Quick Take

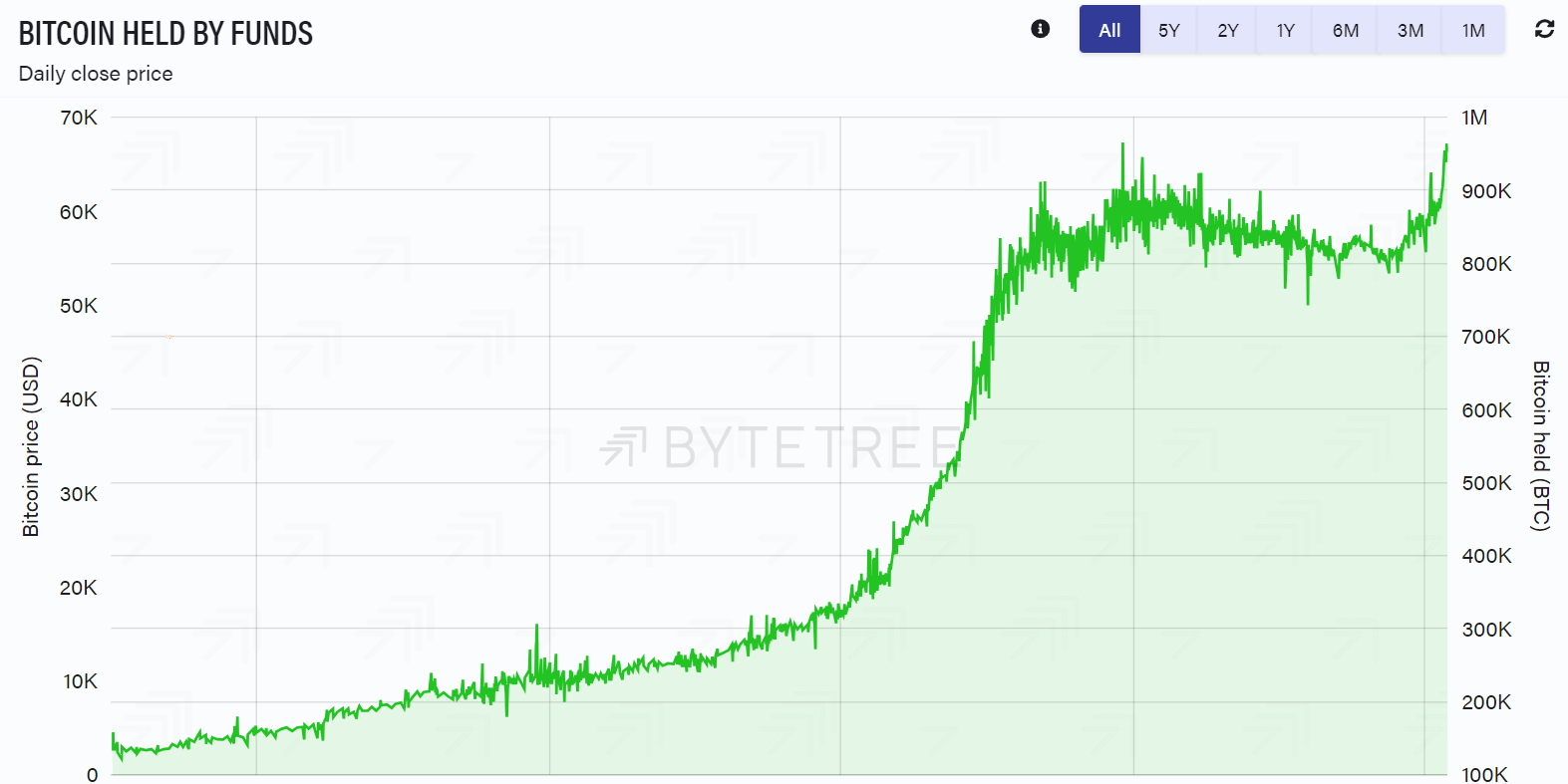

ByteTree data indicates that global Exchange Traded Products (ETPs) are nearing their all-time high of approximately 966k Bitcoin, a record set back in 2021. A significant contributor to this development is the success of spot Bitcoin ETFs in the United States, which have seen a net flow of approximately $5.5 billion.

