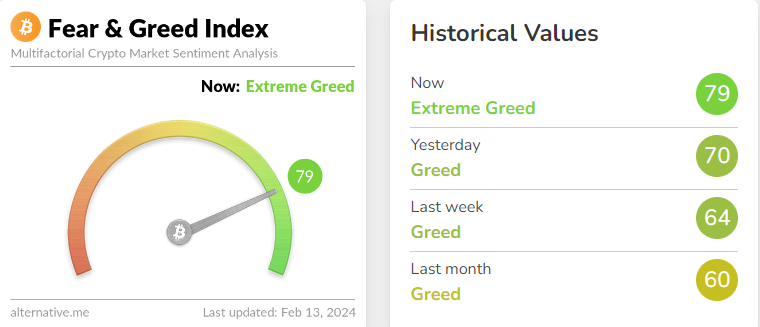

Here is what the Bitcoin Fear & Greed index looks like right now to see which of these regions the market is in:

As displayed above, the Bitcoin Fear & Greed Index has surpassed the 75 threshold for extreme greed during the past day and has attained a value of 79. The metric was at 70 yesterday, so it has seen a bit of a jump in just the last 24 hours.

This surge in sentiment from greed to extreme greed has occurred as cryptocurrency broke past the $50,000 barrier for the first time since December 2021.

Historically, the extreme sentiments have been quite significant for the asset, as major bottoms and tops for the price have occurred in these regions. This relationship between the two, however, has been inverse.

Extreme fear has been when bottoms have taken shape, while extreme greed has been where tops have formed. In the past, Bitcoin has usually tended to move against the majority’s expectations. This expectation is the strongest in these ranges, so it makes sense that a reversal is the primarily likely here.

Followers of a trading philosophy called “contrarian investing” exploit this fact to time their buying and selling moves. “Be fearful when others are greedy, and greedy when others are fearful” is a famous quote from Warren Buffet that sums up the idea.

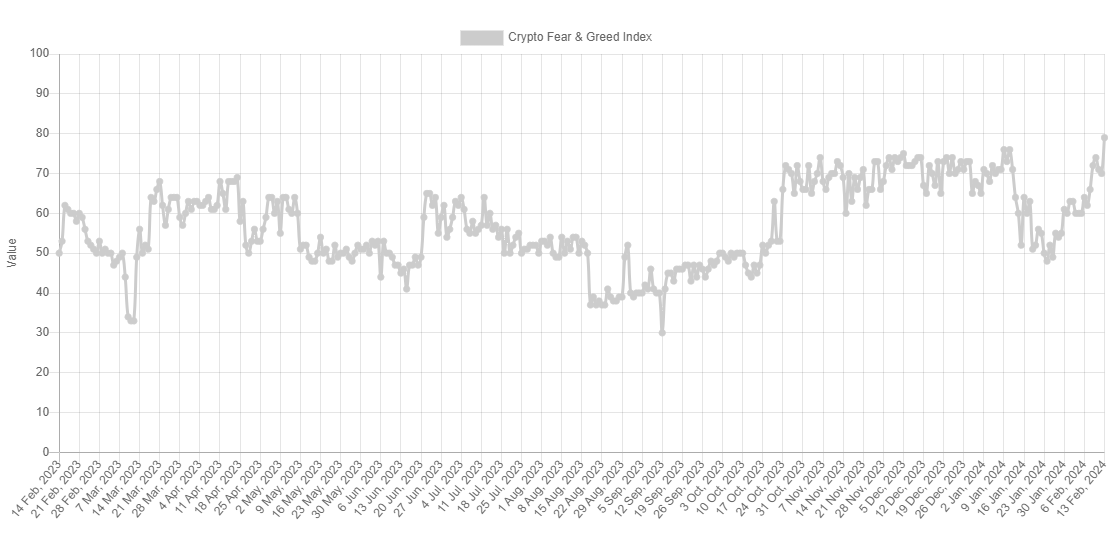

As the chart below shows, the last time the Fear & Greed Index attained extreme greed levels was around the time of the spot ETF approval.

As BTC investors are very well aware, the coin hit a top coinciding with the event as the market took to selling the news. Since the sentiment is now back inside extreme greed with its latest surge, another similar reversal point may be close for its price.

Perhaps it’s at a time like this when a contrarian investor would consider moving towards selling, going against the hype and euphoria floating around the market.

BTC Price

Bitcoin has enjoyed a surge of over 4% in the past day, which has taken its price towards the $50,000 mark.