Bitcoin Spot ETFs are gunning for a new record after an incredible start to the new week. The price of BTC has risen 8% in the last day, and this has caused euphoria in the market. There could be a number of factors behind this; however, institutional investors seem to be playing a big role as daily inflows continue to rise.

Spot Bitcoin ETF Inflows Cross $400 Million

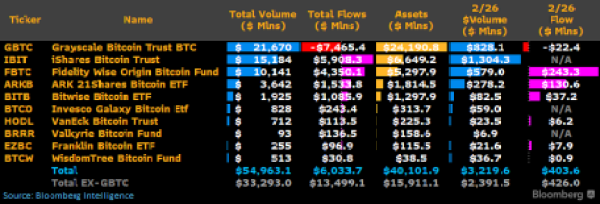

According to Bloomberg analyst James Seyffart, the Spot BTC ETF inflows are not slowing down. In a screenshot shared by the analyst on Tuesday, Seyffart reveals that inflows into Spot BTC ETFs climbed above $400 million.

The image shows that the Fidelity Wise Origin Bitcoin Fund is leading the charge with $243.3 million in inflows, which accounts for more than 50% of the total inflow. The ARK 21Shares Bitcoin ETF follows behind with significant inflows of $130.6 million. The third-largest inflow to a single fund for the day was recorded in the Bitwise Bitcoin ETF, which saw $37.2 million in inflows.

Other funds, including the Franklin Bitcoin ETF, VanEck Bitcoin Trust, and the WisdomTree Bitcoin Fund, all saw minor inflows of $7.9 million, $6.2 million, and $0.9 million, respectively. In total, the inflows to all six funds came out to $426 million.

However, the Grayscale Bitcoin Trust (GBTC) continues to bleed during this time, with outflows of $22.4 million in the 24-hour period. This brought the total net flows to $403.6 million. At the same time, funds such as the iShares Bitcoin Trust, the Invesco Galaxy Bitcoin ETF, and The Valkyrie Bitcoin Fund all saw negligible inflows during this time frame.

Gunning For A New Record

The inflows into the Bitcoin Spot ETFs over the last day are a testament to the demand that these products are getting from the market. With institutional investors gaining more exposure to BitBTCcoin, demand is expected to rise, especially as the BTC price continues to do well.

The inflow volumes, while not the largest single-day inflows so far, are significant when measured up to others. For example, Seyffart points out that the daily record was from the first day of trading when inflows climbed as high as $655 million. The second-largest single-day net flow was then recorded earlier in the month on February 13 with $631 million. “A big day from $IBIT could push us beyond that Day 1 record,” Seyffart declared.

At the time of writing, the BTC price is experiencing a retracement after reaching a new 2-year high of $57,000. It has seen 8.58% gains in the last 24 hours to trade at $55.900, according to data from CoinMarketCap.