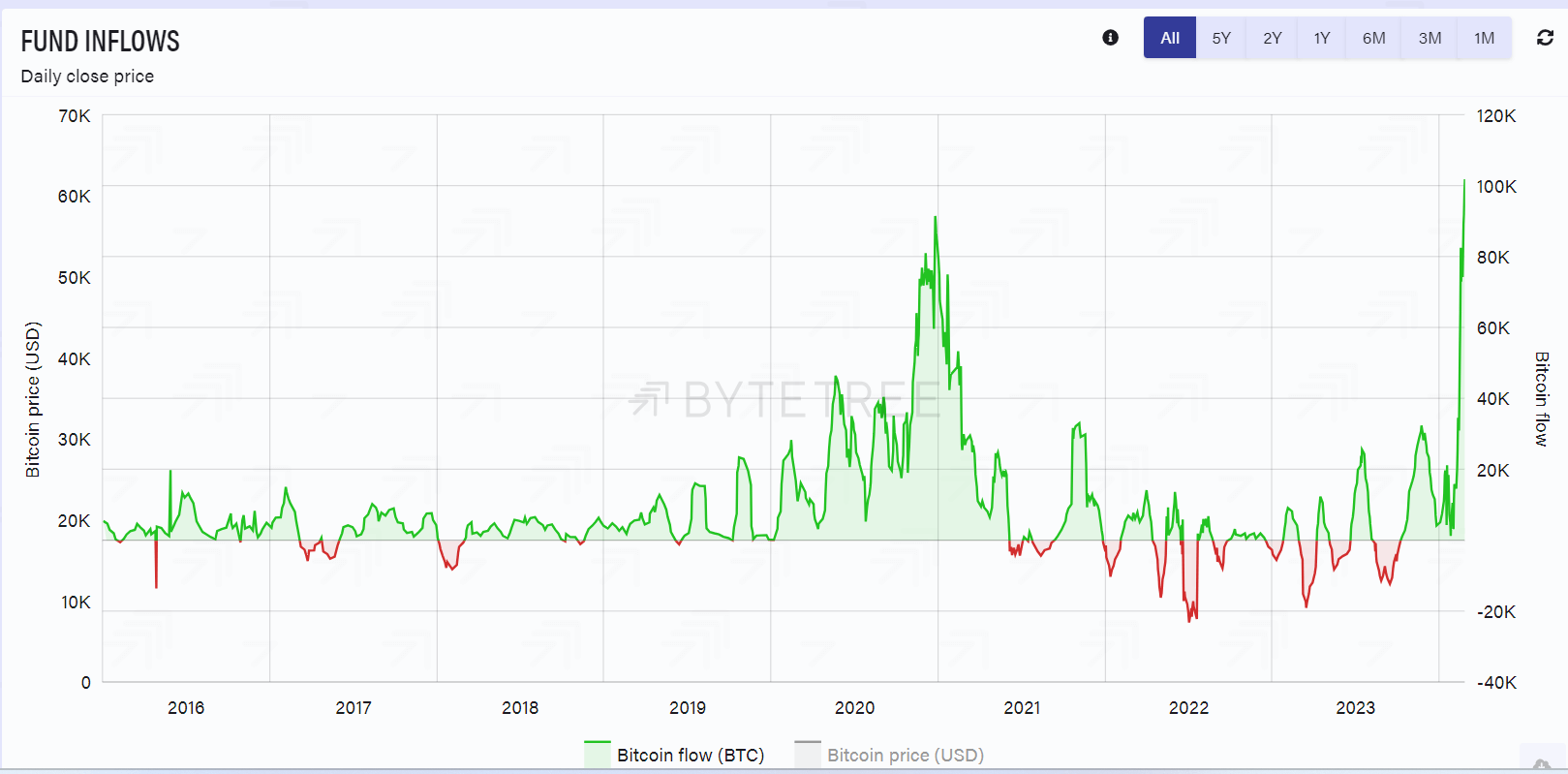

Over the past 30 days, global ETPs recorded a net inflow of over 100k Bitcoin, surpassing the previous 30-day record of 90k Bitcoin set in 2020, according to ByteTree.

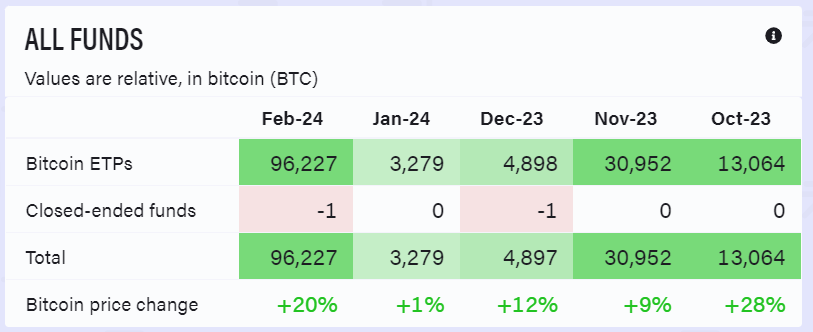

ByteTree data shows, in February alone, an impressive inflow of 96k Bitcoin was noted, which starkly contrasts with the previous four months’ figures: 13k, 31k, 5k, and 3k Bitcoin in October, November, December, and January, respectively. The February figure is particularly notable given that it nearly doubles the aggregate inflows between October 2023 and January 2024.

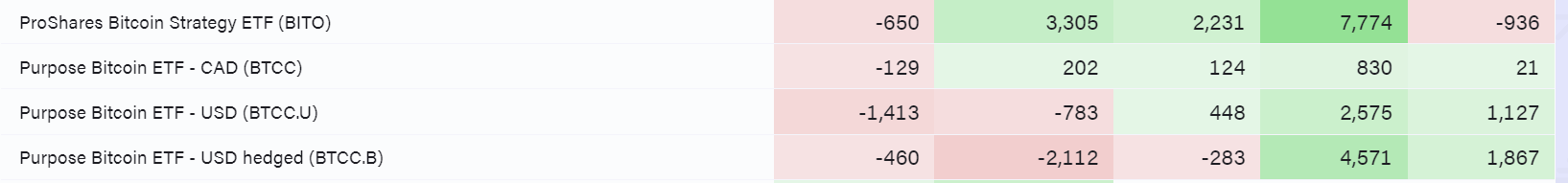

In the months leading up to the spot Bitcoin ETF, inflows can be partially attributed to the ProShares Bitcoin Strategy ETF (BITO) and the Purpose ETF in Canada, which recorded an inflow in November of roughly 8k Bitcoin each, according to ByteTree data.

However, since the US spot Bitcoin ETFs have been approved, both BITO and Purpose ETF are witnessing a continuous outflow, likely due to investors shifting towards cheaper, better-tracked spot ETFs.

The post Bitcoin’s global ETPs inch closer to historic peak, US spot ETFs credited for growth appeared first on CryptoSlate.