Chainlink (LINK), the oracle network powering smart contracts across the crypto landscape, is making waves with a recent surge in whale activity. Data reveals $216 million worth of LINK tokens withdrawn from the Binance exchange by a staggering 83 separate wallets, sending the token price on a parabolic trajectory.

Whales On A Feeding Frenzy

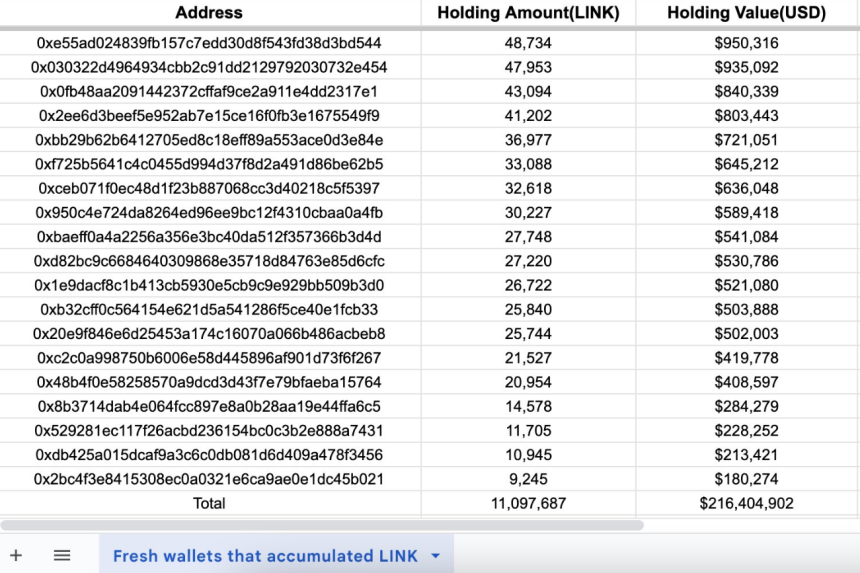

On-chain analytics platform Lookonchain paints a fascinating picture of the ongoing accumulation binge. Their findings suggest a coordinated effort, with distinct wallets withdrawing massive amounts of LINK. While the possibility of a single entity pulling the strings remains unconfirmed, the sheer volume of tokens amassed hints at a major shift in institutional participation within the Chainlink ecosystem.

This coordinated accumulation, especially the withdrawal of such a significant sum from a major exchange like Binance, raises intriguing questions, some analysts say. It could reflect growing institutional confidence in Chainlink’s long-term potential, particularly with initiatives like the Cross-Chain Interoperability Protocol (CCIP) expanding its reach.

83 fresh wallets(may belong to the same institution) withdrew a total of 11,097,687 $LINK($216.4M) from #Binance in the past 2 weeks.

Address list:https://t.co/cYgH52rHzxhttps://t.co/JNuXc43l2I pic.twitter.com/u178vVVGiT

— Lookonchain (@lookonchain) February 17, 2024

Adding fuel to the fire, IntoTheBlock data reveals an additional $129 million stacked up by whales over the past 24 hours alone. This relentless buying pressure has translated directly to price action, with LINK experiencing a meteoric rise of 6% in the past week and a staggering 20% in the past month.

Chainlink Fundamentals Shine

While whale activity often grabs headlines, Chainlink’s underlying fundamentals paint an equally compelling picture. As the leading oracle provider in the Web3 space, Chainlink acts as a bridge between smart contracts and real-world data, enabling them to access secure and reliable information off-chain. This critical role fuels countless DeFi projects, positioning Chainlink as a cornerstone of the burgeoning decentralized finance landscape.

Moreover, Chainlink boasts a relentless development team, consistently rolling out new features and upgrades. Notably, the recent introduction of CCIP further enhances the network’s cross-chain compatibility, opening doors to a wider range of smart contract applications. This unwavering commitment to innovation further strengthens the investor case for Chainlink.

Parabolic Dreams: Will LINK Take Flight?

With bullish sentiment surging and whales circling, the question on everyone’s lips is: can LINK sustain its upward trajectory? While predicting the future of any crypto asset remains a perilous endeavor, analysts are cautiously optimistic. The confluence of strong fundamentals, whale accumulation, and a growing user base creates a fertile ground for further price appreciation.

Analysts said the ongoing accumulation by whales, coupled with Chainlink’s solid fundamentals, suggests a potential parabolic run. However, caution is warranted. The crypto market remains volatile, and profit-taking could trigger corrections. Nevertheless, LINK’s long-term prospects appear bright, making it an asset worth watching closely.”

Whether LINK’s price soars to parabolic heights or faces turbulence in the near future, one thing remains clear: the recent whale activity and unwavering developer commitment have thrust Chainlink back into the spotlight, solidifying its position as a key player in the ever-evolving blockchain landscape.

Featured image from Adobe Stock, chart from TradingView