Worldcoin (WLD), a blockchain-based project fueled by biometric verification, has ignited a firestorm of investor interest, skyrocketing 170% in the past week to reach a record high of $7.48. This meteoric rise stands out against a backdrop of sluggish performance in many other altcoins, prompting questions about the driving forces behind this surge and its potential for longevity.

Worldcoin: Bullish Metrics And AI Hype Fuel The Flames

Several factors appear to be stoking the flames of Worldcoin’s current momentum. Trading volume has soared an impressive 44% to nearly $840 million, propelling the token into the top 10 by volume despite languishing at 91st place in market capitalization. This hyperactive trading suggests strong investor interest and hints at further growth potential.

Adding to the excitement, Worldcoin boasts over 1 million daily active users on its World App, signifying significant adoption. Moreover, the project basks in the reflected glory of its association with OpenAI, the renowned artificial intelligence (AI) research lab co-founded by Worldcoin’s creator, Sam Altman.

The recent release of OpenAI’s cutting-edge text-to-video generator, dubbed Sora, has generated a wave of positive sentiment towards Worldcoin, potentially spilling over to boost its token price.

Privacy Concerns Cloud The Horizon

However, Worldcoin’s path to success is not paved in gold. Regulatory scrutiny looms large, casting a shadow over its iris-scanning verification method and potential privacy violations. European countries, Argentina, Kenya, and Hong Kong have expressed concerns about this technology, raising the specter of regulatory roadblocks that could hinder future adoption and derail the project’s long-term goals.

Alameda’s Shadow Adds A Layer Of Uncertainty

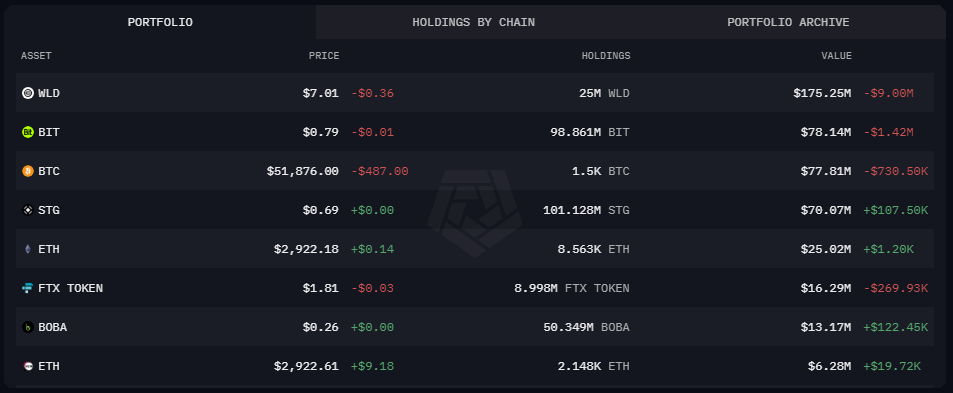

Another layer of uncertainty comes from Alameda Research, a major cryptocurrency investment firm. Alameda currently holds a significant portion of WLD tokens, valued at a staggering $186 million, representing a whopping 33% of its portfolio.

While this investment signifies potential confidence in Worldcoin, Alameda’s recent history of liquidating holdings in other cryptocurrencies casts doubt on their future plans with WLD. Their intentions remain shrouded in secrecy, adding a layer of speculation to the current price rally.

Can Worldcoin Overcome The Hurdles?

Only time will tell whether Worldcoin can overcome these challenges and navigate the treacherous waters of the crypto market. While the project boasts impressive user numbers and an exciting association with OpenAI, regulatory concerns and questions about Alameda’s motives pose significant risks.

Investors should carefully consider these factors and conduct their own research before placing bets on Worldcoin’s future. The coming months will be crucial for the project, as it navigates regulatory scrutiny, addresses privacy concerns, and clarifies the intentions of its major investors. Whether Worldcoin will emerge as a true innovator or fade into obscurity remains to be seen.

Featured image from iStock, chart from TradingView