Quick Take

The record-breaking wave in the ever-evolving digital asset market continues, with the recently launched Bitcoin ETFs setting a new high in trade volume.

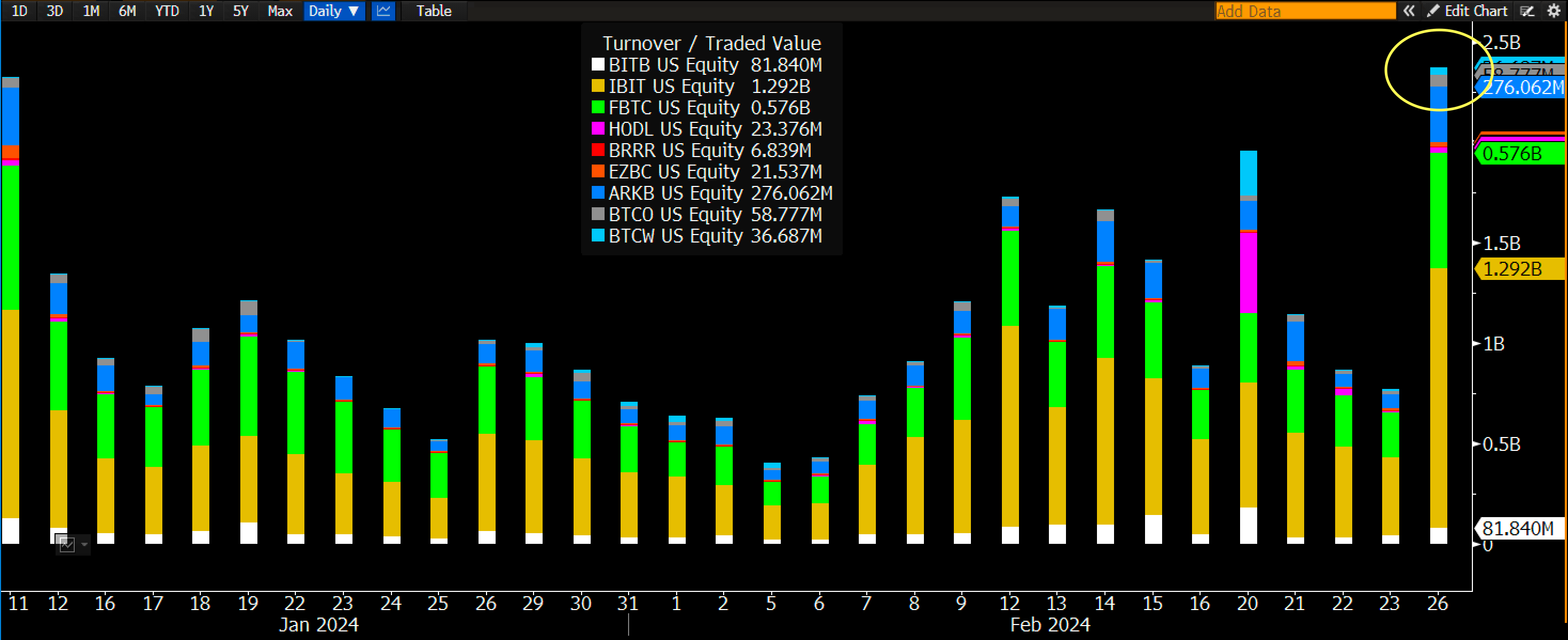

As per data analysis findings shared by senior Bloomberg ETF analyst Eric Balchunas, these newborn- nine Bitcoin ETFs marked an all-time high trade volume of $2.4 billion, which not only surpasses the previous record set on day one but also doubles their recent daily average, according to Balchunas.

Balchunas goes on to say that IBIT notably led the surge, registering a trading volume of $1.3 billion, over 50% of the trade volume, breaking its previous record by a substantial 30%. This was a remarkable achievement that positioned IBIT 11th among all ETFs, putting it in the exclusive top 0.3% bracket. Beyond ETF markets, IBIT also made its mark against stocks, securing a slot in the top 25.

A significant point to note here is the investor interest this asset has managed to garner since its inception on Jan. 11. With an impressive $6 billion in total net inflows, it vividly demonstrates the heightened confidence placed by investors in this asset, suggesting a positive outlook for its future performance.

The post Bitcoin ETFs hit record $2.4 billion trade volume – Bloomberg appeared first on CryptoSlate.